3 Numbers: Slowing Pace EU Industrial Output; More U.S. Jobs Data

James Picerno | Nov 12, 2015 01:43AM ET

The pace of macro releases picks up on Thursday, including the monthly update on industrial activity for the Eurozone. Later, two US releases will provide more context on the state of the labour market in the wake of last week’s strong gain for nonfarm payrolls in October.

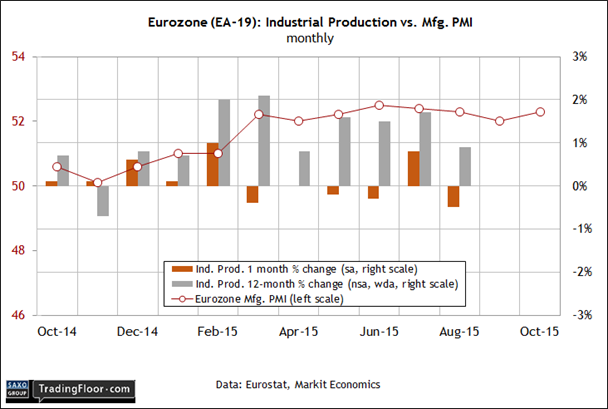

Eurozone: Industrial Production (1000 GMT): The trend in industrial activity has weakened lately, but survey data for the manufacturing sector suggests that stability and perhaps a modest rebound in the hard data is coming.

Today's release, however, is expected to be on the weak side. Econoday.com’s consensus forecast sees the year-over-year change in output inching lower for the second time. Production is on track to rise 0.8% in September, down from the 0.9% advance in August.

A flat to slightly lower annual pace is a reasonable guesstimate, if only because the previously published September numbers for the big-four Eurozone economies already point to a mixed profile: substantially lower year-over-year growth in Germany and France vs. a clear acceleration for output in Italy and Spain.

The current profile for industrial activity in Europe may be cloudy at the moment, but Markit’s purchasing managers’ index for manufacturing points to a mildly stronger run of growth. The Eurozone PMI data for October ticked up to 52.3, close to the highest level in the last two years. That’s still a sluggish pace, although Markit’s numbers imply that the trend is relatively stable.

Meantime, euro area growth for this year is expected to be a sluggish 1.5%, according to this week’s semi-annual Economic Outlook and Interim Economic Outlook from the OECD. But the group projects a slightly faster expansion in 2016 – 1.8%.

Today’s forecast for a fractionally slower annual pace of industrial output doesn’t provide much support at the moment for anticipating higher growth. But if the latest PMI report is an early clue, it’s still premature to argue that industrial activity is about to stumble in a meaningful degree.

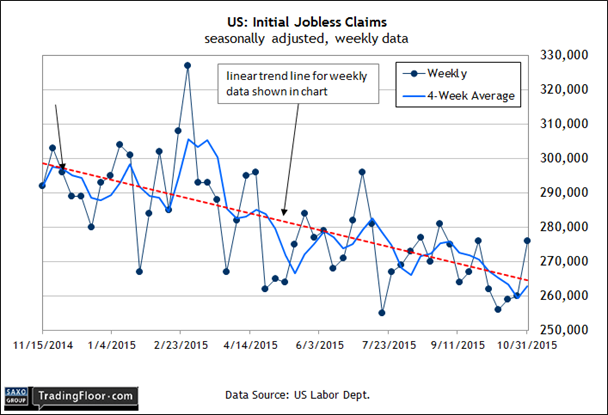

US: Initial Jobless Claims (1330 GMT) : Today’s update on new filings for unemployment benefits offers the first new round of hard data on the labour market since last week’s surprisingly strong report for payrolls in October. The working assumption in the wake of news that the economy added 271,000 jobs last month – the strongest gain so far this year – is that the macro trend is stronger than recent data suggested. In turn, the crowd is again expecting that the Federal Reserve will start raising interest rates next month.

Today’s weekly update on new jobless claims is expected to strengthen the view that monetary policy is about to turn hawkish, if only on the margins. Econoday.com’s consensus view sees claims dipping by 10,000 to a seasonally adjusted 266,000. That’s still close to a multi-decade low. If the prediction holds, the news will quickly be interpreted as sign that last week’s upbeat payrolls report is an accurate sign of stronger growth ahead.

At this point the bears need hard evidence to argue that the latest revival in expectations is misguided. Using the crowd’s outlook for today’s release, however, the pessimists won’t find any support in the weekly claims figures for the week through November 7.

US: Job Openings and Labor Turnover (1500 GMT): The crowd will also look to today’s second batch of numbers on the labour market for a deeper perspective on interpreting last month’s solid gain for nonfarm payrolls. For the moment, however, the rear-view mirror looks weak for job openings.

The recent uptrend for this indicator hit a wall in August, posting a hefty slide. Job openings fell to a seasonally adjusted 5.37 million, posting the biggest monthly setback since the recession. But the decline doesn’t look so bad when you consider that the tumble followed a long run of increases, including a surge higher in July. As a result, the August level of job openings is still close to a cyclical high.

Some analysts are looking for a degree of stabilisation in today’s September update. Given what we already know about payrolls for October, the view that job openings will hold steady shouldn't be terribly surprising.

One upbeat hint that new openings will tread water if not rise can be found in October job cut report from Challenger, Gray & Christmas. The workforce consultancy earlier this month reported that announced plans in the US to eliminate workers fell 14% in October vs. the previous month. Roughly 20% of the cuts are in the energy sector, which is suffering from low oil prices.

“While falling oil prices are impacting the bottom lines of companies in the energy and industrial goods sectors, they are helping many other employers, such as those in transportation and plastics manufacturing,” Challenger’s CEO said last week.

The implication is that a weak number for today’s data on job openings may soon give way to a brighter profile. The Challenger report suggests as much, as do the hard numbers for nonfarm payrolls for October.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.