3 ETF Categories That Barely Reacted To Europe’s Latest Struggles

Pacific Park Financial Inc. | Mar 24, 2013 02:27AM ET

Non-cyclical stock sectors (e.g., consumer staples, health care, utilities, etc.) often do well when there are concerns about economic growth. Indeed, exchange-traded funds representing one or more components of the non-cyclical arena have been the key drivers in the broader U.S. market’s run toward all-time records.

Nevertheless, it is still a bit surprising that the potential for a banking collapse in Cyprus has had little to no effect on 3 ETF categories. In fact, over the last 5 trading days, scores of the funds in select groupings have actually gained ground.

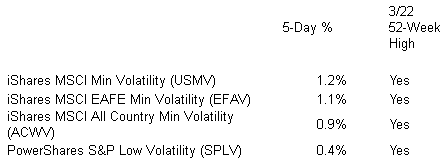

1. Minimum Volatility ETFs. By definition, business that are less tethered to economic cycles are also less volatile. It follows that you’re going to see a whole lot of consumer defensive stocks, pharmaceuticals, utilities, traditional telecom and broader-based health care names in a Minimum Volatility ETF. That said, even if one expected to see “Domestic Low Vol” on the 3/22 52-Week High list, one might be shocked to see “All-World Low Vol” and “International Low Vol” as well.

Low Volatility ETFs Dismiss Cyprus Concerns

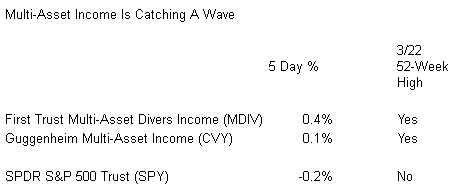

2. Multi-Asset Income ETFs. The artificial manipulation of interest rates by central banks around the world forces no-risk savers to become modest-risk investors; the 1% return from a 1-year CD or the 2% from a 10-year Treasury simply doesn’t cut it… especially if one is drawing 4% annually from his/her account.

Enter a diversified arena of multi-asset income funds. Yield production between 3%-8% on a wide variety of holdings can mean as much as 5.5% in annualized income for shareholders. The potential for capital appreciation is also an attraction for a fund classification that has hit a fresh 52-week peak.

Of course, there’s also the possibility that a down year for a collection of risk assets — master limited partnerships, dividend stocks, real estate investment trusts, preferred shares — would entirely erode the income produced. Granted, some REITs and MLPs depend on economic growth more than others. Yet, safety and income at a reasonable price is still the major thrust for this category.

3. Global Non-Cyclical ETFs. It’s one thing to realize that a major reason for owning U.S. non-cyclical stocks is the undesirability of bond alternatives. It’s another thing to recognize that, in spite of well-publicized systemic threats in Europe, international consumer staples and international utilities and international health care are performing admirably.

The best way to tap the trend? Go global. Global ETFs tend to have 50% in U.S. equities and 50% in large-cap, foreign developed equities. Each has managed to close out the third week of March at a new 52-week pinnacle.

Disclosure:

Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.