3 Ways To Know When It’s Time To Sell A CEF

Contrarian Outlook | Dec 26, 2019 04:28AM ET

With the whipsawing market we saw in early December—and now a snap back to near all-time highs—now is the perfect time to talk about one of the biggest questions you’ll face as a closed-end fund (CEF) investor: how do you know when to sell a fund?

Unfortunately, there’s no simple answer—and often investors who use conventional sell signals, like a falling market price, will end up selling at the worst time.

That leads me to my cardinal rule with CEFs: it’s easier to know when to buy than when to sell. If the fund is well managed, has a strong track record, is deeply discounted and has a relatively safe dividend, it’s generally a screaming buy. Signs to sell aren’t always so obvious, but they are still there. You just need to know what to look for.

With that in mind, here are three points to consider when deciding whether to sell a CEF.

CEF Sell Strategy No. 1: Watch the Discount

The first clue that it’s time to sell a CEF is the most obvious: when the fund is overbought, it’s time to dump it.

For instance, take the BlackRock International Growth (NYSE:BGY), which I recommended to members of service in March 2017. I chose BGY at that time because its discount had suddenly widened, despite the fact that changes in its portfolio indicated it was well positioned to surge.

The fund did this over the following eight months:

A Fast 20% Return

A big reason for this return: BGY’s unusually large discount of 12% in March steadily closed to a more normal 6.7% in November 2017, when I urged subscribers to sell.

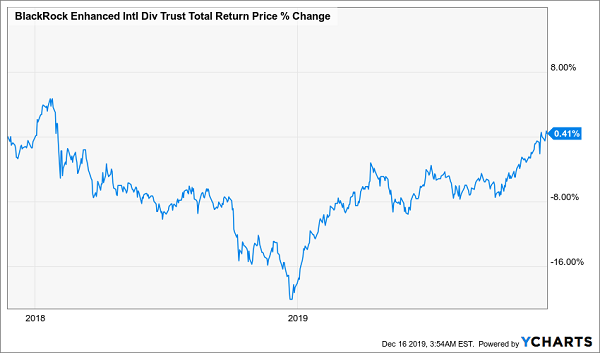

After my sell call, the fund did this:

BGY Goes Negative—and Stays There for 2 Years!

Imagine waiting two full years just for your investment to get back to even! That’s what we need to avoid by selling CEFs at the right time.

The lesson? Keep track of the discount, and when it gets too narrow (or becomes a premium) relative to its historic average, it’s time to get out of this crowded trade.

CEF Sell Strategy No. 2: Watch for Pressure on an Entire Sector

Sometimes some outside force will pressure the type of assets the fund invests in. When this happens, sell as fast as possible.

The great thing about CEFs is that, in large part because of their small size and retail-investor base, they react more slowly and over a longer period to bad news than more popular ETFs. This means anyone who keeps up with the news and invests in CEFs has more leeway to respond to the market and sell.

A clear example of this happened with a municipal-bond fund in late 2017: the Invesco PA Value Municipal Income Trust (VPV).

I recommended this fund to members in March 2017, for familiar reasons: a great and reliable dividend yield, strong management and an unusually big discount. And the fund delivered over the next few months, even outperforming the municipal-bond index ETF that tracks VPV’s benchmark:

Cheap VPV Beats the “Dumb” Index Fund

Then a major news event happened in September 2017 that prompted me to release a sell alert: S&P Global Ratings downgraded Pennsylvania’s bonds, and the state did not immediately respond to the market’s concerns.

The combination of a downgrade and lawmakers’ refusal to address it was a crystal-clear sell signal. VPV did this in the five months after we unloaded it:

VPV Takes a Fast Dive

For a municipal-bond fund, this is a big move in a short time. And all it took to avoid this short-term pain was to follow the news and react in a timely way.

CEF Sell Strategy No. 3: Get Defensive in a Bear Market

My third point is something we briefly saw at the end of 2018: a bear market.

Every investor dreams of avoiding plunges like 2008/09. No one can steer clear of losses all the time, of course, but it is possible to defend your portfolio while continuing to collect the 7%+ dividend streams our picks hand us.

The key is to keep a watchful eye for the economic warning signs: rising unemployment, slower wage growth and a downtrend in consumer spending.

And there’s no sign of any of these yet: as I wrote a couple weeks ago, incomes are rising at a solid pace, real estate is picking up, and the US is basically operating at full employment. That means we’re more likely to see stronger markets and rising corporate earnings next year.

But no matter what happens, I’ll keep a close eye on all the vital economic numbers and keep you updated (including giving you clear instructions on how to respond) in .

My Top 5 Buys for 28% Returns (and 8% Dividends) in 2020

Right now I’m pounding the table on 5 CEFs trading at such ridiculous discounts that they’re practically spring loaded for 20%+ gains in 2020, as these bizarre markdowns (inevitably) snap back to normal.

That’s not all, though.

Because my top 5 CEFs for 2020 also pay 8% average dividends. Tack that onto our expected 20% gain and we’re looking at a 28% total return by the end of 2020!

Unbeatable Nest Egg Protection

In addition to our 20%+ upside, these 5 funds’ huge discounts also let us sleep well at night. That’s because if the market falls on its face next year—which, as I just mentioned, is the opposite of what I expect—these funds are already dirt-cheap, giving them plenty of built-in downside protection. And no matter what happens, we’ll still collect their rich 8% average dividends!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.