3 Numbers: U.S. Jobless Claims To Post Another Weekly Decline

James Picerno | May 26, 2016 01:39AM ET

- New orders for durable goods in the US are on track to show a rise for April

- But any improvement in orders for April may be just a temporary bounce

- US jobless claims are set for a second weekly decline in today’s update

- Any upside surprise in jobless claims would be hard to swallow

- The US Pending Home Sales Index should post its third monthly increase in April

It’s a busy day for US economic news, which will provide timely insight about the state of macro in the wake of weak survey figures this week via PMIs for manufacturing and services in May. Today’s numbers include the April report on new orders for durable goods, the weekly jobless claims data, and the April release of the Pending Home Sales Index.

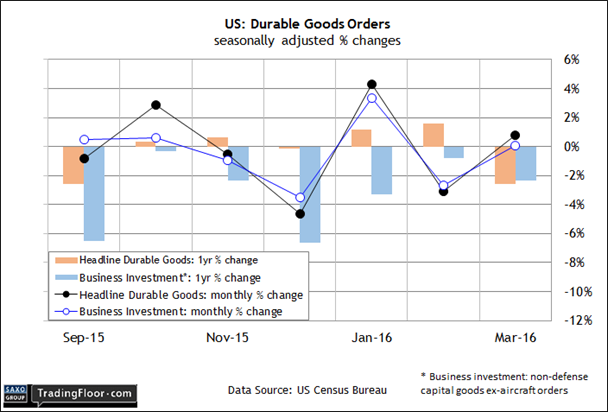

US: Durable Goods Orders (1230 GMT): Manufacturing appears to be recovering from its recent recession, but the preliminary numbers for May via survey data suggest otherwise. Markit’s purchasing managers’ index revealed that output fell this month for the first time more than six years.

“Output is falling for the first time since the height of the global financial crisis, with factories hit by slowing growth of order books and falling exports,” said the chief economist at Markit Economics on Monday. “Backlogs of work are also dropping at the fastest rate since the recession, meaning firms will be poised to cut capacity unless inflows of new work start to pick up again.”

The hard data for April, however, is expected to deliver brighter news, albeit in terms of a one-month lag relative to the latest PMI update. Econoday.com’s consensus forecast sees headline orders for durable goods rising for a second month in a row, which hasn’t happened since last summer. But even if the gain is accurate, the implied year-over-year change will remain in the red, albeit moderately so. The trend, in other words, will probably remain soft.

The bigger challenge, however, is what may be waiting for the manufacturing sector in May and beyond. If the latest PMI data is a reliable clue, any improvement in today’s report on orders for April may turn out to be a temporary bounce.

US: Initial Jobless Claims (1230 GMT): You could almost hear the sigh of relief after last week’s big drop in jobless claims. New filings for unemployment benefits fell a hefty 16,000 to a seasonally adjusted 278,000 for the second week of May. The decline is the first weekly slide since mid-April. The question is whether the recent surge in claims will continue in today’s release.

The stakes are higher than usual, given the sharp gains of late. Although last week’s report offered an encouraging change of pace, it’s always risky to reason from one number with the volatile claims data. A second weekly decline, however, will offer a more reassuring message.

With that in mind, today’s projection for a mild retreat of 3,000 is welcome news. If Econoday.com’s consensus forecast is correct, recent worries about the spike in claims will fade as a real and present danger for the analyzing the labour market. By the same token, however, an upside surprise will be hard to swallow.

Note that yesterday’s survey data for the services sector revealed that activity for the dominant driver of the US economy stumbled to a three-month low of 51.2 reading for May, which is close to the neutral 50 mark. Also, the PMI data for employment in services reflected only marginal improvement. “Jobs growth has now slowed in three of the past four months, with the latest upturn the weakest since December 2014,” Markit advised.

The crowd will be looking at today’sclaims data to help decide if the PMI warning is noise or an early sign of trouble for the labour market.

US: Pending Home Sales Index (1400 GMT): The appetite for house purchases rebounded sharply in April. Reports for new and existing home sales shot up last month, firing up expectations that the housing recovery remains healthy and perhaps poised to accelerate.

Sales of existing units jumped more than expected in April, due primarily to a solid gain in the Midwest US. The main event, however, was in transactions for new homes, which posted especially strong numbers last month--the biggest monthly gain in over a decade.

The recovery in recent years for housing has been choppy at times, but last April’s strong increase in newly built home suggests that demand for residential real estate is in no danger of stumbling any time soon.

“Consumers are taking the leap and buying the biggest of big-ticket items of their lives and this speaks to confidence,” the chief economist at MUFG Union Bank in New York told Reuters on Tuesday. “The Federal Reserve can raise rates at their June meeting without fear the economy is going to slow.”

Today’s data on pending sales will add fresh context for evaluating that forecast for next month’s Federal Open Market Committee meeting at the Fed. Pending sales, although published with a lag relative to sales figures, are considered a leading indicator for existing transacations. As such, the recent rise in the pending sales index in the last two updates bodes well for looking ahead.

Another increase is expected in today’s data for April. Econoday.com’s consensus forecast calls for an 0.8% rise in the pending sales index, which would mark three gains in a row. If the outlook holds up, we'll see another round of bullish news for the housing market.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.