Market Focus

China's quarterly GDP lowered concerns around growth rates, slightly exceeding expectations. In Q2, the growth rate of the country's economy increased to 1.6% which is higher than expected. It is also better than 1.4% it was in the first three months of the year.

The initial market reaction was the strengthening of the purchases of stocks and the yuan, but rather quickly the market participants became more attentive. First, the annual growth rate (6.2%) was the lowest in the last 27 years. Secondly, there were concerns that the Chinese authorities might limit stimulus, noting the success of the measures already taken. Third, the effect of trade conflicts has not yet been fully reflected in the figures, since it was only in the middle of the quarter that new import tariffs were put in place by the United States.

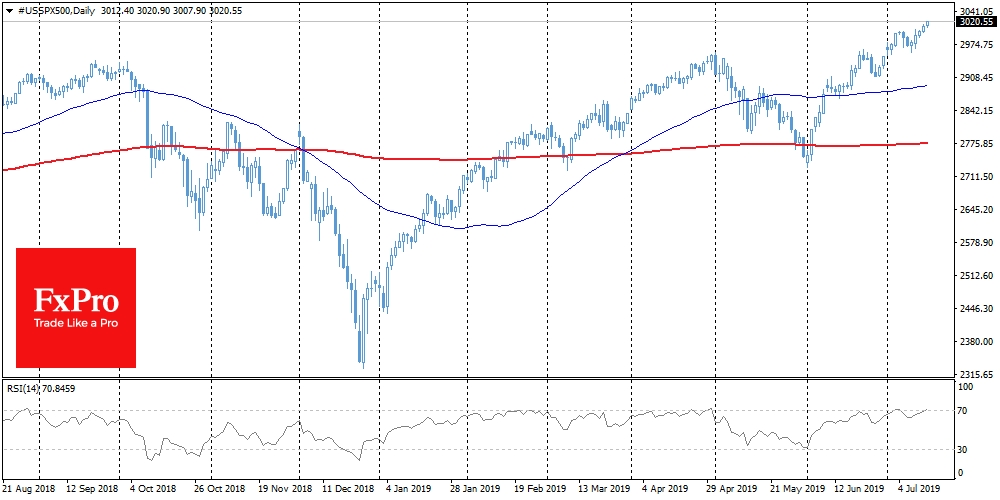

Stocks

Chinese markets, trading back the data above the expectations, managed to rebound from three-week lows, but due to their caution about prospects, the growth did not evolve, leaving the main indices near last Friday’s levels. US stock futures, at the same time, continue to rewrite their historical highs. On the technical side, the S&P 500 and Dow Jones are near overbought levels, but the NASDAQ is still lagging behind.

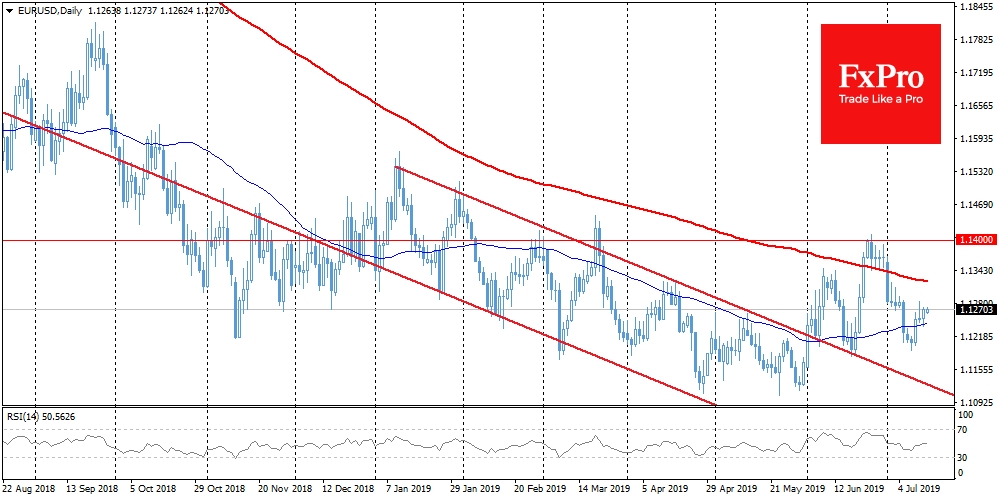

EUR/USD

Euro is experiencing temporary difficulties with growth above 1.1270, where it continues trading for the third session in a row. Strong inflation data from the US seems to have tipped the scales towards debt markets, returning the yield on 10-Year government bonds to above 2%. The growth in yields of such securities is a sign of market confidence in the long-term growth rate of the economy. Higher interest rates support the dollar, as increase the yield on such bonds.

AUD/USD

News from China supported the growth of the Australian dollar. AUD/USD on Friday returned above 0.7000 and now is testing the early May highs, trading near 0.7030. This pair is often viewed as an indicator of global investor sentiment towards the Chinese economy since Australia is strongly tied to exports to China. The level of 0.7000 in recent years serves as a kind of indicator, the fall under which occurs during the period of maximum fear around the growth of the Chinese rates. In light of this, the pair reversal for growth may reflect a positive signal.

The FxPro Analyst Team

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI