Yesterday's recovery followed with further highs, but then buyers went AWOL and things settled back to the day's lows. Rinse and Repeat.

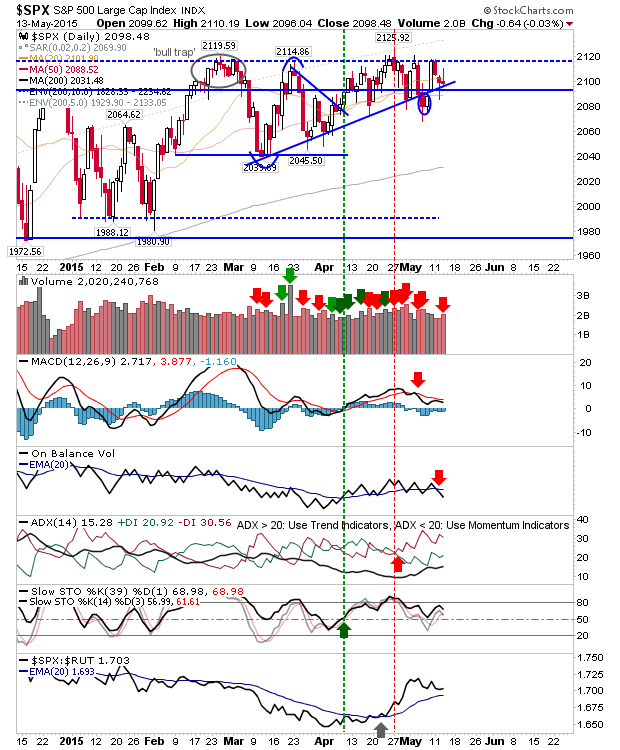

TheS&P 500 has nestled itself against rising trendline support as today's action registered as confirmed distribution. Tomorrow, bears will be seeing if they can break the trendline, but I won't be holding my breath.

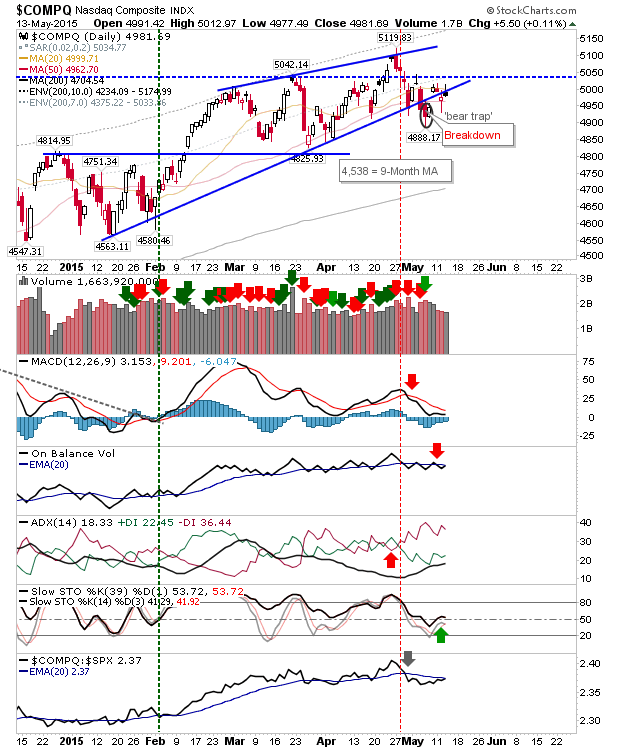

The NASDAQ tagged resistance and remains below the rising wedge. The 'bear trap' is still in play, but there needs to be a return inside the rising wedge if this is to be confirmed. A move above 5040 opens up for a challenge of high at 5119.

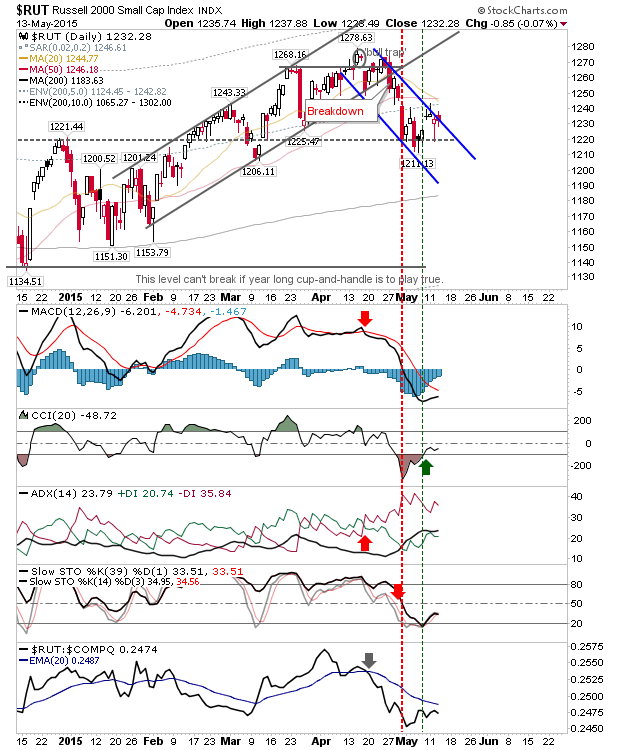

The Russell 2000 is at channel resistance, so the next move will either confirm resistance or deliver a breakout. Should this break upside, then the 'Death Cross' between 20-day and 50-day MAs will quickly come into play as alternative resistance.

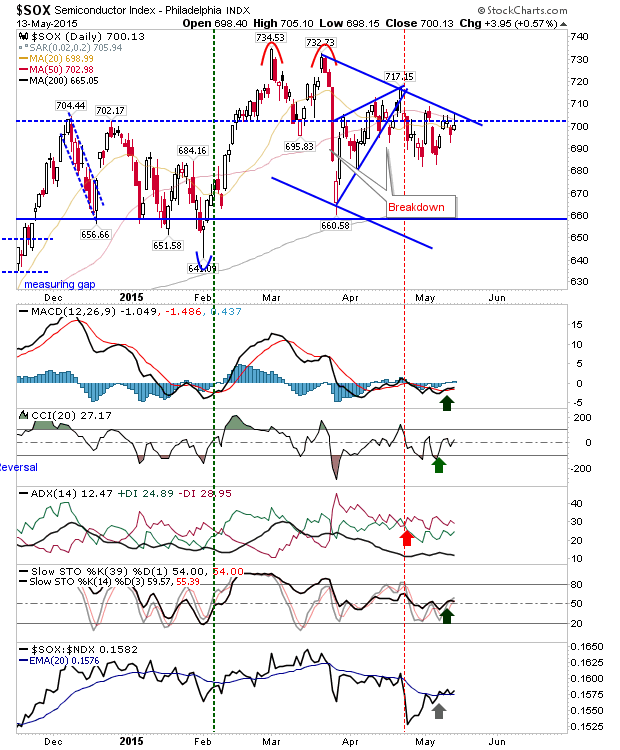

Another index at resistance and looking better as a shorting prospect is the Semiconductor Index. There is converged resistance of the channel, 50-day MA, and 704. Shorts may see some joy here tomorrow.

For tomorrow, the S&P may offer bulls a chance at trendline support. Shorts can look to the Russell 2000, Nasdaq and Semiconductor Index.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI