3 Numbers: U.S. Factory Orders Set To Rise For Second Month

James Picerno | Mar 06, 2017 01:13AM ET

Sentiment in Europe’s retail sector is in focus today with the update of the Eurozone Retail PMI. We’ll also see fresh data on the Eurozone Sentix Investor Confidence Index in the March update, followed by the January figures for US factory orders.

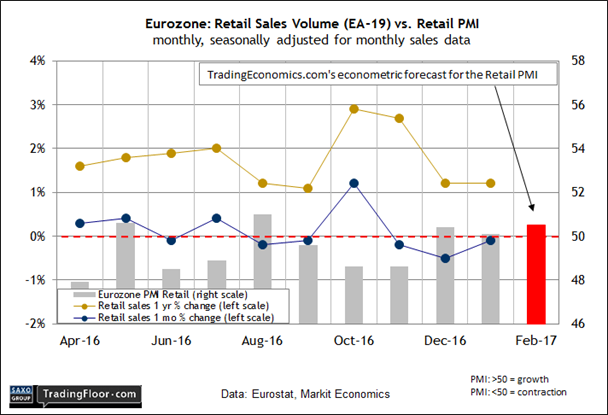

Eurozone: Retail PMI (0910 GMT): Retail spending in the Eurozone fell for a third month in January, surprising economic forecasters and raising questions about the recent increase in growth projections for the countries that share the euro.

The weakness in demand from the consumer sector is blamed on the recent rise in inflation. Headline consumer prices increased 2% in February vs. the year-earlier level, according to Eurostat. The firmer pricing for the headline change in the consumer price index, the fastest pace in four years, lifted inflation slightly above the European Central Bank’s target of just below 2%.

Inflation may be a new headwind, but the year-on-year advance in retail sales held steady in January, albeit at a relatively sluggish 1.2% rate. But in the wake of the disappointing monthly comparison, the market will be sensitive to incoming numbers that disappoint.

On that front, today’s survey detail for the retail sector in February will be widely read. The Eurozone Retail PMI was virtually flat in January, hovering just above the neutral 50 mark at 50.1. A dip below 50 would create more uncertainty about the near-term outlook for spending and the Eurozone’s macro trend generally.

One forecast, however, sees a modest upturn for today’s PMI release. TradingEconomics.com’s econometric estimate calls for the Retail PMI to inch up to 50.5 in February from 50.1 previously. That still signals weak growth bordering on stagnation, but even a thin veil of good news will keep hope alive that the demand will perk up in the spring.

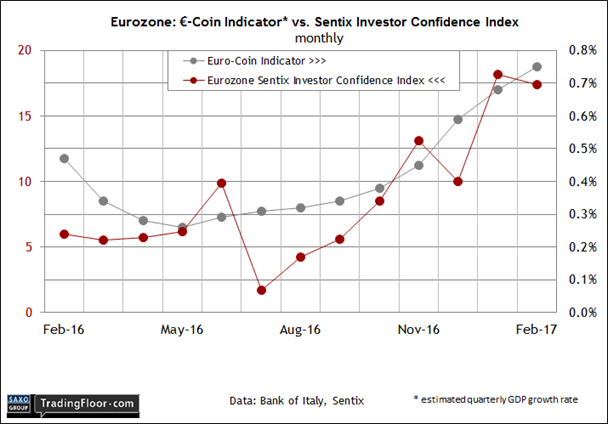

Eurozone: Sentix Investor Confidence Index (0930 GMT): Retail spending in Europe may be sluggish, but GDP growth is still expected to accelerate in this year’s first quarter.

Now-casting.com on Friday continued to posted a 0.75% advance for the three months through February.

The ascent in Q1 GDP estimates in recent months have been accompanied by a brightening mood in the investment community. Although the Eurozone Sentix Investor Confidence eased in February, the decline was mild, leaving the index close to its highest level in almost two years.

Since the last Sentix update for the euro area in early February, the Stoxx 50 Index, a benchmark of blue chip Eurozone stocks, has climbed roughly 4%, closing last week at the highest level in more than a year. The upside momentum implies that investor sentiment will remain buoyant in today's release.

Europe still faces several challenges in the months ahead, including the possibility that Eurosceptic political parties could find traction in upcoming elections in France, Italy and Germany. Meanwhile, the simmering threat to the Eurozone due to hefty debt loads in Greece and Italy could create havoc later this year.

For the moment, however, economic and market sentiment remain bullish overall, and it would be surprising if today’s Sentix data for March throws cold water on the upbeat mood.

US: Factory Orders (1500 GMT): A parade of Fed officials last week advised that a rate hike was near, perhaps at next week’s monetary policy meeting.

“I think the case for monetary policy tightening has become a lot more compelling,” said Bill Dudley, New York Federal Reserve President. His counterparts at other Fed banks made similar comments.

The hawkish chatter was capped with Friday’s speech by Fed Chair Janet Yellen, who reaffirmed that another round of monetary policy tightening is near.

“We currently judge that it will be appropriate to gradually increase the federal funds rate if the economic data continue to come in about as we expect,”

she said.

“Indeed, at our meeting later this month, the Committee will evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the federal funds rate would likely be appropriate.”

The week ahead brings a range of new data for deciding if economic activity remains strong enough to justify more policy tightening next week. Today’s focus is on factory orders, which have been showing signs of rebounding lately. Notably, the one-year trend perked up to 3.6% in December. The last three out of four annual changes have been positive, which is an encouraging sign after nearly two years of red ink.

Today’s update is expected to bring more good news. Econoday.com’s consensus forecast sees factory orders in January rising 1.1% in the monthly comparison, which translates to an implied 3.8% year-on-year advance.

If the projection is correct, the evidence in favour of a rebound in factory orders will strengthen, providing more cover for the Fed to squeeze interest rates at next week's Federal Open Market Committee meeting.

DISCLAIMER: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.