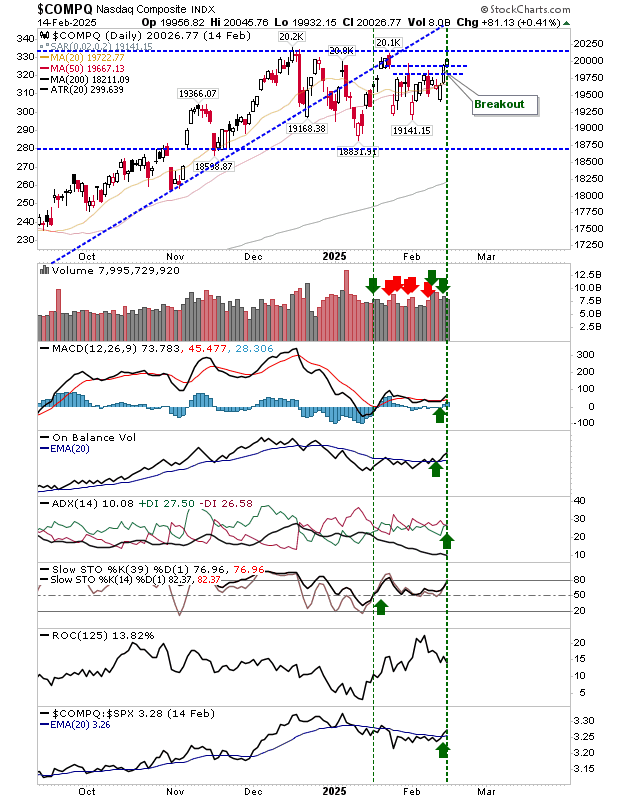

It was subtle but significant; the Nasdaq was able to go beyond the breakdown gap and make a push towards all-time highs, closing above 20,000 in the process. Technicals are net positive. This was the best of Friday's action heading into the long weekend.

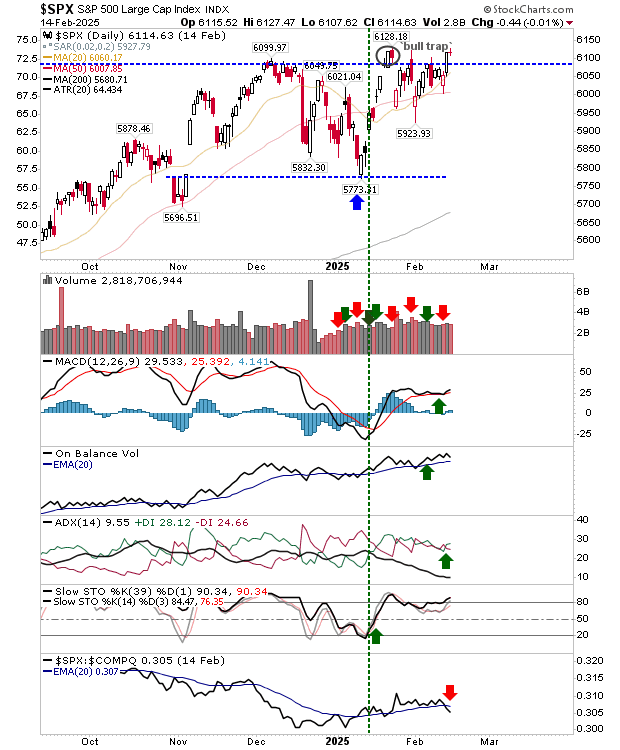

The S&P 500 did its hard work on Thursday, not much on Friday (on low volume), but at least managed to stay above 6,050 support. The index is underperforming relative to the Nasdaq, which in the long run should prove bullish for index.

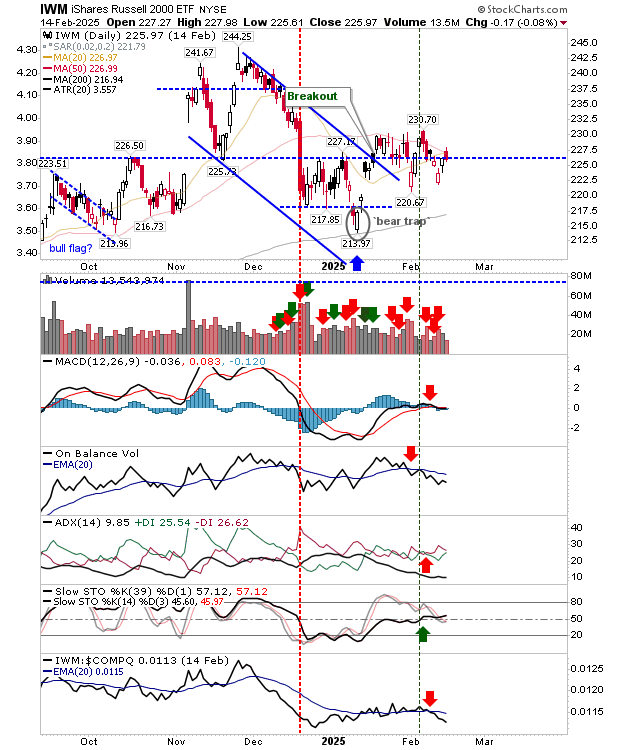

The Russell 2000 (IWM) stayed pegged to its converged 20-day and 50-day MAs, as it has done for the last few weeks. With the exception of stochastics, technicals are bearish.

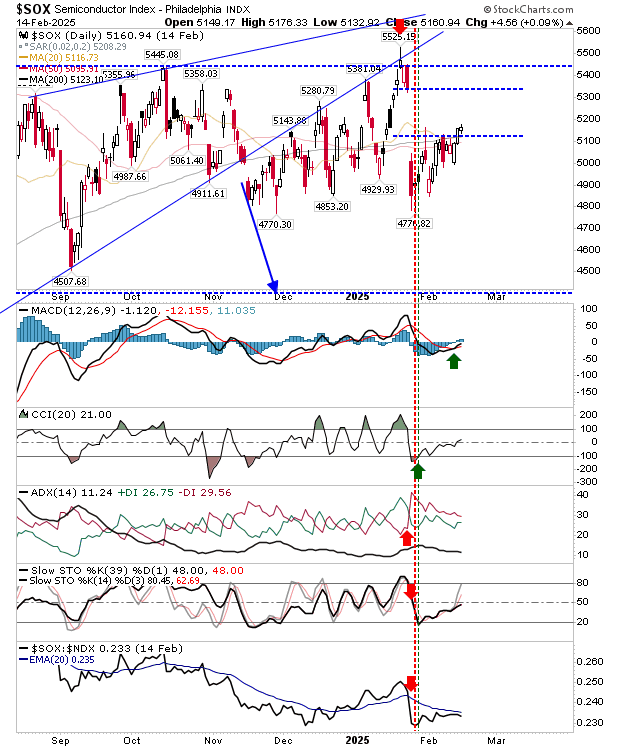

The other benefit coming off the gain in the Nasdaq is the push inside the breakdown gap for the Semiconductor Index ($SOX). Now, this is a trading range 'gap', so it may not close as quick, but there should be some vacuum effect.

For this week, I would like to see a reassertion of the bull market with clear breaks to new highs in the Nasdaq and S&P 500.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.