5 Safe CEFs (With No Debt) Paying Up To 9%

Contrarian Outlook | Mar 02, 2018 05:20AM ET

Legendary investor and Berkshire Hathaway (NYSE:BRKb) CEO Warren Buffett recently gave us an insight into the type of dividend-paying fund he’d invest in if he could:

Our aversion to leverage has dampened our returns over the years. But (partner Charlie Munger) and I sleep well. Both of us believe it is insane to risk what you have and need in order to obtain what you don’t need.

“Leverage” stands out because it’s a common tool used among several high-yield classes, from mortgage real estate investment trusts (mREITs) to business development companies (BDCs). Even closed-end funds (CEFs) – which some investors turn to for relative safety versus individual stocks given CEFs’ diverse portfolios – can sport high leverage of between 30% and 60%. In many cases, leverage in these assets is viewed as a foregone conclusion – what investors must accept in exchange for 8%-12% distributions.

Not so.

Hunters of high income can take a page right out of Buffett’s playbook and still “sleep well,” generating high returns without exposing themselves to lofty levels of leverage. Several CEFs deliver yields anywhere between 6% to more than 9% while using little to no debt to “juice” their returns – and I want to show you five of these funds today.

Just keep in mind: Leverage isn’t the only risk you run in a fund. Some of these CEFs might not toy around with debt much, but that’s hardly the only important trait to look for in a fund. That’s OK, though – I’ll help you sort the winners and the losers.

(By the way, Buffett ironically can’t buy CEFs for Berkshire. He runs so much money that he’d move the entire market, eliminate any “free money” discount (to NAV) and he’d pancake yields in the process.)

But you and I don’t manage billions of dollars. So we don’t have that problem. We can quietly deploy our modest capital into these dividend machines and enjoy price upside to boot!)

BlackRock Enhanced Equity Dividend Trust (NYSE:BDJ)

Type: Covered Call

Leverage: 0%

Distribution Rate: 6.1%

Expenses: 0.85%

I’ve discussed the power of covered calls before, but a quick reminder: Selling covered calls is an options strategy that’s designed to generate income while protecting against downside in the market. It’s a slightly complicated strategy that takes precision to properly execute, which is why some investors prefer to simply put money in funds that do the trading for them.

The problem? Many covered-call exchange-traded funds are governed by overly simplistic mandates that often force the fund to make less-than-ideal trades to close out positions while satisfying its own internal rules. This is a strategy that’s much more efficient when done by real, human managers such as those at BlackRock Enhanced Equity Dividend Trust.

BDJ is a roughly 95-holding portfolio that invests in dividend-paying stocks, then utilizes covered calls to “enhance distributions” paid out to the closed-end fund’s shareholders. This is a mostly U.S.-focused, heavily large-cap basket of stocks whose top holdings are particularly thick in big financial-sector companies. Namely, JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC) and Citigroup (NYSE:C) are Nos. 1-3 and represent roughly 13% of the portfolio. Wells Fargo (NYSE:WFC) and American International Group (NYSE:AIG) are also among top-10 holdings.

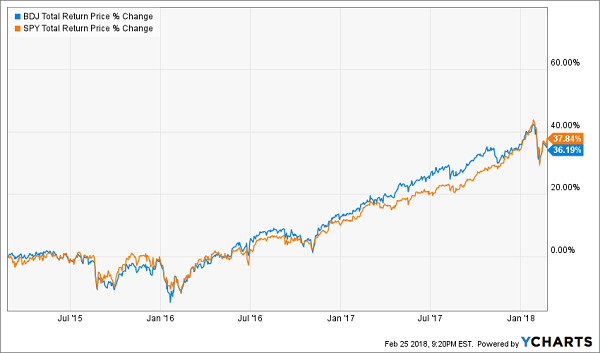

For a tactic that often can lag when the market is in full-bull mode, BDJ sure did well for itself last year. The fund returned 20.8% – less than a percentage point behind the total return of the S&P 500. This same CEF produced a loss of just 17.2% in 2008 while the large-cap index plunged by more than twice as much. In fact, BDJ has performed admirably compared to the S&P 500 over the past three years.

Blackrock (NYSE:BLK) Enhanced Equity Dividend Trust (BDJ) Can Perform in the Straightaways, Too

Liberty All-Star Growth (NYSE:ASG)

Type: U.S. All-Cap Growth Equity

Leverage: 0%

Distribution Rate: 8%

Expenses: 1.28%

Liberty All-Star Growth (ASG) isn’t difficult to figure out: This CEF invests in what the crème de la crème of American investments. In fact, it has three investment managers – one for each slice of the market-capitalization pie:

- Small-Cap Growth: Weatherbie Capital, LLC

- Mid-Cap Growth: Congress Asset Management Company, LLP

- Large-Cap Growth: Sustainable Growth Advisers, LP

The portfolio is more or less exactly what you would expect from a growth-oriented fund: heaviest in information technology (29.5%), with strong allocations to consumer discretionary (22.8%) and health care (16.2%). The fund also has a double-digit weighting in industrials (15%) – a sensible position given the sector’s strength of late, not to mention the many headwinds flowing out of Washington, D.C.

The top 10 holdings aren’t exactly a showcase for large-cap stocks, with stocks like J.B. Hunt Transport (JBHT) and Wayfair (W) sitting up top. But the fund avoids overweights, with those top-two stocks sitting at 1.9% each.

ASG’s total return performance comfortably beats the broader market over all significant time periods . The only hangup I have at the moment is that Liberty All-Star Growth is trading at a 4% premium to its net asset value, whereas it has traded at a 9% discount on average over the past three years. Investors may want to wait for a better entry price.

Gabelli Multimedia Trust (NYSE:GGT)

Type: Global Multimedia Equity

Leverage: 7.9%

Distribution Rate: 9.3%

Expenses: 1.13%

Gabelli Multimedia Trust (GGT) is a hybrid industry fund of sorts – one that mixes media stocks (which often are considered consumer discretionary) with technology stocks. So while it’s not a full-blown tech fund, which comes with a lofty expectation for performance, its top holdings include the likes Facebook (NASDAQ:FB), Alphabet (NASDAQ:GOOGL) and resurgent Sony (NYSE:SNE) … so investors rightly expect a little giddy-up.

In some ways, they get it. For one, GGT yields far more than anyone would rightly expect from this kind of portfolio. Consider that the Technology Select Sector SPDR Fund (NYSE:XLK) yields just 1.3%.

And performance hasn’t been bad, per se. Indeed, the fund has delivered a total return of about 33% over the past three years.

The problem? XLK has delivered just more than twice that.

Gabelli Multimedia Trust Delivers Income, But at a Cost

Portfolio manager and Gabelli CEO Mario Gabelli is a famed investor, but some of his (and his team’s) higher-conviction picks – such as Dish Network (NASDAQ:DISH) and Liberty Global (NASDAQ:LBTYA) – haven’t exactly panned out , dropping by double digits over the past few years.

That has more than negated the benefit of such a large distribution rate.

DoubleLine Opportunistic Credit Fund (NYSE:DBL)

Type: Multisector Bond

Leverage: 16.9%

Distribution Rate: 9.3%

Expenses: 1.48%

DoubleLine Opportunistic Credit Fund (DBL) is another 9%-yielder I would stay away from, if only because there’s another similarly yielding option with similarly talented management that makes more sense.

DBL, managed by bond guru Jeffrey Gundlach, has a wide-ranging philosophy that allows it to invest in income-producing investments of all sorts, from U.S. government bonds to corporate debt to mortgage-backed securities to international bonds. At the moment, for instance, non-agency residential MBSes make up 47% of the portfolio, with agency inverse floaters at nearly 20% and collateralized loan obligations at 15%.

It’s a perfectly adequate fund, but it’s one that’s equally matched in performance and nearly matched in yield by DoubleLine Income Solutions Fund (DSL) – a more straightforward debt-focused CEF that also features Gundlach at the helm.

They’re hardly similar funds, with DSL 44% weighted in emerging-market sovereign debt, and MBSes of any sort only make up 16% of the fund. But what makes DSL stand out is that you’re still getting Gundlach’s debt expertise at a cheaper price. Right now, DoubleLine Opportunistic Credit Fund trades at a roughly 4% premium, while Income Solutions sits at a 7%-plus discount. In other words, you can either pay 104 cents on the dollar … or 93 cents.

It’s not a drastic difference, but it’s a relationship that hasn’t boded well for DBL over the past 18 months .

Alpine Global Premier Property (NYSE:AWP)

Type: Global Real Estate Equity

Leverage: 3.3%

Distribution Rate: 9.5%

Expenses: 1.2%

Real estate investors didn’t have much to cheer about in 2017. The Vanguard REIT ETF (NYSE:VNQ) returned just 5%, which of course was a woeful underperformance compared to the broader market.

You’ll have to forgive investors in Alpine Global Premier Property (AWP) – who saw their fund rocket 45% higher – if they didn’t notice.

AWP invests in real estate companies across the world, and the “global” part of the moniker means America’s in play, too. Specifically, U.S. companies make up nearly 40% of the portfolio. The only other double-digit exposure goes to Japan (16%). Germany (8.5%), Spain (7.1%) and France (6.4%) are among the fund’s other geographical positions.

One note: Even though this CEF uses a marginal amount of leverage, that doesn’t mean it’s a smooth operator.

“Alpine” Is a Fitting Name

Alpine Global Premier Property’s performance history is marked with peaks and valleys. But long-term, AWP can provide geographical diversification with sky-high income that can give you some zig when pure U.S. real estate zags.

The 5 Safest 8%+ Bond Funds to Fund Your Retirement

Safe monthly paying bond funds – with price upside potential – are a cornerstone of my 8% “no withdrawal” retirement strategy , which lets retirees rely entirely on dividend income and leave their principal 100% intact.

Well that’s not exactly right. Their principal is more than 100% intact thanks to price gains like these! Which means principal is actually 110% intact after year 1, and so on.

To do this, I seek out funds that:

- Pay 8% or better…

- Have well funded distributions…

- Trade at meaningful discounts to their NAV…

- And know how to make their shareholders money by increasing NAV consistently.

And I talk to management, because online research isn’t enough. I also track insider buying to make sure these guys have real skin in the game.

Today I like five “blue chip” bond funds as best income buys. And wait ‘til you see their yields! These “slam dunk” income plays pay dividends up to 10.2%!

And as I mentioned, they pay every single month.

Plus, they trade at 10-15% discounts to their net asset value (NAV) today. Which means they’re perfect for your retirement portfolio because your downside risk is minimal. Even if the market takes a tumble, these top-notch funds will simply trade flat… and we’ll still collect those fat dividends!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.