3 Zacks Rank #1s with Growth AND Value

Zacks Investment Research | Oct 01, 2021 12:24AM ET

Whether it’s a business deal, a job, a relationship or your favorite brand of toothpaste at the supermarket; nobody likes to just settle for something. It means we’re accepting less than the best… usually because it’s easy.

And when it comes to investing, it means we’re making less money than we could. If you want to invest in Growth AND Value… you should be able to do it! And Zacks can help.

We’ve got a screen that not only helps you find big growth rates and low valuations, but also adds the power of the Zacks Rank. This screen is ingeniously titled: BBY

It’s scary to think where this country would’ve been in this pandemic without technology. It allowed millions of people to work from home and students to learn from home during an unprecedented shutdown. We were able to stay in close contact with loved ones in quarantine. And technology provided gaming and streaming options to keep the family occupied so you can have just a few sweet moments of solitude before resuming your government-mandated house arrest with those lovely people.

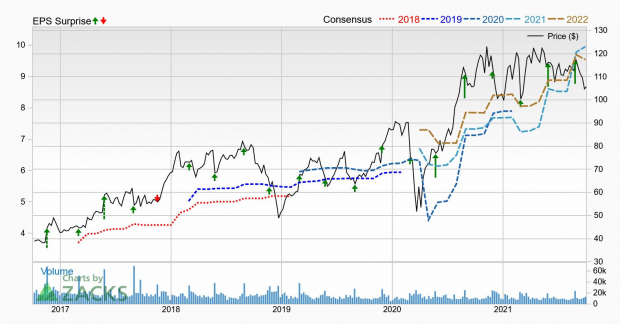

Throughout all these circumstances, Best Buy (BBY) was there with the consumer electronics necessary to keep things going when Covid locked things up. The dependence on technology led to 14 straight quarters of positive surprises for the company, including a more than 56% beat in its recently reported fiscal second quarter.

BBY is part of the Retail – Consumer Electronics space, which means it’s in the top 13% of the Zacks Industry Rank. The company has been focused on developing its omni-channel capabilities, improving the supply chain and cost-containment efforts. It’s really been paying off!

Earnings per share reached $2.98 in its fiscal second quarter, which trounced the Zacks Consensus Estimate by more than $1.

Enterprise revenues jumped nearly 20% to $11.85 billion, compared to our expectation of $11.6 billion. Enterprise comp sales increased by the same percentage. Key drivers in the quarter were computing, mobile phones, home theater, appliances and services.

Best of all though, BBY expects continued customer demand and solid momentum. In fact, it now sees enterprise comparable sales increasing between 9% and 11% for fiscal 2022, compared to the previous outlook of 3% to 6%.

The Zacks Consensus Estimate for this fiscal year (ending January 2022) is up to $9.95, which has advanced 16.9% in just two months. The expectation for next year (ending January 2023) is only at $9.54, which is up 9.3% in two months but down year over year. However, there’s plenty of time for that to improve as consumers are unlikely to throw their computers, TVs and gaming systems away in the future.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it's poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks' Stocks Set to Double like Boston Beer (NYSE:SAM) Company which shot up +143.0% in a little more than 9 months and Nvidia (NASDAQ:NVDA) which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.