4 Top Oil Stocks for Impressive Returns in the Second Half of 2021

Zacks Investment Research | Jul 06, 2021 09:16PM ET

Energy companies recovered from last year when the coronavirus pandemic hit the global oil demand massively. Economies are now reopening with more people socializing and going to work, improving the outlook for fuel demand. This has bolstered optimism for oil players’ significant earnings generations in the second half of this year.

Recovering Oil Price

The price of West Texas Intermediate (WTI) crude, trading at more than $70 per barrel mark, has improved drastically from the pandemic-hit April 2020, when oil was in the negative territory. With the massive coronavirus vaccine rollout, the demand for fuel will possibly improve further. This has paved the way for more recovery in the oil price.

Recently, the price of WTI crude touched its six-year high mark briefly and then retreated. The volatility in the commodity price signifies the tensions within the OPEC cartel since there are possibilities of some producers in the block to boost production in the coming months. However, the volatility is not going to be a headwind. Notably, many analysts are expecting the cartel to reach a deal to gradually raise the output in the coming months, as higher production will match the increasing global consumption level.

Notably, the U.S. Energy Information Administration (“EIA”) expects a relatively balanced oil market for the second half of this year. This is because increasing production will stop the continuous draw in the global crude oil inventory, added EIA.

Impressive Earnings Outlook

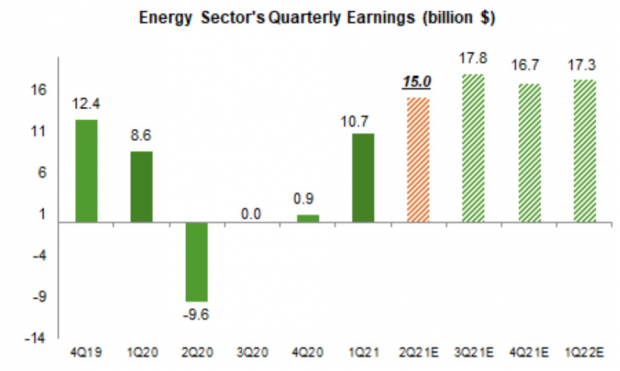

Soaring demand for fuel in the United States and other developed economies is improving energy companies’ earnings outlooks. Per the Zacks Earnings Trends report, the energy sector will likely generate respective earnings of $17.8 billion and $16.7 billion in the third and fourth quarters of 2021, suggesting massive improvements from the prior-year comparable quarters.

Thus, most analysts are projecting fuel demand recovery to continue in the July-December period. Notably, the momentum started from the beginning of 2021 when countries commenced boosting their coronavirus vaccine arsenal to beat the pandemic. In the March-end quarter of this year, the energy sector generated earnings of $10.7 billion, improving from $8.6 billion in the prior-year quarter. Also, the energy sector is likely to generate earnings of $15 billion in the June-end quarter of this year, whereas it reported $9.6 billion losses in the prior-year quarter.

4 Stocks in the Spotlight

Given the backdrop that the energy sector is recovering and is poised to generate significant earnings in the second half; it would be an opportune moment for investors to include oil stocks in the portfolio. We have employed our proprietary Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.