3 Numbers: U.S. JOLTS Expected To Dip For Second Month

James Picerno | Aug 08, 2017 06:21AM ET

- Continuing slow decline expected for US Small Business Optimism

- US job openings for June are likely to fall to their lowest level for the year to date

- Italy’s stock market is the best performer among Europe’s big four economies

- Welcome reforms include a turnaround plan for Italy's troubled financial sector

Tuesday's another low-key day for scheduled economic reports. The main event for US data is the July update for the NFIB Business Optimism Index, followed by the government’s monthly Job Openings and Labor Turnover Survey for June. Meantime, keep an eye on Italy’s FTSE MIB Index, the best-performing equity index this year among Europe’s big four economies.

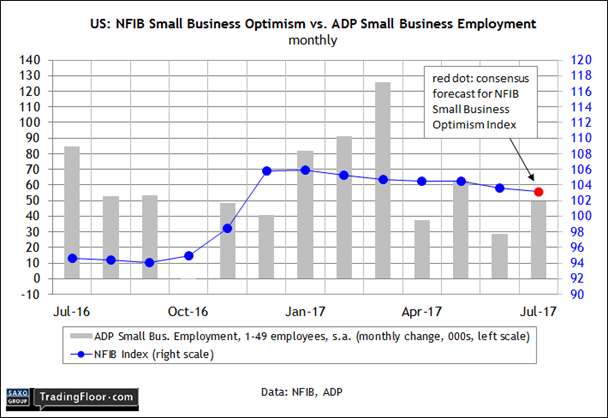

US: Small Business Optimism Index (1000 GMT): Last week’s update on payrolls for July delivered another encouraging profile of the labour market, but the positive news masks weaker jobs data for small companies.

ADP’s estimate of small-business employment posted a modest rebound last month. Companies with fewer than 50 employees created 50,000 new positions, up from 29,000 in the previous month. But the trend looks weak.

After accelerating in the first quarter, employment growth for small companies has dipped sharply in recent months. The stumble is conspicuous in the year-over-year trend, which slumped to a weak 1.3% gain in July – a six-year low. By comparison, private-sector employment growth for the US overall increased 1.9% last month, marking a relatively stable pace relative to recent history, according to ADP.

Despite the slide in the annual growth rate for jobs creation, sentiment among small-company executives has been mostly stable this year after a sharp increase last November. But the Small Business Optimism Index is gradually giving back its late 2016 rise and the downward bias is expected to continue in today’s update for July.

Econoday.com’s consensus forecast sees the optimism benchmark dipping slightly to 103.2. If the estimate is correct, the mood will slip to its lowest reading since last November, providing more evidence that the small-business owners are losing faith that last year’s election promises, including healthcare and tax reform, will survive the political disarray in Washington.

US: Job Openings and Labor Turnover Survey (1400 GMT): Following last week’s upbeat employment news, the Conference Board (CB) on Monday reaffirmed that the US labour market trend looked encouraging.

The consultancy’s Employment Trends Index (ETI) for July increased, posting a 4.8% rise from the year-earlier level. ETI’s “rapid improvement” points to “solid hiring and further tightening of the labor market in the months ahead,” said CB’s chief economist for North America.

Today’s update on job openings for June, however, is expected to show another monthly setback. Econoday.com’s consensus estimates calls for a second month of lower openings. The crowd’s looking for a slide to 5.6 million, the softest number of openings this year.

Is that a warning sign? Not necessarily. But with the year-over-year change in payrolls still decelerating, albeit gradually, a weaker rate of job openings may suggest that the labour market’s growth trend is fading.

The decline is slight, which implies that softer growth can endure. Nonetheless, a bigger-than-expected fall in today’s openings data would reinforce expectations that the Federal Reserve will be forced to delay the next interest rate hike, perhaps until next year.

Italy: FTSE MIB Stock Index: A rebound in the Eurozone’s economic fortunes has been remarkably kind to Italy’s stock market.

Year to date and over the trailing one-year period, Italy’s benchmark equity index, the FTSE MIB, is the top performer relative to the other three big Eurozone markets (Germany, France, and Spain). So far this year, FTSE MIB is up 14.3% (through August 7), edging out the 14.0% rise for Spain’s IBEX 35 Index. Meanwhile, the rally in Italy’s market has left Germany’s DAX index and France’s CAC 40, with roughly 7% year-to-date gains, in the dust.

The rally in Italian shares is a bit surprising, considering the country’s various economic challenges. But investors have cheered recent reforms, including a turnaround plan for the troubled financial sector.

Last week, for example, the Italian bank UniCredit reported a modest increase in second-quarter profits. “We are very convinced that the risk profile of the Italian banking sector is going down, thanks to the government’s actions,” UniCredit’s CEO Jean Pierre Mustier said. “Now there are no more risk or systemic impacts which can be seen in the Italian banking sector, which is very good for the country.”

Investors certainly agree; bank stocks in Italy have rebounded sharply this year, climbing 30% so far in 2017.

The broad market is enjoying a bullish profile too. Monday’s advance lifted FTSE MIB to its highest close since December 2015. Although some analysts wonder if Italy’s equity rebound has gone too far too fast, the technical picture implies that the positive momentum still has room to run.

Disclosure: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.