3 Reasons Why Target’s Q4 Report Should Outpace Wal-Mart’s Results

Estimize | Feb 25, 2015 01:12AM ET

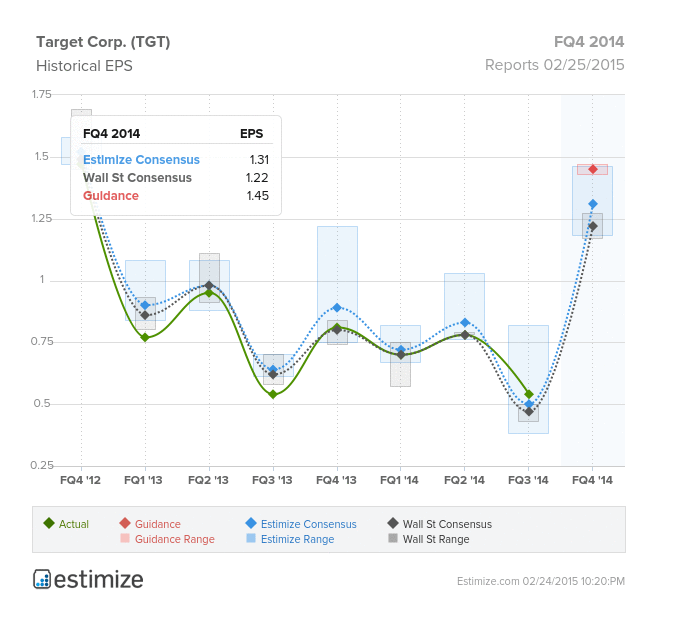

Of all the retailers reporting this week, the biggest delta between the Estimize consensus and the Wall Street consensus is for Target Corporation (NYSE:TGT), which releases results later this morning. Currently, the Estimize community is looking for Q4 EPS of $1.31, a good $0.09 above the Wall Street expectation, yet still $0.14 lower than the company issued guidance.

This is somewhat rare as corporations tend to be conservative when issuing guidance. Estimize revenue expectations are only slightly ahead of the Street, at $22.2B vs. $22.1B.

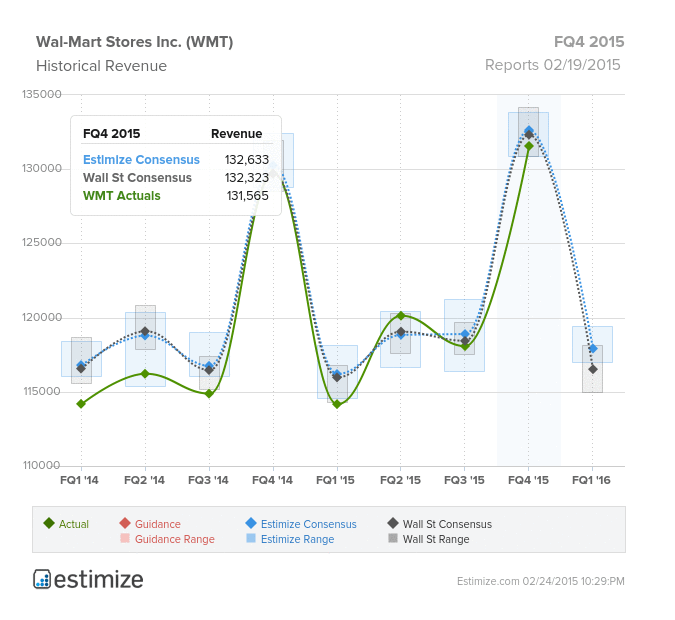

In the wake of Wal-Mart’s (NYSE:WMT) earnings report last Wednesday, contributors have taken EPS estimates for Target up $0.02, while revenues have come down by $73M. This is likely due to the fact that Wal-Mart’s bottom-line came in higher than expected while the top-line missed. As Target is the closest thing Wal-Mart’s has ever had to a competitor, many expect it to perform in the same manner.

However, there are three reasons Target is poised to do even better than Wal-Mart this season.

- Target is considered a “higher-end discounter,” and in a heightened consumer sentiment environment, many traditional Wal-Mart shoppers may decide to trade up. With that being said, this period of consumer confidence seems to be playing out a bit differently. While people are encouraged by lower gas prices and an improving employment situation, they are not necessarily spending their disposable income at the traditional retailers as would typically be expected. Instead, there has been more of a focus on electronics, healthcare and autos.

- Unlike Wal-Mart, Target stores are only located here in the U.S. and Canada, with the company just recently announcing their intention to close their Canadian business. Therefore, the retailer will not have to face the same currency headwinds that Wal-Mart (which operates in 27 countries) admitted to in Q4, which caused them to cut their 2015 sales growth outlook to 1% - 2% from 2% - 4%.

- Target will benefit from easier year-over-year comparisons this quarter. In late 2013 the company suffered from a huge data breach that weighed heavily on profits. This quarter they are looking for massive earnings growth of 62% and revenue growth of 3.4%.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.