5 Funds To Buy On This Dip For Big Gains And 11.5% Dividends

Contrarian Outlook | Dec 03, 2018 05:29AM ET

Ignore the doomsayers: 2019 is setting up to be a strong year for equities—and a great year for dividend investors like us.

I know this might surprise you, so let’s break it down. Further on I’ll give you 5 funds (with dividends up to 11.5%!) that are flashing buy signals you can’t afford to ignore.

So why am I so bullish on the year ahead?

Thanks to the record-breaking profit growth we’ve seen in 2018, along with continued steady gains in employment and wages, there’s little reason to believe next year will bring the big downturn everyone’s worrying about. Instead, the Fed’s prudent scaling back of interest-rate hikes should fuel more growth.

And for dividend investors, slower rate hikes also mean yields on so-called “safe” investments, like Treasuries, will be even less likely to catch up to payouts of 7% and up, like you’ll find on most of the closed-end funds (CEFs) below.

The market will slowly figure this out and jump into these 5 funds, making now a great time to grab an early position. So let’s get going, starting with…

CEF Pick #1: A 7.8% Dividend From America’s Best Blue Chips

The Eaton (NYSE:ETN) Vance Enhanced Equity Income Fund (EOI) isn’t a household name, even if its holdings are: Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN) and JPMorgan (NYSE:JPM) are its top positions, and they’ve helped its underlying portfolio (known as its net asset value, or NAV) deliver a positive return for 2018, even as its price return has been negative:

EOI’s Stock Portfolio Outruns Its Market Price

Since EOI’s returns closely follow those of the S&P 500, which is up barely 1% for 2018, I can excuse this flat return in a tough year—especially since EOI gives you a 7.8% dividend. And thanks to the fund’s long-term NAV strength (its underlying portfolio has delivered a 23.6% total return in the last two years), that dividend remains sustainable, despite the market’s recent weakness.

When investors discover that this fund trades at a 6.9% discount, the lowest since the start of the year and wider than its long-term average, I expect them to buy in at a fast clip, and that makes this an attractive fund to buy now.

CEF Pick No. 2: A 4% Dividend From Berkshire Hathaway (NYSE:BRKa)

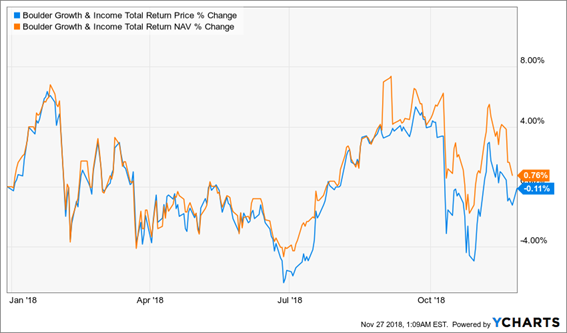

Berkshire Hathaway (BRK.A, BRK.B) doesn’t pay a dividend, but that doesn’t bother us, because we can invest in Warren Buffett’s company and still get a healthy 3.6% payout through the Boulder Growth and Income Fund (BIF).

This value-investing fund is so closely modeled after Buffett’s investing principles that a third of the fund is in Berkshire itself! The rest is focused on bargain stocks like Walmart (NYSE:WMT), Pfizer (NYSE:PFE) and Johnson & Johnson (NYSE:JNJ). That has helped the fund see pretty much the same growth as the S&P 500 in 2018:

Downside “Insurance” in a Tough Year

More crucial, however, is the fact that BIF sports a 17% discount that’s recently recovered from a near-record low, so it appears to have reached the floor of how much the market will let it get sold off:

A Massive Sale Appears

This deal has been around for a few months now, but it’s unlikely to stick around—and a strong market recovery could see BIF’s deep discount slowly evaporate as more investors turn to value stocks. That disappearing discount will hand you nice gains if you buy now.

CEF Pick No. 3: This 11.2% Dividend Is Cheap—for Now

There’s a lot to like about the Liberty All-Star Equity Fund (USA), including an incredible 11.2% dividend yield and a discount to NAV that has been steadily vanishing:

Investors Flock to USA

We’ve seen a big correction to that long-term trend in 2018, as you can see at the right of the chart above. Recent market panic has caused the fund’s move toward a par valuation to suddenly reverse, despite the fact that its equity portfolio has crushed the S&P 500 over the last couple years.

This kind of drop in the fund’s discount is a clear buying opportunity, since nothing about USA’s fundamental performance has changed—it continues to move in lockstep with the market—as it has through most of 2018:

Still Pacing the Market

What’s more, USA beat the market during the recovery months of April, May and June. And with continued market gains ahead in 2019, that outperformance will likely come again.

CEF Pick No. 4: A “Textbook” CEF Bargain With an 8.8% Yield

The Apollo Tactical Income Fund (AIF) has earned a lot of trust from investors, which is why its price return stayed positive through most of 2018. But the recent jitters erased that, and its price has turned negative for the first time, despite its NAV being up far above the market’s 1% gains:

A Disrespected Outperformer

The key here is the highly selective investment process this fund uses. Because AIF invests in fixed-term loans to medium-sized businesses, its ability to analyze credit and make the right bets is crucial. Apollo Credit Management, the fund’s managers, is one of the savviest medium-sized business-lending operations in America, so it’s unsurprising that AIF has been doing well.

But the market doesn’t care. As a result, AIF’s 8.8% dividend yield is up for grabs at a shocking 14% discount to NAV, the lowest it has been in nearly three years. This is clearly a mistake the market will correct—making it a strong bet for the near term.

CEF Pick No. #5: A Proven Contrarian Income (and Growth) Play

The Blackstone/GSO Long-Short Credit Income Fund (BGX) is run by one of the largest private equity investors in the world, Blackstone (NYSE:BX) Group, which also has one of the best track records for bucking the trend and outperforming the market. Blackstone famously bought thousands of houses across America in 2009–10, during the subprime crisis, and made a killing doing so.

Think of BGX as a contrarian fund that finds value where others find fear.

And BGX does a great job of delivering results. Its 9.4% dividend yield and 11.9% annualized return over the last three years are just one part of the story. BGX has also beaten the market in 2018:

A Steady Rise

But the market’s folly is in its short-termism, because investors have sold off the fund to give it its biggest discount in over a year, at 11%.

This is a perfect opportunity to get into this fund, which, like AIF, uses its massive expertise in the private-equity world to give loans to secure businesses and get a high yield as a result. With BGX, you become the creditor, and you profit from the 3% GDP growth that America is enjoying—all while getting BGX’s assets at an 11% markdown.

Yours Now: 17 More Buys for BIG Gains in 2019—and SAFE Dividends Up to 12.9%

These 5 CEF buys are just the start: service boasts a portfolio with 17 more buys I fully expect to soar double-digits next year—and hand us outsized 8.2% average dividends while they do.

And that’s just the average! One of these off-the-radar CEFs pays an astonishing 12.9%! That’s enough to hand you $12,900 next year in CASH—enough to (likely) beat the market on dividends alone, on a $100k investment!

So why isn’t everyone investing in this breakthrough 12.9%-yielder?

Because most of its dividend comes in the form of a yearly special payout that rolls out like clockwork. Trouble is, most folks only see its “regular” payout in their stock screener of choice … and sleepwalk right by:

A True Hidden Yield

Source: Yahoo (NASDAQ:AABA) Finance

And when I say that its yearly special dividend rolls out like clockwork, I mean it. Check out this amazing dividend history:

Get Set for Your Next Yearly “Bonus Check”

Source: CEFConnect.com

I’ll give you the name of this cash machine and the 16 other buys in my CEF Insider portfolio when you take a zero-risk test drive now .

When you add them to the 5 funds I just showed you, you get a rich hunting ground of 23 high-yield funds to pick from as we roll into the new year.

That’s not all … you’ll also get an exclusive Special Report that reveals my 5 very best CEF buys for 8%+ dividends and 20%+ price upside in 2019. This exclusive report is must-reading if you want to protect and grow your nest egg (and income stream) in the critical year ahead.

It’s yours free, too.

Don’t miss out. portfolio, your own copy of my new Special Report and more !

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.