3 ETFs To Consider For Reasons Other Than Ultra-Low Interest Rates

Pacific Park Financial Inc. | Nov 20, 2013 03:14AM ET

I have met David Kotok, chief investment officer at Cumberland Advisors, at several conferences in which we have both been speakers. He is intelligent, amiable and approachable.

Recently, I read an article by Mr. Kotok on whether or not Federal Reserve tapering constituted tightening. He suggested that it may not be. He also maintained that Cumberland would remain fully invested because it will take the world’s economies many years before reaching a stage in which they will need to deal with maturing assets on the balance sheets of their central banks.

Mr. Kotok wrote in his conclusion:

“When interest rates are maintained at a very low level, the discounting mechanism to value assets works to raise the prices of those assets. That trend will continue worldwide in the major economies for several more years as all of them go through this process of central bank stimulus, plateauing, subsequent tapering, reaching a neutrality level, and then confronting in the out years how to permit the assets of the central bank to roll off and mature over time without shocking those economies.”

For the most part, I agree with the assessment thatChina ETFs Quietly Becoming Go-To Performers .” Last month, I expressed a fondness for the yuan via WisdomTree Chinese Yuan (CYB). And now, I am recommending a bond ETF for those who want less volatility than stocks and a reliable income stream beyond merely holding China’s currency as a hedge.

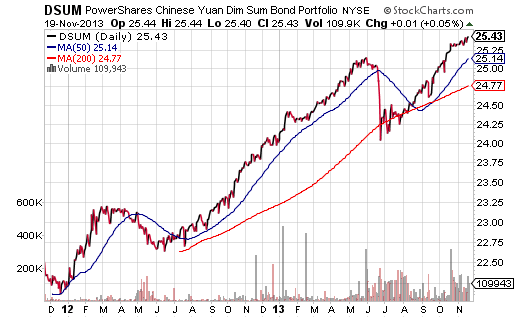

PowerShares Yuan DimSum Bond Portfolio (DSUM) may have an effective duration that is 6-9 months higher than U.S. counterparts, iShares Barclays 1-3 Year Treasury (SHY) and iShares 1-3 Year Corporate Credit (CSJ). However, DSUM offers an income stream of roughly 3.3% whereas SHY’s 0.3% and CSJ’s 0.7% pale in comparison. Moreover, DSUM investors benefit from the underlying bonds being denominated in China’s currency, as the yuan/renminbi has steadily appreciated against the dollar since 2006. DSUM is one of the only bond funds with year-to-date gains in 2013 and it has a very weak positive correlation with the S&P 500.

2. First Trust NASDAQ Technology Dividend (TDIV). With the media fanning the flames of the NASDAQ pushing ever closer to 4000 — with the world buzzing with dot-com excitement over Twitter — less attention is being paid to “old school” tech. I think that’s a shame. While PowerShares NASDAQ 100 (QQQ) currently trades at a P/E near 21, TDIV trades at a more affordable 15. The income stream for TDIV is roughly 2.5% annually whereas QQQ offers close to 1.1%. While the QQQs may demonstrate 3%-4% greater total return year-to-date, the more reasonable valuation and greater cash flow of TDIV is likely to help one weather a 2014 sell-off. (Yeah, corrections and bears still do occur in stock markets!)

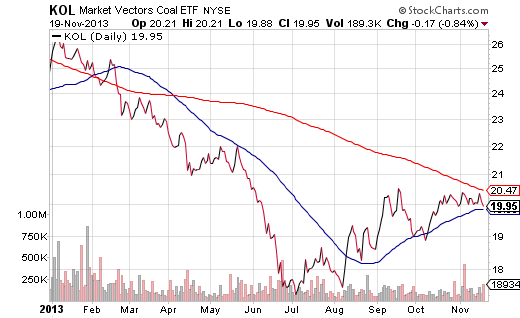

3. Market Vectors Coal (KOL). Has there ever been an industry so universally hated by governments, the general public and now, investors? Yet, with a 30-day SEC yield of 4%, a price-to-book of 1.2 and the current price holding above a 50-day moving average, one might consider KOL as an aggressive contrarian play. After all, you won’t find many ETFs where the 50-day moving average is about to experience a “golden cross,” climbing above its 200-day.

Disclosure:

Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.