Weekly Analysis

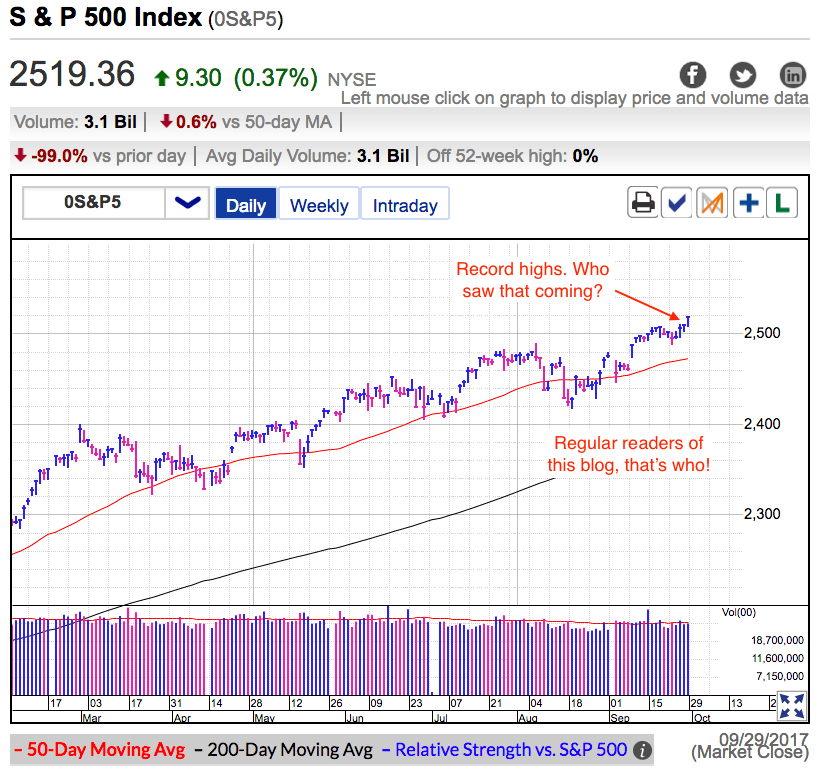

This past week’s theme was “no news is good news”. After several weeks of dire headlines, this past week produced very little on the news front. That reprieve from bad news was all the S&P 500 needed to surge to record highs. As I’ve been saying since early August, a market that refuses to go down will eventually go up. This proved to be the week we’ve been patiently waiting for.

This is a mild breakout as far as breakouts go, but there is nothing wrong with that. The market likes symmetry and last month’s 2% pullback was modest. As a result we should expect an equally modest rebound. This is a healthy market and there is nothing wrong or unusual with these slow and methodical gains.

Few things calm nerves like rising prices. Many of last month’s sellers are quickly going from fear of a crash to fear of being left behind. Underweight money managers are who were waiting for a bigger pullback are starting face the possibility it isn’t going to happen. If this market was vulnerable and fragile, last month’s headlines would have sent us tumbling. Standing strong through both the figurative and two literal storms tells us the path of least resistance remains higher. Gains will continue to be slow and choppy over the near-term, but expect the pace of gains to pick up later in the year as big money starts chasing performance into year-end.

Tuesday September 26th: Why smart traders ignore today’s price-action

In a directional market, a late fizzle like this would be a big red flag. It warns us there is no follow through and support is crumbling. But this isn’t a directional market and traditional trading signals don’t apply.

We have been stuck in a predominantly sideways market most of this year and every breakout and breakdown has been a false alarm. Anyone who failed to realize this has been making the exact wrong trade at the exact wrong moment. Buying the breakout just before it fizzles and selling the breakdown just before it rebounds.

Unfortunately the market fools traders with these tricks far more often than people are willing to admit. That’s because it is nearly impossible to come to the market without a bullish or bearish bias. Many traders cognitively know the market trades sideways 60% of the time, but in the moment they always think prices are either about to take off, or on the verge of collapse.

Score 10/10: In a more typical market, Tuesday’s weak close would have been big red flag and an attractive entry for a short trade. But this isn’t a typical market and we must ignore traditional trading signals. Just as I suspected, Tuesday’s weak close was nothing more than a false alarm and the next four trading sessions saw us charge to record highs.

Thursday September 28th: The bull that refuses to die

Volumes have been average or above since Labor Day. Big money finally returned from vacation and is getting back to work. It is encouraging to see they are more inclined to buy this strength than sell it. Fragile and vulnerable markets tumble quickly. Sticking near the psychologically significant 2,500 level for nearly three-weeks tells us the foundation under our feet is solid.

Earlier in the week we dipped under support, but rather than sell this technical violation, many traders rushed in to buy the dip. Ignore what the bears are saying, this market is healthy and poised to continue higher. August’s basing pattern refreshed the market by chasing off weak owners and replacing them with confident dip buyers. Given how long we have been holding near the highs tells us few owners are taking profits and most are confidently waiting for higher prices. As long as confident owners keep supply tight, expect the drift higher to continue.

Score 10/10: Big money is buying this market, not taking profits. The path of least resistance remains higher and Friday’s surge into record territory confirms it. Without a doubt this market wants to go higher and it is running over anyone who doubts it.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI