4 Biotech Stocks Investors Can Add To Their Portfolio In 2019

Zacks Investment Research | Dec 10, 2018 09:00PM ET

It has been a disappointing year for the biotech industry. The NASDAQ Biotechnology Index (^the complete list of today’s Zacks #1 Rank stocks here .

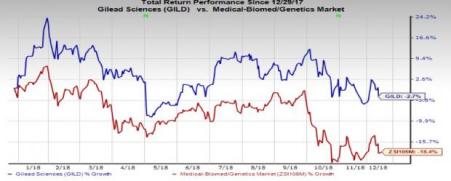

Its shares have declined 2.7% in the year so far, outperforming the industry’s 18.4% decline. Estimates for 2019 have increased 20 cents in the past 60 days.

Based in New Haven, CT, Alexion Pharmaceuticals (NASDAQ:ALXN) focuses on the development and commercialization of life-transforming drugs, for the treatment of patients with ultra-rare disorders. Alexion’s key growth driver, Soliris, is approved for the treatment of two severe and ultra-rare disorders resulting from chronic uncontrolled activation of the complement component of the immune system – paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS). Soliris continues to perform well. FDA approval for the generalized myasthenia gravis indication has boosted sales significantly, leading to an increase in annual guidance. Strensiq and Kanuma are doing well and are expected to boost revenues. Meanwhile, Alexion has been quite active on the acquisition front as the company is looking to diversify its portfolio and reduce dependence on Soliris. Alexion recently acquired Wilson Therapeutics Syntimmune.

Alexion currently carries a Zacks Rank #1. Its shares have lost 3.4% so far in 2018. Estimates for 2019 have increased 3 cents in the past 60 days.

Tarrytown, NY-based Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) is a biopharmaceutical company focused on the discovery, development and commercialization of treatments targeting serious medical conditions. The company’s portfolio boasts of marketed drugs like Eylea (for several eye diseases), Dupixent (moderate-to-severe atopic dermatitis), Praluent (heterozygous familial hypercholesterolemia) among others. The company’s key growth driver, Eylea continues to drive sales and label expansion into additional indications has further boosted growth. The uptake of Dupixent has been strong too and the company is working to expand Dupixent’s label further in several other indications. This should diversify the company’s revenue base and reduce dependence on Eylea.

In September 2018, the FDA approved its immuno-oncology therapy, Libtayo for the treatment of patients with metastatic or locally advanced CSCC who are not candidates for curative surgery or curative radiation. Approval of new drugs should further boost the top line.

Regeneron currently carries a Zacks Rank #2. Its shares have lost 0.8% in the year so far. Estimates for 2019 have increased 43 cents in the past 60 days.

Based in Cambridge, MA, Biogen Inc. (NASDAQ:BIIB) is one of the world’s leading biotechnology companies focusing on developing innovative therapies for treating serious neurological and neurodegenerative diseases, including its core growth areas of multiple sclerosis (MS) and neuroimmunology, Alzheimer’s disease (AD) and dementia, movement disorders and neuromuscular disorders, including spinal muscular atrophy (SMA) and amyotrophic lateral sclerosis (ALS).

Biogen has a strong position in the MS market with a wide range of products including Avonex, Tysabri, Tecfidera and Plegridy. The company is also looking to diversify beyond MS to other areas like Alzheimer’s, Parkinson's and stroke among others. Spinraza (nusinersen) also consolidated its position in the neurological disease market with the drug being the first and only treatment to be approved in the United States for SMA. The company also has a robust pipeline and approval of new drugs will boost growth.

Biogen currently carries a Zacks Rank #2. Shares have lost 0.6% so far in 2018. Estimates for 2019 are up 50 cents in the past 60 days.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.