3 Numbers: Expect A Modest Dip For U.S. Existing Home Sales

James Picerno | Aug 24, 2016 01:12AM ET

- Economists see a setback for US existing home sales in July

- The yen continues to dance around the ¥100 level against the US dollar

- The rally in Brazil’s real against the USD shows no signs of slowing soon

US existing home sales will receive wide attention in today’s news cycle for economic releases. Meantime, keep an eye on two currencies that have strengthened sharply against the US dollar this year: the Japanese yen (USD/JPY) and Brazil’s real.

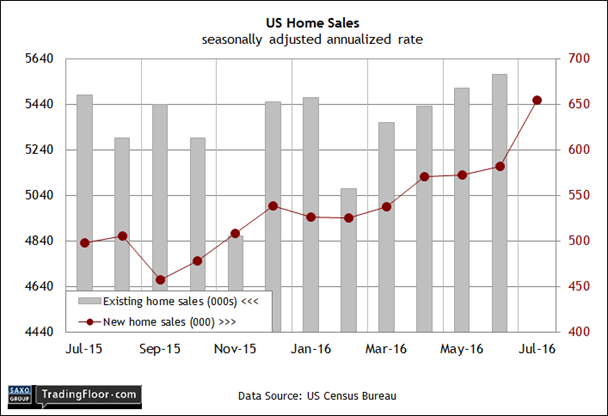

US: Existing Home Sales (1400 GMT): Yesterday’s report on new home sales delivered another round of encouraging news. Transactions in July beat expectations by a wide margin, rising to 654,000 units (seasonally adjusted annual rate), which is close to a nine-year high.

The upbeat release bodes well for today’s July numbers for existing home sales, which reflects a much bigger slice of real estate activity.

But economists are looking for a mild setback. Existing sales are on track to slip to 5.52 million units, slightly below June’s 5.57 million, according to Econoday.com’s consensus forecast. But perhaps another July surprise is waiting in the wings.

Even if existing sales dip, the news will be taken in traders' strides. Sales overall have been rising steadily this year and one weak month is hardly a trend.

Strengthening demand “makes perfect sense when interest rates are low, credit continues to ease, and the consumer is in decent shape given the jobs market”, explained the US economist at Deutsche Bank Securities in New York.

Today’s numbers may deviate from this year’s bullish trend, but it would take a dramatic tumble to convince the crowd that the virtuous cycle for home sales in 2016 has run its course.

USD/JPY: The Japanese yen has tested the ¥100 mark against the US dollar several times this month but USD/JPY has yet to make a decisive break below that round number.

Analysts say that the strengthening currency warrants intervention from the Bank of Japan (BoJ), perhaps by pushing interest rates further into negative terrain.

Meantime, the world’s strongest currency is hovering around ¥100, keeping traders guessing about when or if that line will be broken on the downside in a convincing degree.

A key factor that could influence expectations is linked to the Federal Reserve’s monetary policy meeting next month. Although the crowd continues to price in no change in US interest rates for September, this Friday’s speech by Fed chairwoman Janet Yellen may give the hawks a new reason to adjust the outlook.

If the Fed does squeeze policy on September 21, the news will probably weigh on the yen.

“There's still a huge amount of scepticism as to whether the Fed really can hike, irrespective of the hawkish remarks we've heard from Fed bankers,” a Rabobank currency strategist told Reuters on Tuesday.

Other than Yellen’s speech, scheduled for August 26, traders will be focused on the US payrolls report for August, which is due on September 2.

Another solid gain for jobs in the wake of robust increases in June and July may convince the Fed to raise rates after all.

Meantime, the yen’s dance around ¥100 will probably continue until the headlines offer a new catalyst for an attitude adjustment.

USD/BRL: Speaking of strong currencies, Brazil’s real is also looking rather muscular this year.

Expectations that the recession may soon end for Latin America’s largest economy is boosting the currency against the US dollar. There are also hints that the country’s long-simmering political crisis linked to the impeachment of Dilma Rousseff, the suspended president, may be nearing resolution.

Another factor behind the real’s strength: High interest rates. Brazil’s 10-year government bond yield yesterday traded at roughly 11.80%, a huge premium over the US benchmark 10-year yield’s at 1.53%.

The bullish mix of catalysts has ignited a rally in the real, which has climbed more than 23% against the greenback year to date.

The currency’s technical profile suggests that the currency will continue to strengthen for the foreseeable future. Indeed, USD/BRL is trading well below its 50-, 100-, and 200 Day Moving Averages.

The potential for a rate hike in the US next month could derail the real’s bullish momentum, but at the moment the crowd is still expecting no change for monetary policy at next month’s Federal Open Market Committee meeting.

The next opportunity for thinking otherwise is scheduled for this Friday, when Yellen delivers a speech at the central bank's symposium in Jackson Hole, Wyoming.

"The big surprise [at Jackson Hole] would be a hawkish shift from Yellen which would be enough to rock the boat on risk and send US rates and the dollar sharply higher," advised the managing director at Jefferies, a New York investment bank.

"But I doubt she wants to do this and would prefer a relatively mixed view that has elements of hawkishness and dovishness and ultimately results in a December tightening, but a dovish December tightening."

In that case, the real's rally will probably roll on.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.