3 Numbers: U.S. Annual Core Inflation To Hold At Four-Year High

James Picerno | Apr 14, 2016 02:50AM ET

- Analysts expect the Bank of England to keep record low rates unchanged today

- Core inflation has firmed, and deflation risk is no longer a concern in the UK

- US jobless claims are on track to hold steady, near 40-year low

- March consumer inflation should rebound, supporting a high for annual core CPI

There’s a busy day ahead for economic news, including today’s monetary announcement from the Bank of England. We’ll also see fresh US numbers on jobless claims and consumer inflation—updates that will be closely read in the wake of yesterday’s surprisingly weak data on US retail spending in March.

UK: Bank of England Announcement (1100 GMT): Inflation in the UK inched up to a 15-month high in March. Is that a sign that the Bank of England will begin raising interest rates today? Unlikely, but the firmer pricing pressure suggests that the writing’s on the wall for later this year.

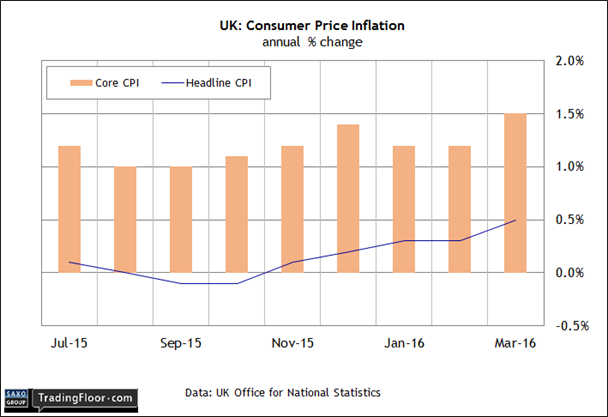

For the moment, the main takeaway in yesterday’s news for the consumer price index for March is that deflation risk continues to fade. The 0.5% year-over-year increase in headline CPI is still a modest pace, but it’s comfortably above the mild negative rates from last September and October.

Note, however, that core inflation is substantially stronger, ticking up to a 1.5% year-over-year gain last month—the most since October 2014.

But while deflation risk is no longer a concern, the CPI data still gives the BoE room to leave the policy rate unchanged at 0.5%—a record low—without triggering fears that inflation is poised to spin out of control on the upside. Indeed, BoE Governor Mark Carney has been careful to advise that tighter monetary policy will arrive only when inflation is increasing on a sustained basis.

“This is the first sign of a pick-up [in inflation] after effectively stalling over the previous last six months or so,” an economist at Capital Economics said after Tuesday’s CPI report. “Accordingly, the first rate hike looks to still be some way in the distance.”

The crowd agrees. Econoday.com’s consensus forecast calls for no change in the 0.5% policy rate at today’s BoE announcement. The outlook for punting on the first rate hike is also a function of uncertainty about the June vote in the UK on the question of whether to leave the European Union. Opinion polls show that the vote will be close and so the odds are low for squeezing policy ahead of what could be an economically destabilizing vote for a potential Brexit.

US: Initial Jobless Claims (1230 GMT): Yesterday’s disappointing news on retail sales for March looks troubling, but it’s premature to argue that the jig is up for economic growth—assuming that job growth stays healthy.

We already know that nonfarm payrolls posted a solid gain last month, which translates into the best year-over-year gain since last October. The April report for jobs, meanwhile, is several weeks away, which leaves today’s weekly release on jobless claims as the first round of hard data for deciding if the tumble in retail spending in March is an early sign that the labour market is set to crumble too.

Economists, however, see another upbeat release for today’s data. Econoday.com’s consensus forecast anticipates that new filings for unemployment benefits will remain unchanged in the first week of April. If so, a second print for claims at 267,000 (seasonally adjusted) is on the agenda—close to a four-decade low. If the prediction holds, the case will strengthen for seeing yesterday’s surprisingly bearish report on retail spending for March as noise.

US: Consumer Price Index (1230 GMT): Inflation is appears to be firming, but the arrival of weak retail sales data for March throws cold water on the idea that the Federal Reserve will be forced to begin tightening monetary policy at this month’s Federal Open Market Committee meeting--or any time soon, for that matter.

"The data solidifies the well-entrenched narrative of a very weak first quarter for the US economy,” noted the deputy chief economist at TD Securities yesterday. “For the Federal Reserve ... it argues for continued caution.”

Caution is also on the mind of Fed chair Janet Yellen, who advised in an interview published by Time yesterday that in the current environment “it makes sense to use a risk-management approach to identify and avoid the big mistakes. That’s one reason I favor a cautious approach.”

Nonetheless, today’s inflation report is expected to reaffirm that pricing pressure, while still soft, is gaining a bit of momentum. Consumer prices are on track to rise 0.2% in March—a conspicuous rebound after a 0.2% slide in the previous month.

The annual pace of inflation is still projected to remain weak. But the implied 1.0% year-over-year gain for March, if accurate, will mark the third monthly increase at or above the 1.0% rate.

Meantime, keep your eye on core inflation, which is expected to rise 0.2% in March—the equivalent of a 2.3% year-over-year gain. If so, consumer prices (excluding food and fuel) will continue to advance at their fastest pace in four years.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.