3 Numbers: U.S. Inflation Expectations Shift Higher

James Picerno | Feb 13, 2017 06:25AM ET

- US inflation expectations may rise further, ahead of next month’s Fed meeting

- The RBNZ believes Washington's protectionist policies could give prices a lift

- Argentina’s stock market closes at a record high as economic rebound priced in

- Upbeat economic news for the UK is supporting the FTSE’s bull market

The week begins with a quiet day for scheduled economic releases. While we’re waiting for fresh numbers, let’s review three cases of upside momentum in markets, starting with US inflation expectations, based on Treasury yield spreads. Meantime, keep your eye on two stock markets that have been on a tear recently: Argentina’s Merval Index and the UK’s FTSE 100.

US: Treasury Inflation Forecast: Blackrock recently advised that “inflation is rising faster than many expect”. Housing costs, for instance, are trending up at the fastest pace in almost 10 years. Meanwhile, wages are starting to firm and consumers are anticipating that inflation will inch higher.

“None of this signals ’70s style inflation; it does suggest inflation may surpass still modest market-based expectations,” reasoned Russ Koesterich, a portfolio manager on BlackRock’s global allocation team.

The governor of the Reserve Bank of New Zealand seems to agree, noting that the Trump administration’s recent comments favour protectionist trade policies and, if implemented, could boost inflation. “It would raise inflation rates in the US. The said last week.

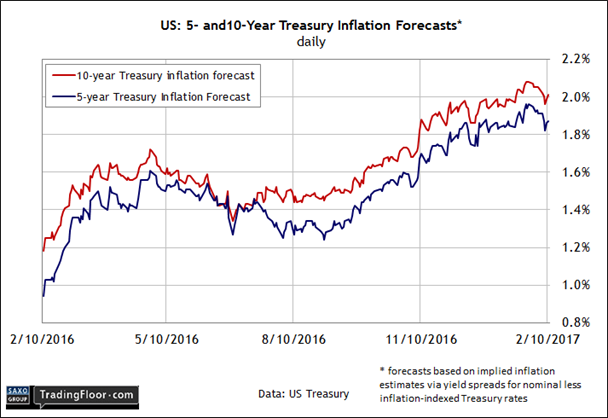

The Treasury market appears to be pricing in that possibility. The implied forecast, based on government yield spreads for nominal less inflation-indexed securities, has been steadily rising since last September.

The 10-year maturity’s inflation estimate has recently been running at roughly 2% this year, up from the 1.7% range on the eve of Trump’s election last November.

The odds are still low (around 24%) that the Federal Reserve will raise interest rates next month, according to Fed funds futures. But if the Treasury market’s inflation estimate ticks higher in the days ahead, the pressure will grow for another round of policy tightening sooner rather than later.

Argentina: Merval Stock Market Index: Elections have consequences, sometimes for productive reasons. Consider the sharp turnaround in the outlook for Argentina, South America’s second largest economy, that followed Mauricio Macri’s victory in the December 2015 presidential election.

Soon after taking office, Macri embarked on a plan to reverse the ill-advised economic policies of his predecessor.

The latest example: Last week’s announcement that Argentina and Brazil will strengthen their trading relationship in a bid to grease the wheels for economic growth. The news gives investors another reason to stay bullish on Argentina’s stockmarket.

The Merval Index, which closed at a record high last week, has been enjoying strong positive momentum for months and there’s no sign that the trend is about to reverse.

The economy is still struggling, but the outlook is brightening according to FocusEconomics. “Some green shoots are starting to emerge,” the consultancy advised recently, pointing to a rise in consumer confidence and industrial activity in the last two months of 2016.

The World Bank’s latest forecast anticipates recovery too. After several years of decline, GDP is expected to increase 2.7% in 2017, according to the January edition of the bank’s Global Economic Prospects.

The stock market is clearly on board with the recovery narrative. There are no guarantees, of course.

But as long the Merval holds above its key moving averages, as it has for most of the past 12 months, it’s reasonable to assume that the year ahead will bring upbeat economic comparisons against recent history.

UK: FTSE 100 Stock Market Index: Better-than-expected news for Britain’s economy keeps rolling in.

On Friday, the government reported that manufacturing activity surged in December. A key reason: Stronger exports, which received a lift from the sharp drop in sterling in the wake of last June’s Brexit vote.

The economy overall has been surprisingly resilient after last year’s vote to leave the European Union and few economists see the upbeat trend fading in the near term. In fact, last week’s monthly GDP estimate from the National Institute of Economic and Social Research revealed that output is picking up.

“Our estimates suggest economic output in the three months ending in January 2017 was 0.7% higher than in the previous three months,” a NIESR analyst said. “Driving growth is strong momentum in consumer spending combined with a pickup in output growth of manufacturing.”

If NIESR’s estimate is right, Britain’s macro trend last month accelerated to the fastest pace in more than a year.

The stock market seems to agree. The FTSE closed at a three-week high on Friday, building on a post-Brexit rally that has pushed the index close to an all-time high.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.