3 More Years Of Expansion? How Will Gold React?

Sunshine Profits | May 24, 2019 01:27PM ET

We are just a few weeks away from breaking the record. If the current U.S. economic expansion lasts until July 2019, it will reach 121 months, becoming the longest ever. The extended duration of the prosperity begs the question of when the next downturn will occur. We invite you to read our today’s article about the state of the U.S. economic expansion and find out whether its days are numbered. And what it all means for the gold prices.

We are just a moment away from a significant achievement. If the current U.S. economic expansion lasts until July 2019, it will reach 121 months, becoming the longest ever. The extended duration of the prosperity begs the question of when the next downturn will occur. Many analysts believe that its days are numbered, but we dare to disagree.

You see, we do not focus on the mere headlines, but always investigate the underlying factors behind the changes in specific data series. That's true that the current expansion will likely be the longest on the record, but the reason for this is the softness of the recovery. The present expansion has been weaker than historical recoveries. Indeed, the real GDP has jumped just 24 percent since the end of the Great Recession. That's a very disappointing result by historical standards: on average, the GDP rose by 33 percent during the previous three economic expansions, even though they were shorter.

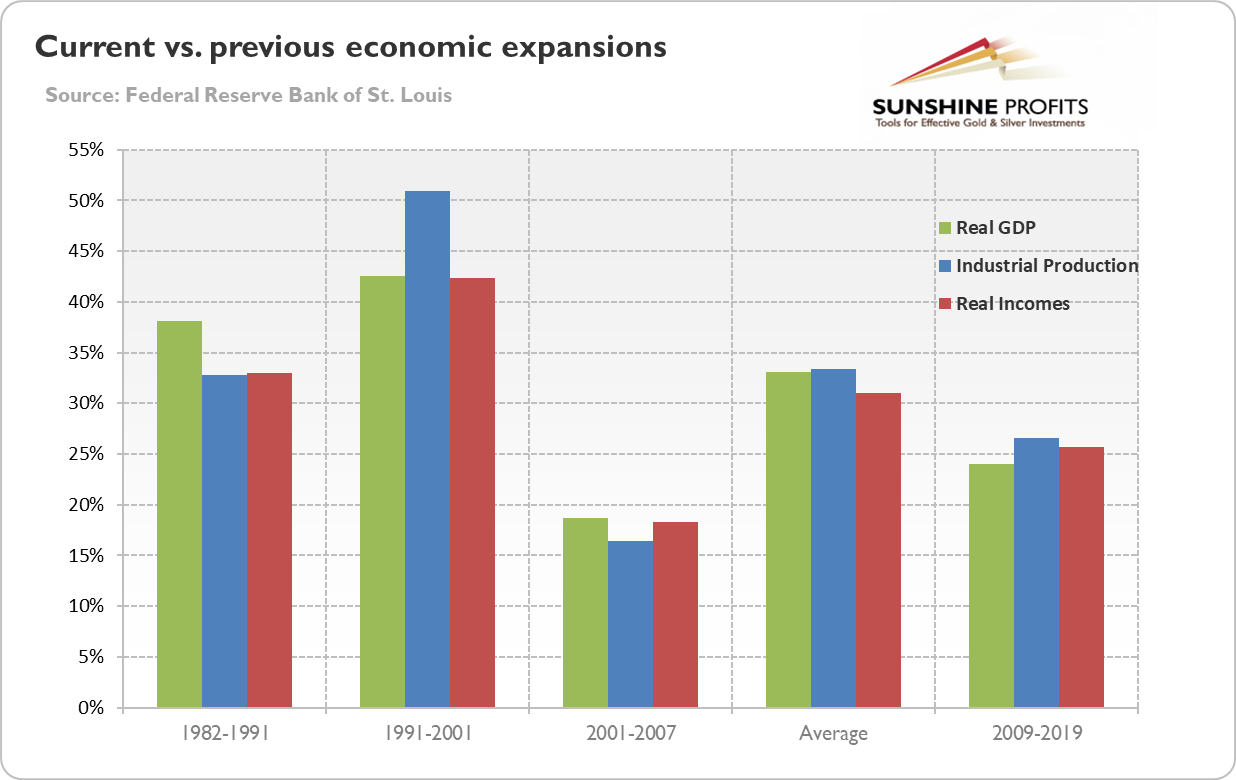

Other indicators paint a comparable picture. For example, the industrial production has increased 27 percent so far during the current boom, compared to the average of 33 percent. Similarly, the real incomes rose by 26 percent in the present expansion, while the historical average increase was 31 percent. The chart below compare graphically the current boom with previous expansions.

Chart 1: Current vs. previous economic expansions (1982-1991; 1991-2001; 2001-2007) compared in terms of real GDP (green bars), industrial production (blue bars) and real incomes (red bars)

As one can see, the expansions of 1982-1991 and of 1991-2001 were significantly more dynamic. The expansion of 2001-2007 was nominally weaker, but only because it lasted only six years. But the pace of growth was faster, so if it lasts the same number of months as the current expansion, the accumulated growth would be larger (the real GDP would grow almost 30 percent).

The sluggish pace of the current recovery is very disturbing, as deep recessions have generally been followed by steep recoveries in the past. So why does this recovery, which follows the second worst recession, diverges from the historical pattern? One explanation is the debt burden. The housing sector was so heavily indebted that it did not want to take new loans, but focused on deleveraging, despite the zero interest rate policy. Another factor to blame is the increased political uncertainty and tightened regulatory environment after the financial crisis. The new regulations and policies weakened companies' willingness to invest.

Hence, the present expansion still has room to run. Our comparison indicates that if the U.S. economy is set to achieve the historical average of economic recovery in terms of real incomes, industrial production and real GDP, we could enjoy another two or three years of economic expansions. And this assumes only average level of three previous economic recoveries. If we assume that the U.S. economy is to replay the robust recovery of the 1990s (or if we include the strong 1960s), it could grow for additional couple of years.

And there are a few important reasons to be optimistic. The first one is that the interest rates remain very low, while the Fed still conducts accommodative monetary policy, as it hikes the federal funds rate very gradually. Second, the housing debt to GDP has declined significantly since the economic crisis. There is, thus, more room for adding some leverage (however, the corporate debt is high, which could be potentially disrupting). Third, the political uncertainty is very elevated. We should expect that it will be very low during the late boom or just before the recession. It means that we could see more investment and growth when the political uncertainty recedes.

What does it mean for the gold market? Our research indicates that the U.S. recession is not imminent. The current expansion is exceptionally old, but it is also abnormally weak. When we adjust for slower pace of growth, the statistical analysis concludes that we should enjoy the boom until 2021 or 2022. To be clear: we are not ruling out the possibility that the recession will come earlier. We are showing that focusing simply on the length of economic expansions, while abstracting from its strength, may lead to overly pessimistic conclusions.

This is bad news for the gold bulls. Although the fundamental outlook for the yellow metal for this year is better than for 2018 - think about less tight monetary policy - the gold price will probably not start a parabolic rally until the next economic crisis. It will happen one day, that's for sure. But expansions do not simply die of old age. Investors should be prepared for the worst - and own some precious metals as a portfolio insurance - but they should not cry the wolf just because they have not seen him for a long time.

Thank you

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.