5 Cheap Dividend Stocks Yielding Up To 10.3%

Contrarian Outlook | May 05, 2023 05:05AM ET

The best thing about a multi-year bear market? The bargains.

Today we’ll talk dividend deals. Big payers. Stocks yielding up to 10.3% and trading for as little as three-times free cash flow (FCF).

That’s right—3X FCF!

Profits are Fake, Cash Flow is Real

Wall Street accountants can “adjust” just about every number in a 10-Q. “Adjusted earnings.” “Adjusted EBITDA.” Heck, I’ve even seen “adjusted revenues.” But it’s next to impossible to “adjust” cash. Cash flow is, well, cash flow.

Also, cash is ultimately what pays us. Dividends aren’t paid out of sales, or even paper earnings, but out of real cash. Same goes for buybacks, which we don’t like as much as dividends, but that can still help lift the price on our shares.

Given just how important cash is, then, we should factor it in when we’re valuing companies—especially as we stare down the potential for a recession, and as we’re in the midst of Year 2 of a bear market.

“The Great Equalizer”

Another of my favorite valuation metrics is price/earnings-to-growth, or PEG.

Price/earnings (P/E) is a halfway decent way to value a stock, but it’s somewhat subjective—a 15 P/E could be cheap in a growthy sector but expensive in a more conservative sector.

Price/earnings-to-growth, however, not only factors in potential growth—effectively putting all stocks on an even measuring ground—but it’s also super-simple to understand. A PEG of 1.0 means a stock is fairly valued; above 1.0 means it’s overvalued; and below 1.0 means it’s undervalued. Relativity still matters—the S&P 500’s PEG is a whopping 2.0 right now, meaning the market as a whole is extremely overvalued. So, any stock cheaper than that is at least relatively undervalued.

But real bargain hunters don’t just want relative values—they want value values, and that’s what I have my eye on today. Let’s look at five dividend stocks, yielding up to 10.3%, that are cheap based on two important metrics: PEG, and forward-looking price-to-free cash flow (P/FCF).

1. Whirlpool

- Dividend Yield: 5.0%

- Forward P/FCF: 3.6

- PEG: 0.98

Whirlpool Corporation (NYSE:WHR) hardly needs any introduction. This 112-year-old company has long been a staple of American kitchens and laundry rooms, spanning clothes washers and dryers to refrigerators, dishwashers, cooktops and microwaves.

But while you might be aware of all the gadgets Whirlpool makes, you might not be aware that it does so under many more brands than its namesake. Whirlpool’s brand umbrella also includes the likes of KitchenAid, InSinkErator, Amana, and Maytag—all popular in the U.S.—as well as international brands such as Hotpoint, Brastemp and Consul, among others.

WHR, like many home-related shares, has come down hard since the height of pandemic-fueled jubilee. As the housing market began to cool last year, so too did demand for Whirlpool’s various products—and that chill has extended into 2023.

Indeed, Whirlpool’s stock is off by more than a third since the start of the bear market. And given a soggy economic outlook for the rest of the year, it’s hard to see shares bouncing back anytime soon.

But if you take the long view, WHR might be worth a closer look.

Whirlpool doles out a respectable 5% yield that’s in no danger of evaporating anytime soon. The company needs about $380 million-$390 million in cash to fund its dividends every year, and good news!—it generated $800 million in FCF in 2022, and it’s guiding for another $800 million this year. Also, the company is selling off its EMEA (Europe, the Middle East and Africa) holdings to focus on its strong North American unit, which should help boost free cash flow significantly in 2024.

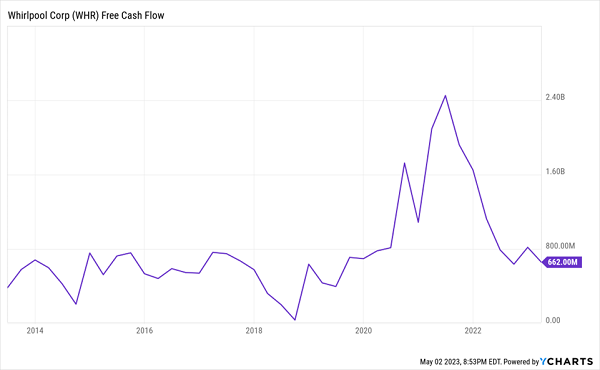

Cash Flow Is Normalizing, But to Still-High Levels

While Whirlpool looks only slightly undervalued based on PEG, it’s dirt-cheap compared to its cash flow. Growth potential could take a hit given its exit from some international operations, but even a value-reversion to the mean could greatly reward shareholders—who are paid well, through dividends, to wait.

2. Travel + Leisure (TNL)

- Dividend Yield: 4.7%

- Forward P/FCF: 7.8

- PEG: 0.32

You might know Travel + Leisure Co (NYSE:TNL) best for the months-old magazines sitting in your local doctor’s office. But it’s much, much more.

One of the primary businesses is Wyndham Destinations (NYSE:TNL), which is comprised of nearly 250 vacation club resorts (read: timeshares) around the world. In fact, Wyndham Destinations bought the Travel + Leisure brand from Meredith (NYSE:MDP) Corp. two years ago and adopted T+L as the corporate name.

Travel + Leisure also includes Panorama—a membership travel business that includes global benefits firm RCI, luxury exchange program The Registry Collection, and booking-engine platform provider Alliance Reservations, among others.

Even the Travel + Leisure brand itself is more than just magazines. T+L includes a travel subscription service, as well as branded consumer products.

It’s an aspirational consumer segment, to be sure. Of course, the company’s travel and membership business could be considered aspirational, too. It aspires to hit its targets, though it’s largely been unable to so far—the division has missed revenue expectations in five of the past six quarters.

Among other worries? The Wyndham part of the business, pre-acquisition, cut its dividend by 40% during the pandemic, to 30 cents per share from 50 cents previously. The combined T + L has since started raising again, but the current 40-cent payout is still well shy of pre-cut levels. Also, higher interest rates are pressuring margins on TNL’s timeshare financing securitizations, and there’s the open question of how much a potential recession could cramp vacation demand.

Thus, for now, it looks like TNL is very cheap for a reason.

3. Nordstrom

- Dividend Yield: 5.1%

- Forward P/FCF: 3.0

- PEG: 0.69

E-commerce has gone from mere snacking on mall operators’ lunch years ago to outright devouring it, making it difficult to get behind just about any traditional operator.

Nordstrom (NYSE:JWN) is no exception; its shares have been battered over the past few years. Indeed, both its attempt and failure to go private a few years ago felt like an omen of the industry’s troubles to come.

However, the problem hasn’t so much been sales—which have been extremely resilient compared to its brethren—so much as an increasingly difficult operating environment that has led to evaporating profits.

Most Brick-and-Mortar Retailers’ Top Lines Don’t Look Like This

But Its Earnings and Price Action Are Grimly Familiar

While retail has become a more difficult business for years, Nordstrom is particularly pressured right now amid a tightening economic environment. JWN might be a more luxury-minded name than rivals Macy’s (M) and Kohl’s (KSS), but it’s hardly immune to these pressures. CEO Erik Nordstrom said its 2022 holiday season was “highly promotional, and sales were softer than pre-pandemic levels.” The company was forced to absorb even more markdowns to return its inventory to acceptable levels.

The dividend’s appealing 5% yield is hardly worry-free. Yes, it’s only 40% of JWN’s projected 2023 earnings. But remember: It’s only half of what it was paying in 2020 before Nordstrom suspended the dividend for two years. Also hanging over JWN like a cloud is $4 billion in net debt.

But given just how cheap Nordstrom shares are trading—based on P/FCF, PEG and several other metrics—it might be foolish to bet against JWN, too.

4. Griffon Corporation

- Dividend Yield: 8.4%

- Forward P/FCF: 6.7

- PEG: 0.60

Griffon Corporation (NYSE:GFF) is a holding company that owns brands in the consumer and professional products, and home and building products industries. Some of its brands include storage solution firm ClosetMaid, lawn-and-garden toolmaker Ames, and garage doormaker Clopay, among others.

Unlike many other home-related firms, Griffon wasn’t struck by a 2022 hangover—instead, its stock kept heading higher. But it wasn’t just continued momentum from increased homebuying. At the start of 2022, GFF said it was reviewing “strategic alternatives”—Wall Street code for “exploring a sale.”

Griffon has become cheap, however, courtesy of a nearly 33% decline from its February 2023 highs. Curiously, much of that came after activist investment firm Voss Capital won representation on GFF’s board in January—typically, activist involvement spurs more buying, however short-lived it might be.

Then in April, Griffon concluded its strategic review and determined it wouldn’t sell out, but instead continue with its current strategic plan. So, at least for now, a buyout pop is out of the question. But prospective shareholders are staring at a deeply discounted company that’s improving its free cash flow generation.

Also worth noting: After ending its strategic review, Griffon decided to throw cash at shareholders. GFF announced it would add $200 million to its existing repurchase authorization (for a total of $258 million, or 17% of shares outstanding!) and distribute a $2 special dividend, payable May 19 to shareholders of record as of May 9.

The problem? Griffon’s 8.4% yield gets a ton of help from that special dividend; based just on GFF’s (admittedly growing) regular payout, shares yield just 1.4%.

This kind of special dividend—a one-off payment we probably won’t ever see again—is not a long-term recipe for high and sustainable income. But our next stock’s “specials” might be.

5. Coterra Energy (NYSE:CTRA)

- Dividend Yield: 10.3%

- Forward P/FCF: 5.1

- PEG: 0.19

Coterra Energy (CTRA) is a name that has popped up on my radar again and again and again in recent months. This oil, natural gas and natural gas liquids (NGLs) company was formed in 2021 as a result of a merger between Cabot (NYSE:CBT) Oil & Gas and Cimarex Energy (NYSE:XEC). It’s a major player in Texas’ and New Mexico’s Delaware Basin, also boasting acreage in the Marcellus and Anadarko basins.

Coterra has hardly been a dog compared to the broader market, but it has struggled compared to the rest of the energy sector since late 2022, largely on expectations that natural gas prices will struggle to gain traction in 2023. (90% of Coterra’s proved reserves are 78% gas, 12% NGLs, and just 10% oil.)

CTRA Shares Are Deflated

The good news? Coterra is an excellent operator whose investments in production improvements have helped it squeeze more cash out of every drop of oil. But instead of throwing that cash indiscriminately at investors in the form of a fixed dividend—then praying commodity prices remain high—CTRA instead adopted a .

In short, Coterra aims to pay out 50% of its free cash flow as dividends. This starts with a 15-cent “base” dividend, then a variable dividend as remaining free cash flow allows. The yield on the base dividend is an admittedly modest 2.5%, but given that the total yield is 10%-plus, you can see the income-producing potential of this stock.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.