6 More Overvalued Dow Stocks: Part 2 Of 5

Chuck Carnevale | Oct 11, 2017 12:30AM ET

Introduction

In part 1 of this five-part series, I covered what I considered the 6 most expensive stocks in the Dow Jones Industrial Average Index of 30 stocks. With this part 2, I’m going to cover 6 additional Dow stocks that I consider overvalued currently. So far, these two articles represent approximately 40% of the stocks in the Dow Jones that appear overvalued. However, this group of 6 expensive Dow stocks generally has very different fundamental characteristics than we saw with the first group. With our initial group of 6 we saw, for the most part, cyclical operating histories. With this group of Dow stocks we will examine 6 stocks with more consistent operating histories.

Personally, and as a general rule, I tend to favor companies with long-term consistent operating track records. Much of my preference can be attributed to the opportunity for more reliable forecasting. Although there are exceptions to every rule, companies with consistent operating histories tend to persist over time. As they get larger, their growth rates may slow down a little, but their consistency of performance is comforting. Although past performance is no guarantee of future success, a long-term consistent track record is worth acknowledging and given credit to.

Additionally, this group of 6 Dow constituents—3M (NYSE:MMM), Coca-Cola (NYSE:KO), Home Depot (NYSE:HD), Microsoft (NASDAQ:MSFT), Procter & Gamble (NYSE:PG) and Nike (NYSE:NKE)—will also illustrate one of the underlying objectives of this series, suggesting that it is a market of stocks not a stock market. Common stocks come in all sizes, shapes and flavors. Just as it is for larger indexes, it also holds true for the Dow Jones. Therefore, I always suggest that it makes more sense to worry about the specific stocks that you own over obsessing with what the market might or might not do. Because, as this series unfolds, you will discover that there are in fact Dow stocks that are attractively valued. As a sneak preview, we will not see attractively valued Dow stocks until we get to parts 4 and 5. Stated more precisely, I believe that approximately 60% of the 30 Dow stocks are overvalued, but there is attractive valuation with some of the other 40%-stay tuned to future installments.

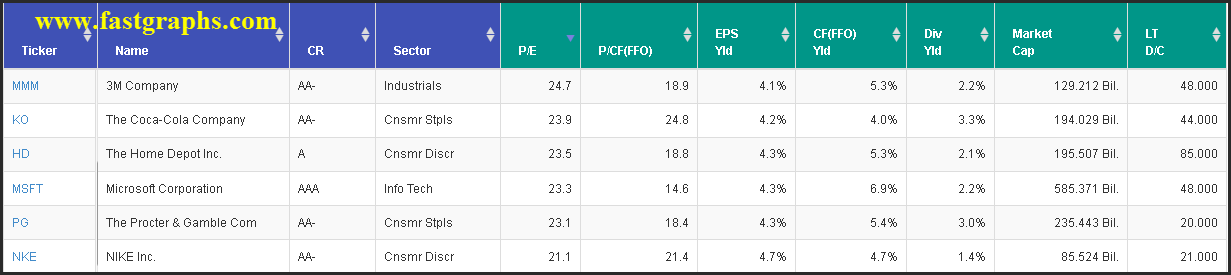

Portfolio Review: Six More Expensive Stocks in the Dow Jones Industrial Average

The following portfolio review lists the next 6 most expensive stocks in the Dow Jones Industrial Average based on their current blended P/E ratio. However, there are many ways to value a stock in addition to the P/E ratio. Consequently, I suggest the reader also notices the price to cash flow of each of these 6 Dow constituents. For those investors most interested in dividend income, price to cash flow might be more relevant for higher-yielding dividend paying stocks. Furthermore, when ascertaining valuation, other factors such as expected growth need to be considered as well. I will elaborate more fully in the video below.

The following portfolio review is presented in order of highest blended P/E ratio to lowest. As an additional valuation check, note that the earnings yield (EPS Yld) of each of these Dow constituents is below my 6 ½ to 7% threshold.

FAST Graphs Analyze Out Loud Valuation Analysis

This video will present a quick overview of each of these Dow constituents based primarily on price relative to earnings and cash flow. However, for certain constituents, I will also evaluate several other metrics. For any reader concerned with the current valuation of the stock market, this video, the video in Part 1 and the subsequent three videos that will follow in future articles are must watches. Furthermore, although I will be only providing a cursory, or a pre-more comprehensive due diligence analysis, I believe you will find the video enlightening and hopefully entertaining.

Summary and Conclusions

In Part 1 of this 5-part series, I covered what I considered the 6 most expensive stocks in the Dow Jones. With this Part 2, I added and covered 6 more expensive Dow stocks and as a result approximately 40% of the Dow Jones Industrial Average constituents have been reviewed. In Part 3 will be looking at 6 additional Dow Jones stocks that I would consider more fully valued than overvalued. However, it will not be until we get to Part 4 and Part 5 where attractive valuation will be found.

To summarize what we’ve seen so far, the Dow Jones Industrial Average remains at all-time highs. However, and much more importantly, we have now discovered that 40% of the 30 Dow Jones Industrial Average constituents are overvalued relative to fundamentals and historical norms. High valuation is a precursor to low future returns. Therefore, it seems logical to expect that a significant portion of the Dow Jones constituents are facing high valuation headwinds relative to future returns.

Therefore, several scenarios could be in play over the near to intermediate term future. The overvalued stocks could hold their value or correct significantly. The undervalued Dow constituents that I will be examining later could possibly increase as they revert to mean valuations. And of course, a major correction could drag all Dow Jones stocks down. However, I believe a strong case can be made that fairly valued stocks will recover better and more quickly. Nevertheless, it will be interesting to see.

In Part 3 I will be reviewing the following: Apple (NASDAQ:AAPL), The Walt Disney Company (NYSE:DIS), Johnson & Johnson (NYSE:JNJ), UnitedHealth Group (NYSE:UNH), United Technologies (NYSE:UTX) and Walmart (NYSE:WMT).

Disclosure: Long KO,PG at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.