4 Trade Ideas For AIG: Bonus Idea

Dragonfly Capital | Dec 24, 2018 07:18AM ET

Here is your Bonus Idea with links to the full Top Ten:

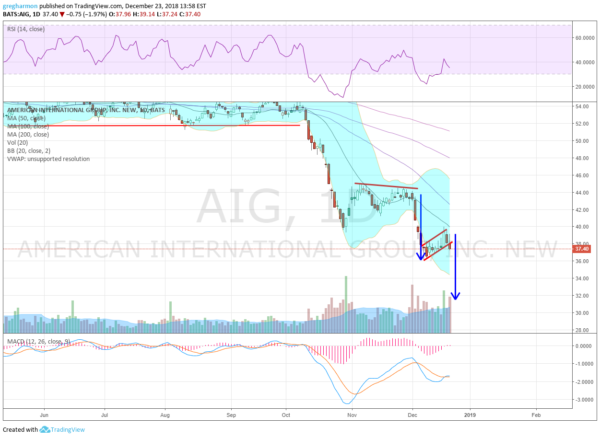

AIG (NYSE:AIG), $AIG, moved sideways in consolidation in a channel for 6 months until dropping out of it in October. It found support by the end of the month more that 25% lower and bounced. The bounce stalled at the 20 day SMA and it held there for another month. Then in December it started lower again. It found support at a lower low and has been building a bear flag since. Friday it started to break that flag to the downside.

A Measured Move lower gives a target to under 32. The RSI is falling and bearish with the MACD level and negative. There is support at 36.40 and then 34.60 back in 2013. That is followed by 33 and 30.50 before 30. Resistance above comes at 39.40 and 41.60. Short interest is low at 2.1%. The stock pays a 3.42% dividend but went ex-dividend on December 12th. The company is expected to report earnings next on February 6th.

The December 28 Expiry options chain shows biggest open interest at the 39 Call strike. The January chain shows enormous open interest at the 45 strike on both sides. And the February chain, the first to cover the earnings report, shows big open interest at the 32 and 41 strikes on the put side, and 42 and 43 strikes on the call side.

AIG, Ticker: $AIG

Trade Idea 1: Sell the stock short on a move under 37.25 with a stop at 39.

Trade Idea 2: Sell the stock short on a move under 37.25 and add a January 4 Expiry 39 Call (59 cents) as protection.

Trade Idea 3: Buy the January 37/32 Put Spread ($1.15).

Trade Idea 4: Buy the February 37/32/28 Broken Wing Put Butterfly ($1.09).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the Christmas shortened week sees equities looking the worst they have in at least 2 years.

Elsewhere look for Gold to continue in its uptrend while Crude Oil continues the path lower. The US Dollar Index continues to mark time moving sideways while US Treasuries are biased higher short term. The Shanghai Composite and Emerging Markets have resumed their downtrends.

Volatility looks to remain elevated and creeping higher keeping the bias lower for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts are in solid downtrends on both the daily and weekly view, with the IWM and QQQ in unofficial bear markets, off more than 20%, with the SPY close behind. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.