3 Numbers: U.S. Retail Spending To Ring Up Another Solid Gain

James Picerno | Nov 15, 2016 01:16AM ET

- Germany’s ZEW economic sentiment indices expected to rise again in November

- Revised data for Eurozone Q3 GDP growth predicted to match initial estimate

- Any upbeat GDP forecasts are really just early guesstimates about what’s coming

- US retail sales likely to increase at a healthy pace for a second month

The second estimate of Eurozone GDP for the third quarter is the main event for Europe today. We’ll also see an update on November’s economic sentiment for Germany, followed by the October report on US retail sales.

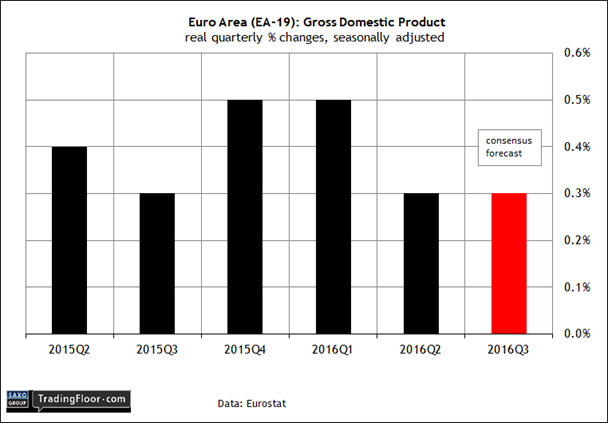

Eurozone: Q3 GDP (1000 GMT): The crowd’s projecting that the second estimate for Eurozone GDP growth in the third quarter will hold steady at 0.3%, based on Econoday.com’s consensus estimate.

The slow pace of growth in the single currency area is expected to continue in the fourth quarter via the implied projection in the current release of the Eurozone Composite PMI data for October. “The October PMI signals a mere 0.3% GDP growth rate, suggesting the fourth quarter could see growth unchanged on that seen in the second and third quarters despite the ECB’s further efforts to stimulate the economy,” the chief business economist at IHS Markit said earlier this month.

But Now-casting.com sees the potential for a stronger trend unfolding. The consultancy last week estimated Q4 GDP growth at a firmer 0.55% rate. The Bank of Italy’s Euro-Coin Indicator is softer, reporting that euro area output expanded 0.38% in the three months through October. But here, too, there’s a whiff of a mild acceleration in the macro trend in the final three months of this year.

It’s still early in the current quarter and so upbeat forecasts are little more than preliminary guesstimates about what’s coming. But if the trend is picking up, one would expect that today’s Q3 data won’t lose any ground relative to the previous Q3 GDP estimate of 0.3%. If a weaker-than-expected number arrives, however, the news may be an early warning that the prospects for faster Q4 growth are due for a downgrade.

Germany: ZEW Economic Sentiment (1000 GMT): Europe’s main economy is expected to pick up speed in the fourth quarter, according to recent sentiment data. Today’s November survey figures from the Centre for European Economic Research (ZEW) will deliver a reality check on the rosy outlook.

Meanwhile, the German PMI Composite Output Index for October suggests that the optimists are right. This benchmark of the macro trend ticked up to a three-month high last month, prompting forecasts for firmer growth in the fourth quarter. “The improvement in the PMI in October lifts hopes that the weaker expansions we have seen in the past two months were just a temporary soft patch, rather than the beginning of a serious slowdown,” an economist at IHS Markit said late last month.

Today’s ZEW report is expected to reaffirm that forecast. Econoday.com’s consensus forecast calls for a modest rise in the current and expectations numbers for November. If the projections are right, the current conditions data is on track to rise to its highest level in more than a year.

Analysts think that the expectations index will inch up too, although remain in a middling range relative to the past year. Nonetheless, if the forecasts are accurate, the widely read ZEW looks set to support the view that Germany’s economic growth will end the year on a relatively strong note.

US: Retail Sales (1330 GMT): Consumer sentiment in the US perked up in November, reversing last month’s slight loss, based on this month’s preliminary data of the University of Michigan’s measure of the mood on Main Street. Is this a sign that consumer spending will firm up in the final quarter of 2016?

“The recent gain in sentiment was driven by an improved outlook for the economy,” noted the chief economist for UoM’s survey research.

Meanwhile, economists are looking for another solid advance in retail sales for October. Econoday.com’s consensus forecast sees a spending increase of 0.6% for the second month in a row. The projected gain translates into a 3.5% year-on-year rise, which would be the strongest annual rise in eight months.

If the forecast holds up, the news will add more weight to expectations that the Federal Reserve is poised to raise interest rates next month.

Fed funds futures are already on board with that assumption. The market is pricing in an 86% probability that the central bank will squeeze monetary policy in December, based on CME data for Monday. Another healthy gain in retail spending today will further strengthen the conviction that the policy rate is headed higher in the final month of 2016.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.