Nvidia to resume H20 chip sales in China, announces new processor

Traders got the spin they wanted out of Friday's data which offered the impetus for the breakouts in lead indices. It's hard to understand how markets could perceive things as out of the woods but yet here we are, and you play the hand you are dealt.

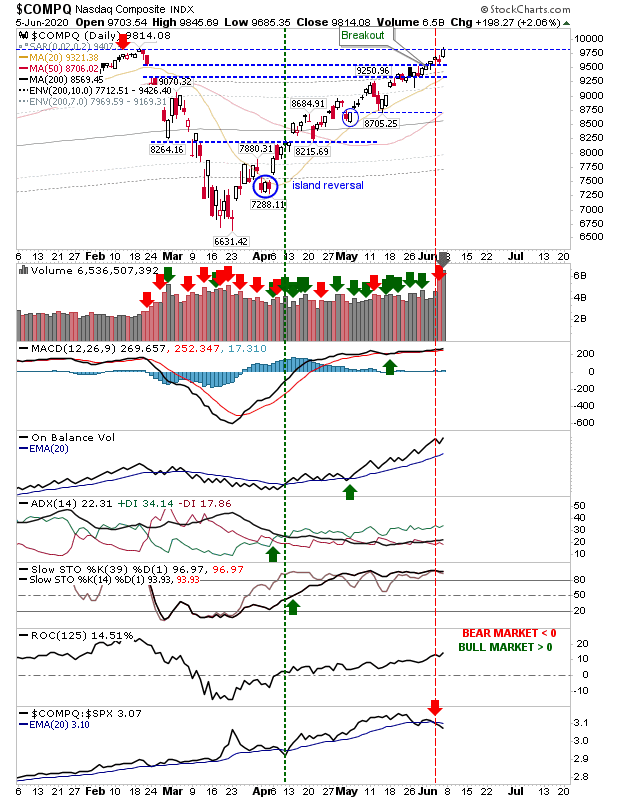

The pack leader is the NASDAQ as it closed on the February swing high—the next move will see it at all-time highs, following the lead of the Semiconductor Index. These gains have allowed the MACD to accelerate higher, taking it out of its flat-line condition. Other technicals are very positive even though there is a relative underperformance against the S&P 500.

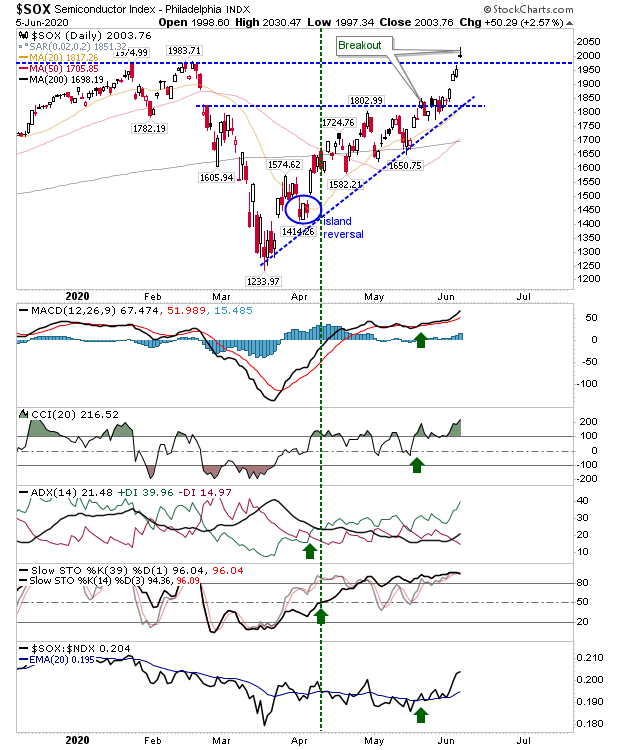

The breakout in the Semiconductor Index was a little reluctant given it occurred with a 'gravestone' doji. If there is a gap lower it would open up the twin problem of a 'bull trap' and a bearish evening star but for now it's a positive—but perhaps it's not a candlestick to buy.

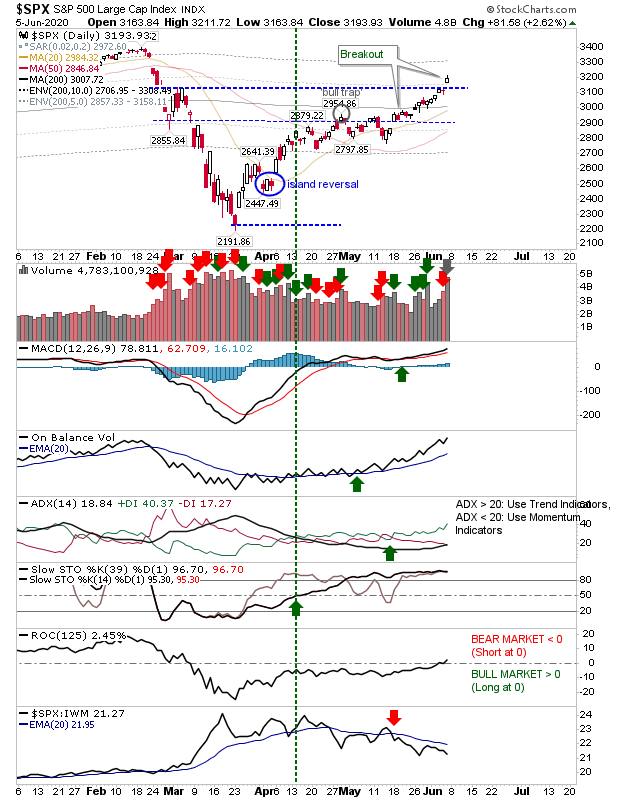

The S&P managed a breakout of its own, although it did so from the swing high in February (it's still got a few weeks before it gets to challenge all-time highs). Friday's buying did come on significant buying volume, marking it as accumulation.

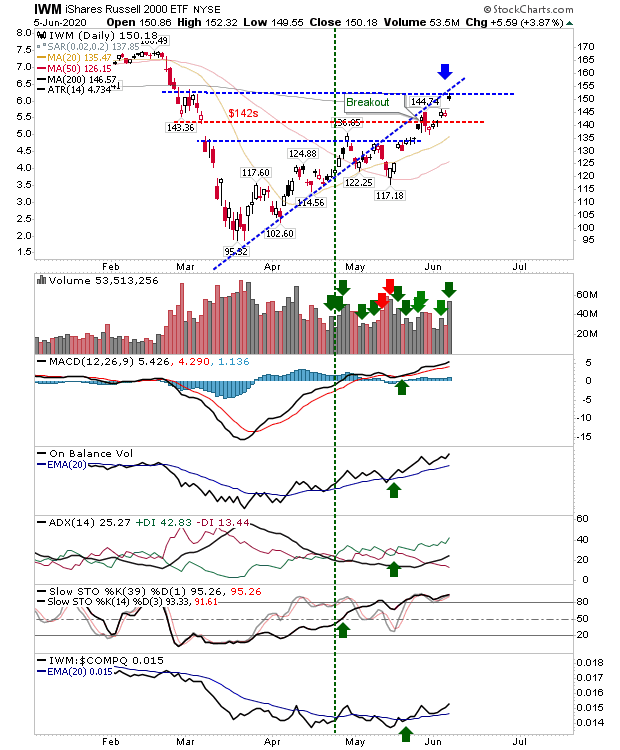

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) is caught a little between a move above the 200-day MA and the convergence of resistance between the February swing high and an earlier rising trendline. Technicals are all positive and Friday's buying ranked as accumulation.

The breakouts are important as they look to draw a line underneath the COVID-19 sell-off, but until the second wave of the disease is navigated, (immunity running around perhaps a max of 20% of the population, but more likely 10%, and a vaccine 12-months away from development, and perhaps 18-months from ready availability), it does seem a little early to be trading new highs.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.