3 Reasons It’s Not Too Late To Be Bullish On Apple

Estimize | Apr 29, 2015 05:00AM ET

Apple (NASDAQ:AAPL) stunned the world again with its second quarter earnings report. The sale of 61.2 million iPhones carried Apple above and beyond the expectations of Wall Street and investors alike. Here are 3 reasons to believe that shares of the world’s most valuable company can continue going higher.

1. Post earnings drift

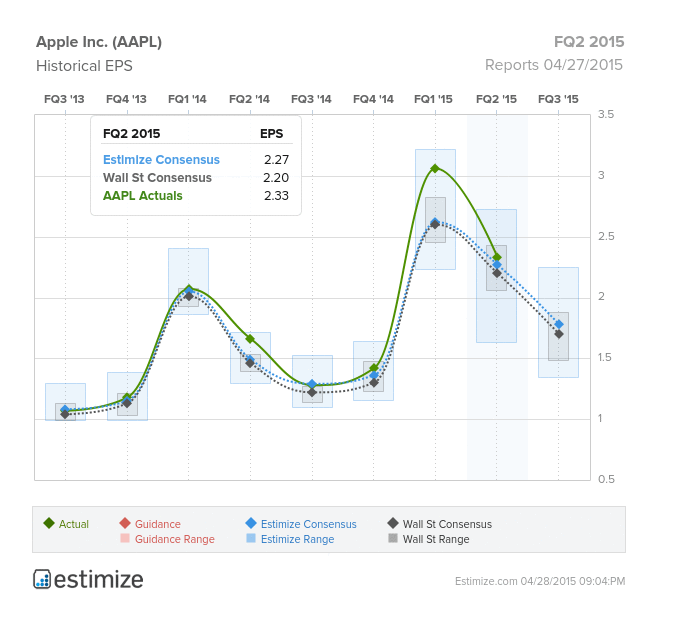

We know statistically that when a company beats the Estimize EPS consensus, on average, shares go higher over the next three days of trading compared to the broader market (via SPDR S&P 500 (ARCA:SPY)). Even though Apple was off to a slow start in Tuesday trading (down 1.2%), more often than not we expect an earnings beat like AAPL's to act as a positive catalyst over a 3 day period.

Apple not only topped the Wall Street consensus, it also topped the Estimize forecast by 6 cents per share, a hearty 2.6% beat. Before Apple’s report we wrote about how we expected a positive pre-earnings drift due to the differential between estimates from Wall Street and ChartIQ Visual Earnings platform has a tool called Price Horizon which lets users map future price targets based on current earnings estimates. Price Horizon applies a one-year trailing price to earnings ratio or price to sales ratio and extrapolates a price target based on consensus estimates.

If we apply Apple’s average price to earnings (P/E) ratio from the past year to estimates for next quarter, we arrive at a price target of $142.73. That’s 8.9% above the current price of $131.06.

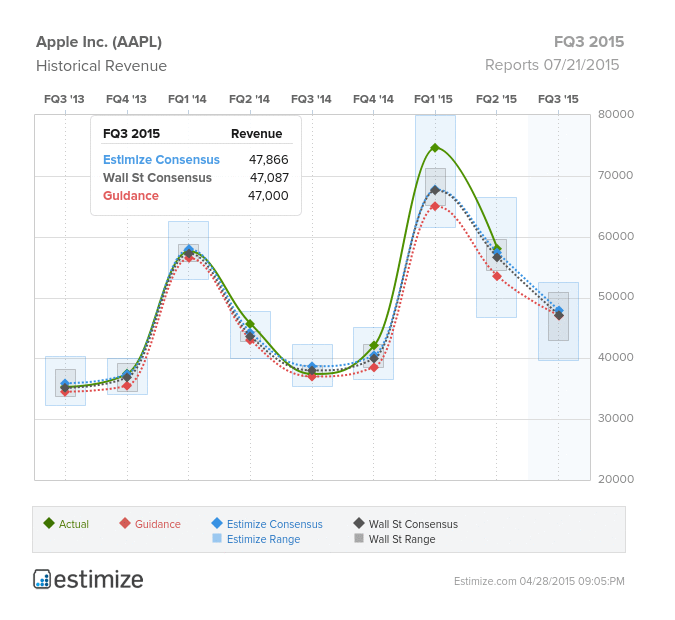

Furthermore, a quick glance at Apple’s guidance for the upcoming quarter suggests that estimates need to rise. In the past 2 quarters which have swelled due to the release of the iPhone 6, Apple has beaten its revenue guidance by $9.6 billion and $4.5 billion sequentially. One day after Apple’s Q2 earnings report Q3 estimates remain less than $1 billion above Apple’s newly issued guidance.

Apple also announced an extension to its share buyback program. By repurchasing its own stock Apple will decrease its count of shares outstanding, inflating earnings per share by decreasing the denominator.

3. Compared to peers, Apple is cheap

When compared to its closest rivals by market capitalization within the Information Technology sector (Google (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT), Facebook (NASDAQ:FB), and Alibaba (NYSE:BABA)), Apple is the cheapest by almost every valuation stat in the book.

Compared to its closest rivals Apple has the lowest forward and trailing price to earnings ratios.

The same is true for forward and trailing price to sales ratios.

Apple’s financial results are on another planet. In the second quarter Apple recorded net income of $13.57 billion, 40.8% gross margins, and increased its stock buyback program to $140 billion. With results like these it’s no wonder that Apple is the most valuable company on Earth and there are many reasons to believe its worth could continue climbing.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.