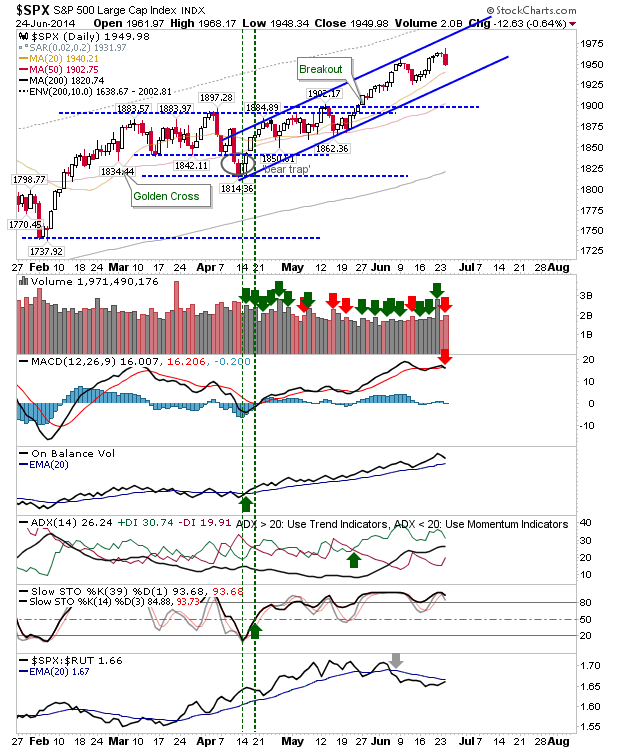

Sellers had to return at some point, and Tuesday was the day they paid a visit. I was too consumed with Suarez's fine dining skills to do an update last night, but given the day ranked as a distribution day it's worth passing comment.

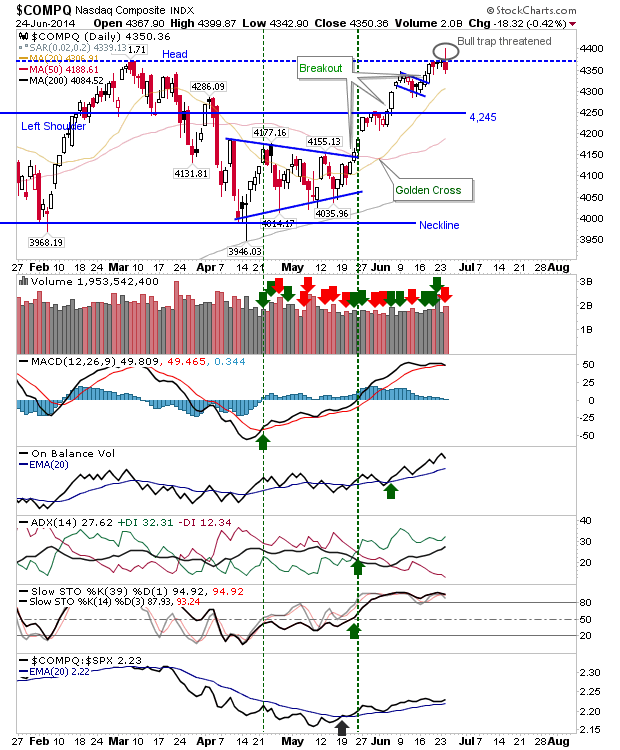

The most important action was found in the NASDAQ. The index had looked to comfortably break past resistance, only to see it finish below this resistance. A classic 'bull trap' requires a close above, then below resistance, but Tuesday's action was more a plain rejection of the breakout level as a support zone. The 'inverted hammer' on overbought short and intermediate term stochastics is a possible short entry with a break of 4,342 and an initial stop above 4,400. If going short, look to move the stop to around 4,369 on the first close below 4,342.

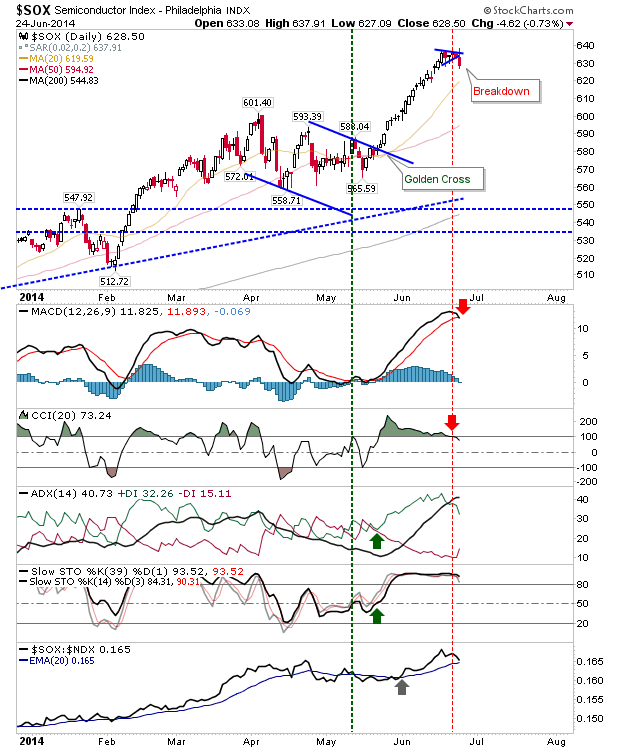

The semiconductor indexis also worth passing comment. The small pennant broke lower - setting up a short play - but watch for the counter rally which could set up a more profitable long position. The cover-switch-long level is around 636.

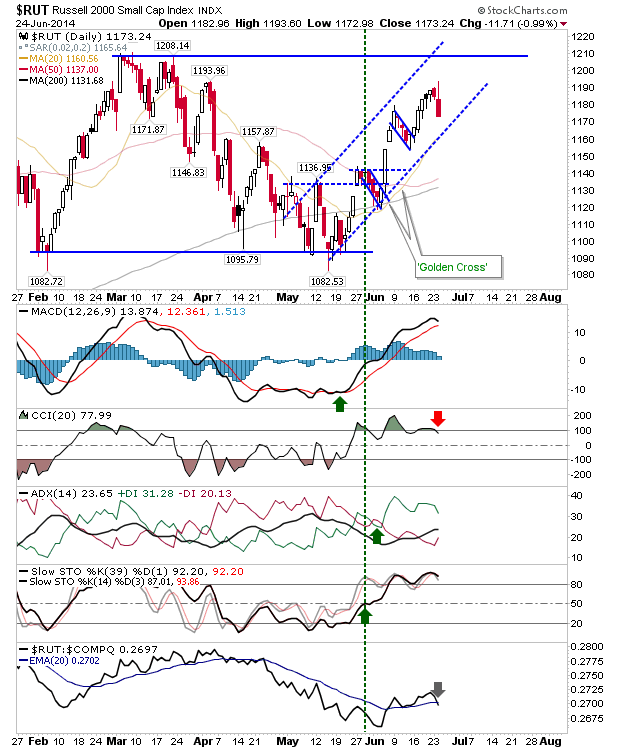

The Russell 2000 experienced the worst of the selling given it's caught in a bit of a no-mans land. A move back to a channel line I have drawn will offer potential buyers something to work with.

For the first time in a while, shorts have something to work with in the Nasdaq (Nasdaq 100 too?) and Semiconductor index. If this proves to be a 'bear trap', then the semiconductor index is likely to be the one to punish shorts more. If going short, look to get your stops as close to breakeven as soon as possible - the short side of the market is not one you want to be hoping on things going your way.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.