$BPSPX Says The S&P Is Set To Drop

Abigail Doolittle | Jul 20, 2012 05:09AM ET

There’s sure to be at least one note tomorrow morning devoted to the S&P’s close today just above resistance at 1375 and something that needs to be respected as a technical sign that the S&P could climb to or above the top of this year’s sideways range at 1422, but ahead of that discussion, let’s take a quick look at the S&P 500 Bullish Percent Index as a read on whether sideways will continue up from current levels.

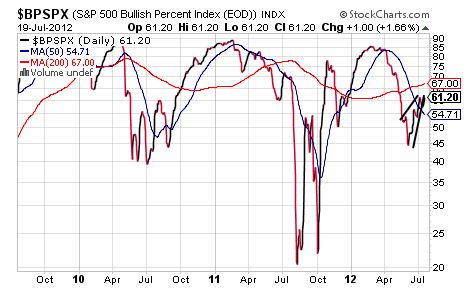

In looking at the daily three-year chart above, it is the dynamic between the 50 and 200 DMAs that pops out with the last two Death Crosses working to signal big declines from the area of the cross in both the 50 DMA and the S&P 500 Bullish Percent Index itself rather than the somewhat shallow decline showing in both since the Death Cross back in June. Should this current Death Cross play out in a similar fashion to the last two, it suggests that at best the S&P 500 Bullish Percent Index will trade sideways between 45 and 60 while at worst a much greater decline is on the way.

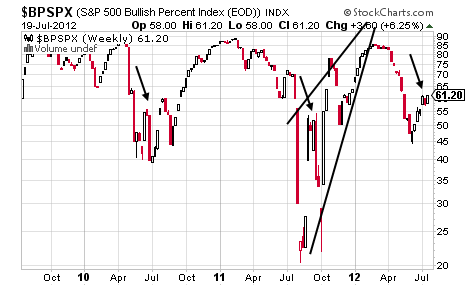

Supporting a serious bout of sideways or simply a big drop is the fact that when this index makes a serious move in either direction it has a tendency to do so in straight line trajectory as opposed to the converging trading action of late that appears to be forming a bearish Rising Wedge with a possible Double Top apex with both of these aspects supporting a decline toward 45 and one that could become much bigger if support fails as is likely.

Support near 45 is likely to fail considering that the S&P 500 Index is currently fulfilling a multi-month Rising Wedge with a target of about 20 that is the mirror to the same pattern in the S&P itself and it may only produce a partial fulfillment, but it is likely to be far more than that level of 45.

Let’s be generous, though, and humor the sideways possibility in addition to the major drop scenario and this means believing it has a few more whipsaws left considering the gaps at 55.80 and 50.60 along with what appears to be an intermediate-term topping reversal pattern of sorts that is somewhat similar to what occurred in the summer of 2010 and 2011.

It seems, then, that the S&P 500 Bullish Percent Index says that the S&P is less likely to take on 1422 successfully any time too soon being set to make another sideways drop down toward 1267 – at least.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.