Are DOGE layoffs set to resume?

Trader's Corner:

- Gold finally breaks the triangle in style

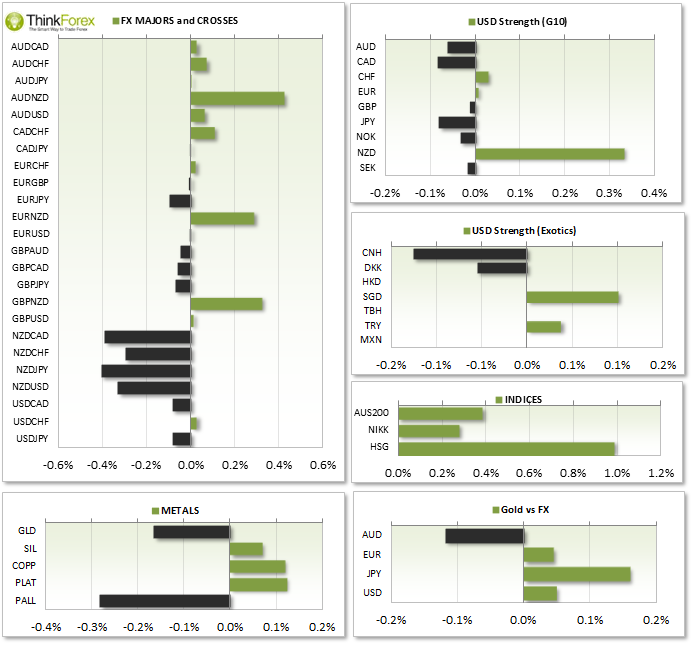

- USD continues to rise on thinning volumes

- DAX en route to 10,500

- EUR/JPY forming potential bear flag

ASIA ROUNDUP:

- The AUD leading Index is at 0.5%, it's lowest since Jan 09. Construction work was at a 2-month high and beat expectations of -0.3% to see +0.3%. The RBA may take this as a sign that the lower interest rates are beginning to help in the correct areas. The AUD/JPY remained subdued, trading withinn yesterday's range whilst remaining below 94.53 resistance.

- The Kiwi Dollar saw the larger moves during Asia following dwindling business confidence, selling off against all major crosses. The NZD business confidence sees a 3rd consecutive decline from the 20-year high to sit at a 5-month low, as the interest rate rises begin to take effect. The AUD/NZD traded to a 7-day high and remains above the monthly pivot.

- The Nikkei 225 remained flat following yesterday's 7-week highs as investors booked profits and traded well within yesterday’s range.

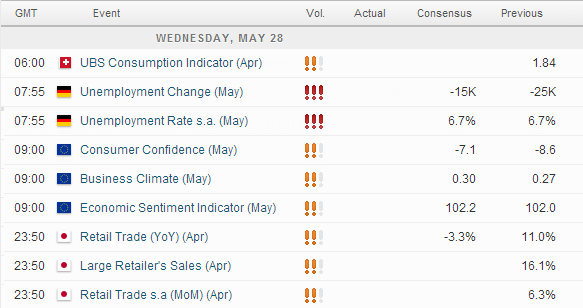

- German unemployment has been decreasing for 5 consecutive months, so a reading above 0 (rising unemployment) would cause more of a stir to the markets and be Euro negative.

- Eurozone data arrives 5 minutes later to show economic, consumer and business sentiment which would be monitored by the ECB in regards to any stimulus decisions next month.

TECHNICAL ANALYSIS:

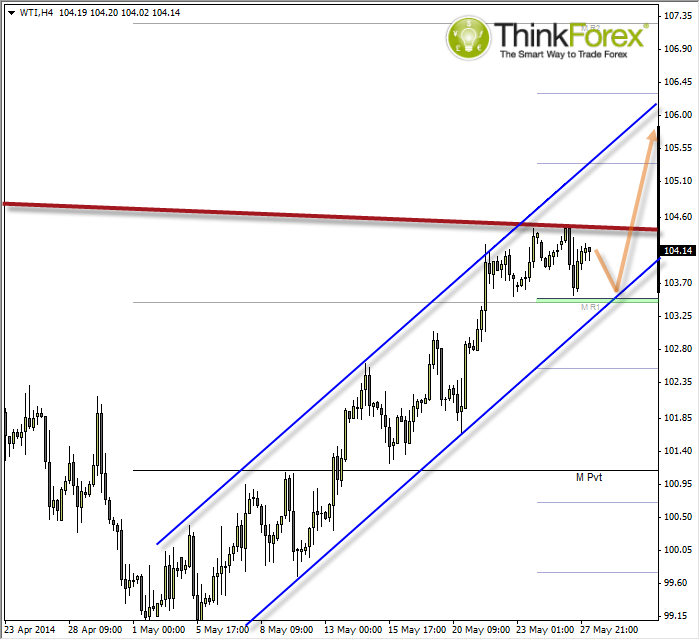

WIT: Bullish breakout pending?

The red line represents a breakout line which would confirm a double bottom (not fully pictured). We can see how price is currently trading within a tight bullish channel and found support above the Weekly and Monthly Pivots. As long as we remain above 103.50 then a bullish breakout is favoured. However, a break below 103.50 and the bullish channel would confirm a change in near-term trend and for price to recycle lower towards 102.60.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.