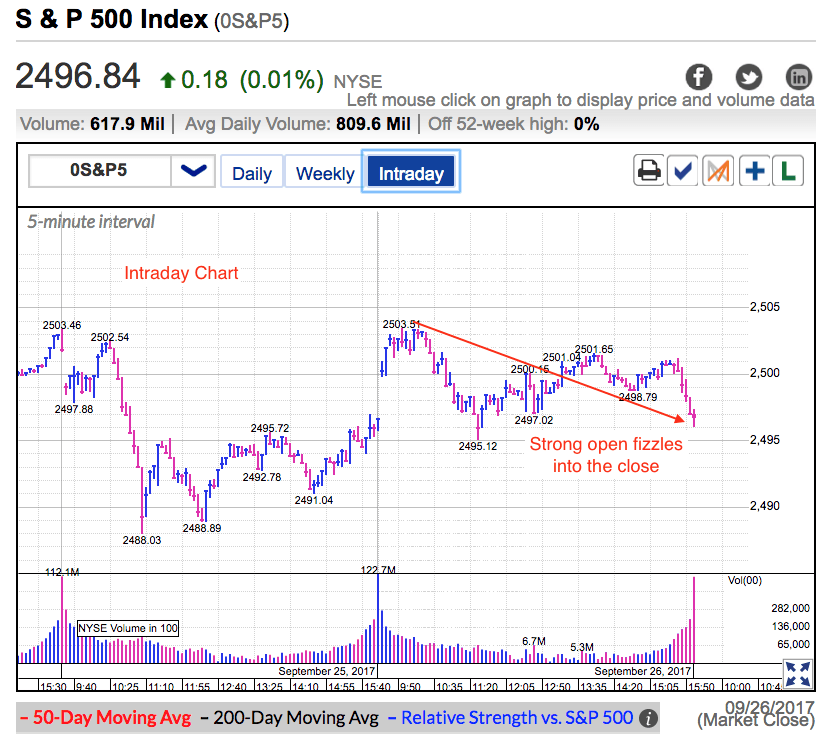

On Tuesday the S&P 500 rebounded from Monday’s selloff but it was unable to hold those early gains and closed flat.

In a directional market, a late fizzle like this would be a big red flag. It warns us there is no follow-through and support is crumbling. But this isn’t a directional market and traditional trading signals don’t apply.

We have been stuck in a predominantly sideways market most of this year and every breakout and breakdown has been a false alarm. Anyone who failed to realize this has been making the exact wrong trade at the exact wrong moment. Buying the breakout just before it fizzles and selling the breakdown just before it rebounds.

Unfortunately the market fools traders with these tricks far more often than people are willing to admit. That’s because it is nearly impossible to come to the market without a bullish or bearish bias. Many traders cognitively know the market trades sideways 60% of the time, but in the moment they always think prices are either about to take off, or on the verge of collapse.

Read any blog post or social media stream and all you see is endless bickering over whether the market is about to explode higher, or about to plummet. The rarest opinion is “meh, the market isn’t doing much and I don’t think it will do anything any time soon.”

Unfortunately for most traders, these bullish and bearish biases convince them to buy the breakout or sell the breakdown, moments before prices reverse. Then they either chicken out or hit their stop-loss and lock in their losses. To add insult to injury, prices reverse hours after the trader closes his position. Almost every single person reading this knows exactly what that feels like.

Buy high and sell low is a horrible way to trade the market, unfortunately it happens way more often than anyone wants to admit. Directional traders make a lot of money getting here, but they give it all back in these sideways stretches.

The above was a very long-winded way of saying, ignore yesterday’s late fizzle because it is meaningless. Just like last week’s breakout didn’t mean anything, and the fizzle before that. We are stuck in a market that refuses to go down nearly as much as it refuses to go up. Don’t fall for these tricks by reading too much into this meaningless price action.

While we are in a mostly sideways market, the path of least resistance is definitely higher. Headlines have been resoundingly bearish over the last several weeks and the market has flatly refused to breakdown. If this market was fragile and vulnerable to a crash, it would have happened weeks ago. The fact we withstood wave after wave of bearish headlines means this market is far more resilient than most people realize. A market that refuses to go down will eventually go up.

Keep doing what has been working. Stick with your buy-and-hold positions and add on dips. Big money returned from summer vacation and they are more inclined to buy this market than sell it.

Expect this demand to prop up prices over the near-term as big money keeps buying every dip. Over the medium-term expect this resilience to pressure underweight managers into chasing prices higher into year-end. This is an old bull market, but it still has life in it. Underestimate it at your peril.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.