3 Reasons Why You Should Be Scared Of Inflation

MarketBeat.com | Jun 15, 2021 05:35AM ET

This Is Why The FED Will Hike Rates This Year

If the COVID-19 pandemic was the defining Black Swan event of our generation, rising inflation is the white swan event that will dominate our lives for the foreseeable future.

White Swan events are events that are easily predictable—and easily avoided—but for some reason, no one seems to be doing anything about it and in this case, it is rising prices. The FOMC has been trying to assure us that hyperinflation is transitory, but we do not agree.

The evidence does not suggest that recent spikes in consumer prices are transitory and will lead the FOMC to raise interest rates this year. The real question for investors is whether or not to prepare for such an event; we think the answer is yes.

If you think about it, the FOMC has been begging the economy to begin raising prices for years and it finally started to listen.

1. Inflation Is Already Here And You Can't Get Away From It

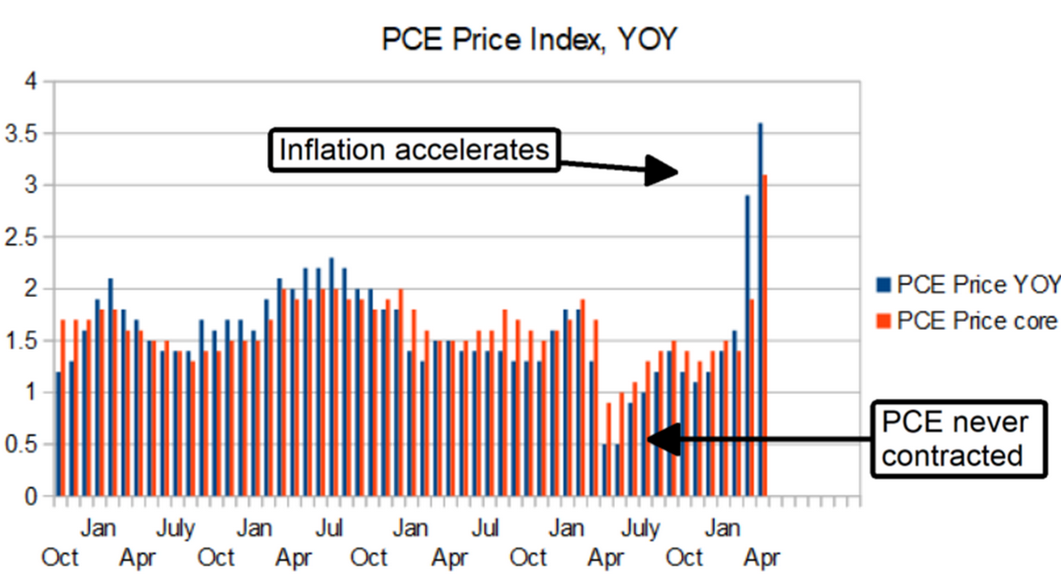

The really scary thing about the inflation picture is that Inflation is already here and nobody's doing anything about it. Starting with the Fed's preferred measure of core consumer-level inflation—the PCE price deflator—inflation spiked above the FOMC's 2% target, in March and has only accelerated in the time since.

The PCE accelerated at the core level from 1.9% in March to 3.1% in April and we expect it to go higher in May and June. Not one single S&P 500 company has been talking about lowering prices; if anything, they're talking about the impact of higher input costs, higher wage costs, and higher commodity costs, and the need to raise their prices to offset these pressures.

The Consumer Price Index tells the same tale. The Consumer Price Index has come in hot and above expectation for the past 2 months and accelerated from April to May with YOY gains of 5.0%. That's more than double the Fed's target 2% rate and it's accelerating.

Now, if we were talking about GDP or earnings growth the hot numbers wouldn't be such a big deal. Last year GDP shrank by 30% and earnings shrank by a high double-digit for most companies making this year’s comps incredibly good.

That said, the economy and corporate earnings have only barely returned to pre-pandemic growth levels. Inflation did not contract last year. It slowed to about 0.5% and then it reaccelerated and it's still accelerating. If there was ever a time for the FED to act to tamp down inflation, we think this is it.

2. Core Inflation Data Doesn't Measure Actual Inflation

If inflation is the net result of rising prices on the consumer, our core consumer inflation data isn't measuring what it is supposed to. The two most impactful items on consumer spending are energy and food, and those are the first two things taken out of the equation. When they are included, the impact of the index often doesn't match reality.

We know from the signs out on the street—and the prices that we pay—that gas prices are nearly double what they were last year. That's a 100% increase in energy inflation that's not being measured correctly; and that cost is feeding into food prices.

The biggest cost for food producers is energy. When it cost more for them to buy gas, it's going to cost us more to buy food and this goes for oh so many other sectors of the economy. According to the CPI, the cost of shelter only increased 2.2% over the past year, but we know the price of lumber and construction materials and houses are up at least 20% YOY and that's a very generous estimate.

Home prices are up at least 20% based on the Case-Shiller report and lumber prices are up triple digits. In our view, true consumer inflation is already running at a double-digit pace.

3. The FED knows More Than It's Letting On

You’d have to be pretty naïve to believe that the FOMC doesn't know more than it's letting on. We believe this is evident in the abrupt shift IN stance that we've seen within the committee over the past six months.

At the beginning of the year, even as late as March, the FOMC was projecting at least two years of zero interest rate policy, no need for taper, and no need for interest rate hikes. Now, 6 months later, the group of them are babbling on about “talking about talking about the taper,” along with their buddy, Secretary of the Treasury Janet Yellen (cough cough the x-FOMC chief), who thinks a rate hike could be needed.

The questions for us about the June FOMC meeting aren’t about if they will change what they say in the statement, but what is it they change and how will it affect the market.

In our view, the market needs to be prepared to be put on a firm track towards tapering and rate hikes.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.