3 Numbers: German Export Machine Due For A Fall

James Picerno | Feb 09, 2016 02:55AM ET

The pace of macro updates picks up today, including the monthly report on Germany’s foreign trade numbers for December. Later, two US releases will draw attention as the market looks for more perspective on evaluating the risk outlook as macro fears weigh on sentiment.

First up is the monthly estimate of small-business sentiment from the NFIB, followed by the government's estimate of job openings at last year's close.

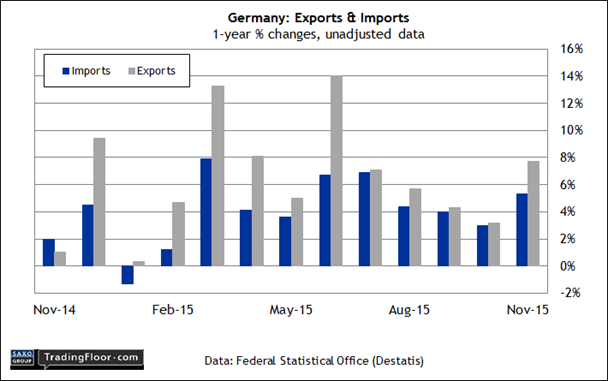

Germany: Foreign Trade Balance (0700 GMT) Will Europe’s biggest economy continue to defy the global macro headwinds by delivering upbeat numbers in today’s trade report for December? Recent history shows a firmer year-on-year increase for Germany’s exports. The crowd will be eager to learn if a similar narrative applies for last year’s final month.

The previous release certainly looks encouraging via the year-on-year trend. Export growth accelerated to 7.7% through November - the strongest annual gain in five months and more than double October’s increase.

But the German government has been managing expectations down since the last update on foreign trade. Late last month the Economy Ministry advised that it sees export growth slowing due to rising challenges in emerging markets.

“Sustained economic progress will be supported primarily domestically, especially in the areas of consumer spending and real-estate investment,” the ministry explained. “In contrast, a slowdown in growth in many developing nations will have a damping effect.”

The emerging markets' crisis had a negative affect on the German export market.

Berenberg also expects softer data for German exports. In a report published last week, the Hamburg-based bank predicted that net trade would turn negative this year. “After the weaker euro boosted exports in early 2015, the crisis in many emerging markets interrupted German export growth in late 2015.” The bank is currently forecasting that net exports’ contribution to GDP growth will be flat in this year’s first quarter, dipping into negative territory for the rest of 2016.

A weak report in today’s December trade report will serve as a down payment on Berenberg’s bearish outlook for exports.

US: NFIB Small Business Optimism Index (1100 GMT) Last week’s employment numbers for small companies echoed the headline data: weaker growth. The January gain on both counts wasn’t terrible, but the pace was conspicuously slower.

Consider how job growth for companies with fewer than 50 employees stacks up. In December, small firms added 101,000 new positions (seasonally adjusted), according to data published by ADP - a six-month high. But the advance dropped sharply to 79,000 last month.

Is that a sign of trouble for small companies? It’s hard to tell at the moment, in part because sentiment in this corner of the economy has been treading water lately, based on the monthly measure of the mood published by the National Federation of Independent Business (NFIB).

The group’s small-firm optimism index has remained in a tight range of roughly 94 to 96 throughout the seven months through December. NFIB noted in the previous update that small business owners are “divided on [the] sales outlook [and] business conditions.”

Will today’s report offer more clarity? Unlikely, according to Econoday.com’s consensus forecast. Economists are looking for a fractional decline to 94.9 in the January reading, close to the lowest level since last June. It’s not great, but it’s not horrible either. Rather, it’s another indication that small business sentiment remains in a holding pattern as uncertainty about the economy rolls on.

US: Job Openings and Labor Turnover Survey (1500 GMT) Yesterday’s January update of the Federal Reserve’s Labor Market Conditions Index (LMCI) dipped to its lowest level since last April. The soft reading, which is based on a broad set of indicators, offers more evidence that the economy’s ability to mint new jobs remains challenged…again.

We’ve been here before, of course. Several times since the last recession there’s been a downshift in economic activity. Yet the positive momentum always revived before deeper trouble set in.

Previous bouts of weakness can be seen in LMCI’s dip to roughly zero or just below over the last several years. The January update pushed the index back into the grey zone of just 0.4. Will we see a repeat performance in the months ahead that pulls the macro trend back from the edge? Or is the latest LMCI dip a prelude to a new recession?

The jury’s still out but today’s update on job openings for December will be widely read in search of a crucial clue. Considering the latest round of labour market data, however, implies that job openings are due for fall, if not today then in the months to come. Indeed, note the sharp deceleration in nonfarm payrolls in the chart below. Meantime, there’s already a hint in openings that the trend has weakened relative to last July’s peak.

Given what we already know about the labour market, it would be surprising if the openings figures today can defy the forces of gravity that are showing up in other data sets.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.