2 Additional ETF Trends Flash Yellow Warning Signs

Pacific Park Financial Inc. | Feb 28, 2013 02:15AM ET

Yellow lights may not signal that a driver should slam on the brakes. On the other hand, anyone who has ever pushed the pedal to the floor to make it through an intersection has been burned by a speeding ticket - or three.

Similarly, when warning signs appear, investors should not abandon every exchange-traded asset in their vehicle. Yet ignoring significant impediments to sustainable price appreciation is likely to cause emotional stress at best and undesirable financial hardship at worst.

A week ago, I gave readers and listeners 3 ETFs for trends are what make or break bull markets . For example, if China’s economic growth trends from 10% to 9% to 7.5%, its stock market fears the direction of the trend more than it is capable of embracing an absolute GDP number. Similarly, if the U.S. experiences genuine improvement in the jobs picture in 2013, the U.S. stock market may struggle with the possibility of a trend shift from loose monetary policy to tighter monetary policy.

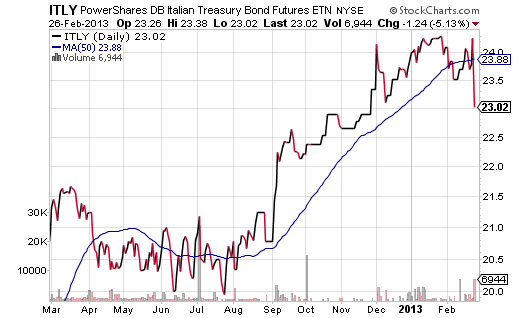

So essentially, we are more interested in rising Italian bond yields (falling government bond prices) than the absolute price/yield. If PowerShares DB Italian Treasury Bond ETN (ITLY) continues to deteriorate further and further below key moving averages, you are likely to see volatile price swings in stocks — both domestic and abroad.

Disclosure

: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.