3 ETFs For Hedging Against A Falling Dollar

Pacific Park Financial Inc. | Oct 30, 2013 04:07AM ET

The Federal Reserve is getting ready to announce its decision to stay on its ultra-accommodative course; that is, they will continue to print $85 billion each month to buy U.S. debt and to suppress intermediate-term interest rates. However, the central bank’s rationale for avoiding the choice to taper its bond buying may not sit well with critics of quantitative easing (QE). Many maintain that the electronic creation of U.S. dollars is leading to a probable collapse in the currency.

In truth, the Dollar Index ($USD) is roughly in the same spot as it enjoyed back in January 2005. Long before zero-percent-interest rate policy, way before Bernanke’s Fed began printing dollars to purchase U.S. Treasuries in December 2008, the Dollar Index (USD) registered a price of 80. That’s nearly nine years of trading against different currencies of the world without a definitive longer-term trend of depreciation.

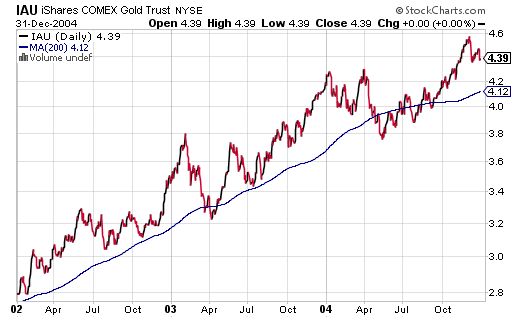

Perhaps ironically, the real decline in the greenback occurred between the start of 2002 and the end of 2004. The USD Index fell 33% over those three years alone. Meanwhile, foreign stocks making up the iShares MSCI EAFE Index (EFA) gained 40% while the S&P 500 picked up only 10%; most of the gain differential is attributable to the currency effect. And gold? The yellow metal via iShares Gold Trust (IAU) gained 57%, in the three years period (2002-2004).

Does this mean critics of QE are off their respective rockers? Hardly. The dollar has, in fact, fallen considerably since the Fed began printing “greenies” back in December of 2008. If one looks at the PowerShares DB Dollar Bullish Fund (UUP) over the past five years, a case can be made that Bernanke’s crew is encouraged by the 20% erosion of worldwide purchasing power.

As I noted in a previous article on stock ETFs that are benefiting from the greenback’s decline, one cannot simply smile at how the weak dollar helps U.S. exports. Foreign investors hold over $13 trillion in U.S. market-based securities. As long as the dollar’s decline is moderate, capital appreciation may offset currency losses. On the other hand, if the dollar decline breaks through the lows of 2011 and picks up speed as it descends, foreign investors may begin dumping their dollar-denominated U.S. stocks and bonds.

Do I think it will happen? Probably not. In the same way that Standard & Poor’s debt downgrade of U.S. Treasuries actually created more demand for the perceived safety of U.S. Treasuries, central banks around the globe are not yet willing to abandon the world’s reserve currency. The pressure to shore up the buck to “save” the global financial system would be overwhelming.

That said, ETF investors may wish to consider several ways to bolster the safety of their portfolios. For example, if direct investment in China stocks seems too volatile, there is relative equanimity in owning the yuan via WisdomTree Dreyfus Chinese Yuan (CYB). There is little risk of the Chinese dollar depreciating against the U.S. dollar over a significant time period. Meanwhile, capital appreciation, to the extent the Chinese government will allow, may be one of the safest currency calls around. CYB has accumulated a total return of roughly 11% over the previous three years.

The only other currency ETF that I like for safe harboring is the Swiss Franc (FXF). It definitely came in handy during the double-threat in 2011 (i.e., U.S. debt downgrade and euro-zone debt crisis). On the other hand, the Bank of Switzerland did not sit idly by as its own franc soared through the proverbial roof. In order to keep its own economy stable, the National Bank of Switzerland printed francs by the “jillions” to ensure a peg of sorts. In other words, neither FXF or CYB are likely to make you rich.

Of course, commodities tend to come to the forefront whenever one discusses dollar devaluation. Yet the gains that might be expected in a world where developing countries pick up the economic slack for the developed countries ( e.g. 2002-2004) are not the gains that may be counted on today (i.e., 2012-2014). Strangely enough, to the extent that emerging economies have been unable to export their wares, the less demand many of them have had for natural resources and related hard assets. It follows that commodity ETFs/ETNs as well as precious metals have not sheltered investors the way they have in the past.

On the flip side, a solid defense may still be achieved through diversifying into commodity intensive countries like Russia. Market Vectors Russia (RSX) has a trailing P/E of 10, which is 30% cheaper than the S&P 500 SPDR Trust (SPY). RSX yields 2.6% to SPY’s 2.0%. The price-to-sales ratio for RSX is roughly 0.5 whereas SPY is closer to 1.5. Equally critical, nearly three-fifth of the portfolio is dedicated to energy and basic materials. Recently, RSX experienced a “golden cross,” where its 50-day trendline crossed above its 200-day trendline.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.