3 Numbers: U.S. Housing Demand Continues To Build

James Picerno | Dec 28, 2016 01:11AM ET

- Consumer and business sentiment in Italy set to head higher in December

- Pending Home Sales Index for the US in November expected to rise

- No obvious catalyst on tap this week to reverse GBP/USD's December slide

Sentiment data for Italy is in focus today with December updates for the business and consumer sectors. We’ll also see new figures for the US Pending Home Sales Index in November. Meanwhile, keep an eye on GBP/USD, which has been slipping throughout most of December.

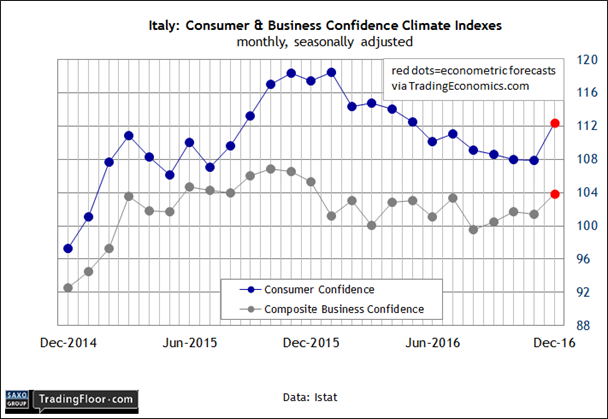

Italy: Business and Consumer Confidence Indices (0900 GMT): Consumer sentiment in Italy has been trending lower during much of 2016 while the mood in the business sector has been generally flat. Will today’s update for December – the first official sentiment release since voters rejected the constitutional referendum earlier this month – mark a change in the trend? Yes, according to TradingEconomics.com’s econometric forecast.

The mood is expected to brighten in the business and consumer sectors in the closing month of the year. The data site’s estimate on both fronts calls for a solid upside reversal after weakness in recent months, particularly for the consumer index.

What accounts for the expected improvement? Good question. At the moment, there’s no obvious trigger. Italy’s economy remains sluggish at best and there’s more political uncertainty lurking in the wake of the "No" vote’s success in this month's referendum snub. Then again, maybe the potential for a changing of the guard in the upcoming parliamentary election has inspired hope.

Italy’s stock market is certainly looking on the bright side at the moment, suggesting that the crowd’s outlook for change (political or otherwise) is skewing positive. The FTSE MIB Index is up more than 14% so far in December. European equities generally are higher this month as well, although Italy’s rally is quite a bit stronger vs. the gains in Germany, France, and Spain. Germany’s DAX Index, for instance, is ahead by roughly 8% month to date, or well below Italy's gain.

Is that a sign that sentiment in Italy is about to pop as well?

US: Pending Home Sales Index (1500 GMT): Demand for houses has been firm this year, as last week’s surprisingly strong gain for existing homes in November reminds. The concern is that the recent rise in interest rates has more room to run in 2017. If so, the outlook for housing may face its strongest test yet since the recession ended in 2009.

The 10-year Treasury yield, for instance, was just below 2.6% at mid-day trading on Tuesday – up sharply from around 1.8% in early November. The resulting increase in mortgage rates poses a challenge for the housing market, although there’s a decent tailwind that may keep the positive momentum intact for the near term.

Today’s November data for the Pending Home Sales Index – a leading indicator for housing demand – is expected to climb 0.5%, according to Econoday.com’s consensus forecast, marking the third straight increase. If the projection is right, the news will restate the message in last week’s numbers for existing sales: purchases continue to rise.

But with financing costs heading higher, the industry is preparing for headwinds. The turbulence probably won’t show up in today’s release, but it is likely to appear in the months ahead.

GBP/USD: The pound’s November rally against the US dollar continues to fade, raising questions of whether GBP/USD will soon re-test the October lows.

It’s easy to assume no less, given sterling’s bearish pattern via moving averages. Based on daily data, the inability of the 50-day average to move decisively above the 100-day average suggests that the previous low of roughly 1.21 will be re-tested at some point in the weeks ahead.

A run of stronger-than-expected economic numbers could change the calculus, of course, but the cupboard is nearly bare for the rest of the week in terms of scheduled releases. The pace picks up in the first week of the new year, including December PMI data for the manufacturing and services sectors and a fresh GDP estimate from the National Institute of Economic and Social Research.

Meanwhile, there’s the elephant in the room: Brexit chatter generally, and Article 50 in particular. This slice of the Lisbon Treaty lays out the framework for a member state’s departure from the European Union. With expectations that it will be formally invoked in early 2017, there could be a new wave of reverberations looming for the pound.

“[We] believe that activation [of Article 50] will be the crystallisation of Brexit fears and the final leg lower in the pound,” predicted a foreign exchange strategist at Bank of America Merrill Lynch.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.