Market Brief

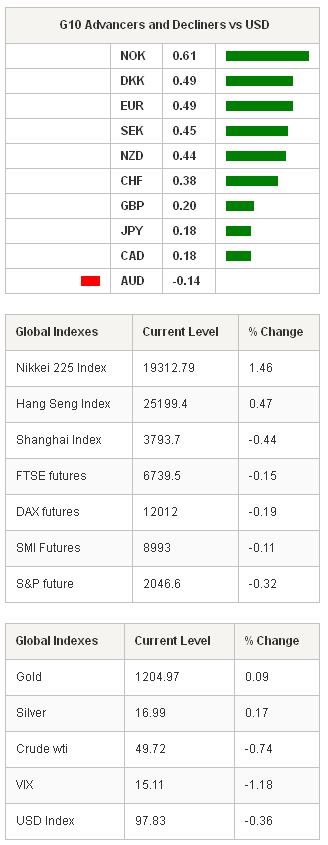

News of Greek banks downgrades, lack of details in Greek reform plan and soft US data failed to discourage risk seekers. Asia’s regional indices’ were broadly higher as the Nikkei 225 rallied up 1.91%. The Hang Seng rose 0.65% and the Shanghai Composite was up slightly to 0.11%. In the forex markets, EUR/USD was able to breakout of yesterday consolidation pattern, rallying to 1.0791. USD/JPY bounced between 119.50 to 119.77 with no directional impulse despite US treasury 2-year yields rising marginally. USD was weaker verse EM FX. USD/CNY Fixed lower to 6.13960. AUD/USD and NZD/USD were weaker against the greenback (increased speculation that the RBA cuts interest rates). Australia’s trade deficit widened to 1256mn in February, below the expected deficit of 1300mn. New Zealand’s commodity prices increased as the ANZ commodity price climbed 4.6% in March from February revised rise of 4.2%. With select Asian markets already closed heading into the long weekend, liquidity has become thin. Crude Oil prices dropped as attention returned to Iran-US nuclear talks, as the prospects for an agreement and an increase in Iranian crude exports put pressure on prices.

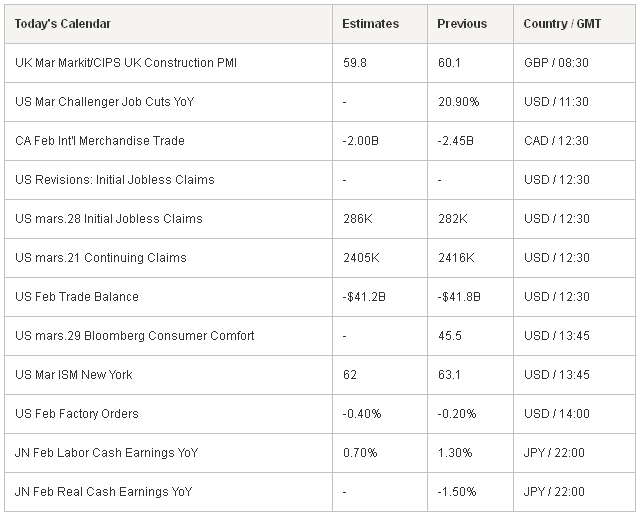

Heading into the holidays, Greek Prime Minister Alexis Tsipras failed to secure a financial bailout. That means Athens will have scramble to get cash to pay pensions and salaries to make a €460 million debt repayment to the IMF on 9th April. In brighter news, the ECB agreed to increase the amount of capital Greek banks can borrow under the emergence lending assistance (ELA) program. The ECB increased the amount the Greek central banks could lend to domestic banks to €71.8bn from €71.1bn (following a €1.2bn increase last week). The ECB forced Greek banks to turn to the ELA after suspending an exemption that had allowed banks to use junk-rated government bonds as collateral for access to standard ECB lending. These loans hold a higher interest rate and any default will be on the Greek central banks’ balance sheet not the ECB. ECB President Draghi denied he is using financial leverage to force Greek into an agreement with creditors. EUR/USD marginally recover to 1.0788 just short of minor resistance at 1.0845. Failure to extend bullish momentum will result in a retest 1.0458 March low. In the European session, the ECB is expected to release its Account of the March monetary policy meeting. Emboldened by ECB QE and solid euro area manufacturing PMI data European equity markets should continue to outperform peers. In the UK, march construction PMI is expected to come in at 59.8 from 60.1 prior read.

Yesterday, US data was weaker than expected. ADP employment report indicated job expansion of 189k in March, below the 225k consensus. US ISM manufacturing index fell to a 2-year low at 51.5 in March. US treasury curves steepen slightly on the weak numbers but eventually shrugged off the soft number. Friday’s March US Employment report will also be diligently observed. Markets expect nonfarm payrolls to increase 250k m/m and the unemployment rate to remain unchanged at 5.5%. Fed Chair Yellen could provide more clarity on the USD monetary policy speech today. We remains constructive on the USD and see dips as opportunities to reload longs.

Currency Tech

EUR/USD

R 2: 1.1280

R 1: 1.1043

CURRENT: 1.0809

S 1: 1.0768

S 2: 1.0613

GBP/USD

R 2: 1.5166

R 1: 1.4994

CURRENT: 1.4845

S 1: 1.4635

S 2: 1.4547

USD/JPY

R 2: 122.03

R 1: 120.50

CURRENT: 119.59

S 1: 118.33

S 2: 117.93

USD/CHF

R 2: 0.9984

R 1: 0.9812

CURRENT: 0.9640

S 1: 0.9491

S 2: 0.9450

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI