The financial world continued trading in a risk-on mode in the end of last week, with the positive morale rolling somewhat into the Asian session today. It seems that the surprising rebound in US jobs added to optimism that the global economy is on the road to recovery after many weeks of restrictive measures aimed at controlling the fast-spreading coronavirus. As for this week, the main event on the economic agenda may be the FOMC decision on Wednesday. Although we don’t expect any action, it would be interesting to see what official’s view on the economy is, especially after Friday’s better-than-expected employment report.

Monday is a relatively light day in terms of data scheduled on the economic agenda. We already got Japan’s GDP final GDP for Q1, which was revised higher, to -0.6% QoQ from -0.9%. Later in the day, the only releases worth mentioning are Germany’s industrial production for April, as well as Canada’s housing starts for May and building permits for April. Germany’s industrial production is expected to have tumbled 16.0% mom after sliding 9.2% in March, while Canada’s housing starts are forecast to have declined to 150.0k from 166.4k. No forecast is available for the nation’s building permits.

On Tuesday, during the Asian morning, we have New Zealand’s ANZ and Australia’s NAB business confidence indices for May, but neither is accompanied with a forecast.

During the European morning, Germany’s trade balance for April, Eurozone’s final GDP for Q1 and the bloc’s employment change for the quarter are due to be released. The German trade surplus is forecast to have declined to EUR 10.2bn from 12.8bn, while Eurozone’s final GDP is just expected to confirm its preliminary estimate, namely that the Euro-area economy shrank 3.8% QoQ during the first three months of 2020. The bloc’s employment change is expected to show that the Euro-area economy has lost 0.2% jobs after gaining 0.3% in the last quarter of 2019.

Later, from the US, we get the JOLTs job openings for April, which are expected to have slid to 5.750mn from 6.191mn in March.

On Wednesday, all lights are likely to fall on the FOMC decision, the first after April, when the Committee kept interest rates unchanged at the 0-0.25% range, and hinted that more stimulus may be delivered if judged necessary. We will continue to use powers proactively until we’re confident that the US is solidly on the road to recovery”, Fed Chair Powell noted. He also added that economic activity will likely drop at an “unprecedented pace” in Q2, which suggests that they were more willing to act again than not.

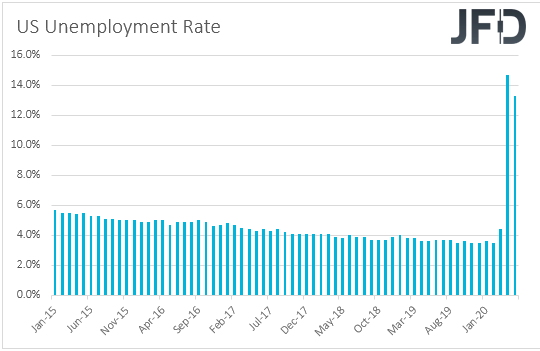

However, we don’t expect them to act at this gathering. Yes, the Atlanta Fed GDPNow and the New York Nowcast add credence to Powell’s remarks, pointing to a -53.8% and a -25.5% growth rates respectively, but until we get official numbers, we don’t believe that the Fed will rush into expanding its stimulus efforts. After all, they already announced an expansion of their Municipal Liquidity Facility on Friday. Another factor that makes us believe that the Fed is unlikely to act this time is the much-better-than-expected employment report for May. On Friday, the report showed that the US economy added 2.51mn jobs instead of losing 8.0mn as the forecast suggested, with the unemployment rate falling to 13.3% from 14.9%, beating estimates of a surge to 19.7%.

Given that this will be one of the “bigger meetings”, which are accompanied by economic projections, it would be interesting to see what the current view among officials in the wake of such a surprising jobs report is. In our view, the report suggests that the worst with regards to the coronavirus is behind us, but it remains to be seen whether officials will share that view as well. Although we don’t expect them to act, we believe that they will stay ready to do so if things fall out of orbit, which combined with a relatively not-that-worrisome language over the economic outlook, may allow equities and risk-linked assets to continue drifting north, as investors abandon safe havens.

As for Wednesday’s data, during the Asian morning, we have Australia’s Westpac consumer sentiment index for June, for which there is no forecast available. China’s CPI and PPI rates are also coming out. The

CPI is forecast to have slowed to 2.6% YoY from 3.3%, while the PPI rate is anticipated to have fallen further into the negative territory, to -3.3% YoY from -3.1%.

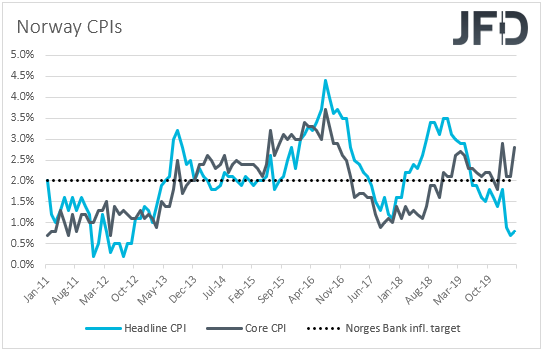

During the early EU morning, Norway’s CPIs for May are coming out. The headline CPI rate is anticipated to have risen to +1.2% YoY from +0.8%, while the core rate is forecast to have ticked up to +2.9% from +2.8%. At its latest meeting, the Norges Bank cut its benchmark policy rate to 0.0%, with officials saying that it will most likely stay at that level for some time ahead. “We do not envisage making further policy rate cuts”, Governor Olsen said in the accompanying statement. Thus, accelerating inflation may add credence to their view and allow them to sit comfortably on the sidelines.

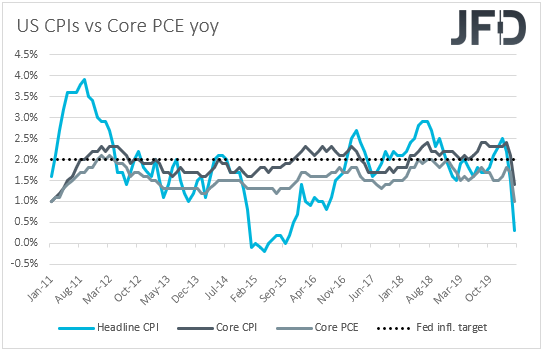

We get more CPI data for May later in the day, this time from the US. The headline rate is expected to have ticked down to +0.2% YoY from +0.3%, while the core rate is forecast to have slid to +1.3% YoY from +1.4%. Despite a potential slowdown in US inflation, we don’t expect market participants to pay so much attention. We expect them to keep their gaze locked on the FOMC decision, which is due to be released later in the day.

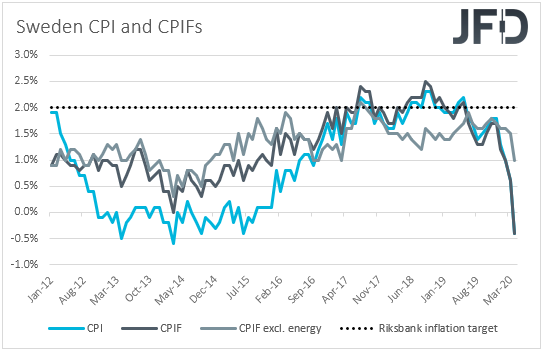

On Thursday, EU trading time, Sweden’s inflation numbers for May are due to be released. Both the CPI and CPIF rates are forecast to have remained unchanged at -0.4% YoY, but as it is always the case, we prefer to pay more attention to the core CPIF rate, which excludes energy. That rate slid to +1.0% YoY in April from +1.5% in March. When they last met, Riksbank policymakers decided to continue purchases of government and mortgage bonds up to the end of September 2020 and to leave the repo rate unchanged at 0.0%. They also said that the measures will be adjusted to economic developments. Thus, a potential rebound in the core CPIF metric may raise some speculation that the world’s oldest central bank may start scaling back its QE at some point soon.

From the US, we get the PPIs for May. The headline rate is forecast to have declined to -1.3% YoY from -1.2%, while the core rate is anticipated to have slid to +0.4% YoY from +0.6%.

Finally, on Friday, during the Asian morning, Japan’s final industrial production for April is due to be released, with the forecast expected to confirm the preliminary print of -9.1% mom.

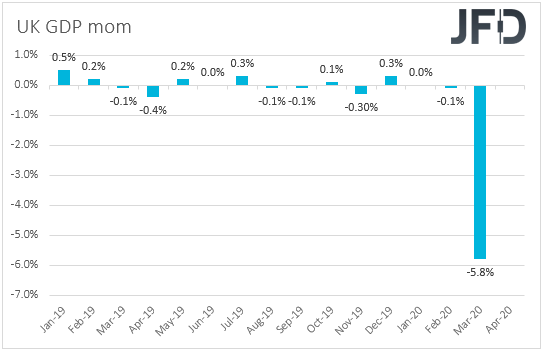

Later in the day, the UK’s monthly GDP, industrial production, and the nation’s trade balance, all for April are due to be released. Economic activity is forecast to have tumbled 18.7% mom after sliding 5.8%, something that will drive the YoY rate down to -22.3% from -5.7%. Industrial production is also expected to have accelerated its decline, to -15.0% MoM from -4.2%, while the nation’s trade deficit is expected to have narrowed to GBP 11.54bn from 12.51bn.

Although this data set may increase the chances for the introduction of negative interest rates by the BoE, we believe that GBP-traders may stay on the edge of their seats in anticipation of fresh headlines with regards to Brexit. On Friday, EU and UK negotiators said that they have made very little progress in their latest round of talks, and with just a few days left for the UK to ask for an extension to the transition period, headlines on that front may carry extra weight as we get closer to the June 18th and 19th EU summit. UK PM Johnson has been insisting on a December 31st deadline for finding common ground, while EU Chief negotiator Barnier noted that a deal needs to be sealed by the end of October to allow enough time for ratification by the bloc’s 27 member states. Thus, anything pointing to further disagreement could strengthen the case for a no-deal Brexit at the end of this year and may add pressure to the British pound.

We also have an EU finance ministers meeting, where they are expected to discuss a coronavirus rescue fund. The euro has been on a fly mode recently, perhaps due to the announcement by the EU Commission over a EUR 750bn rescue plan, and an official approval may keep the currency supported. On the other hand, a failure to seal an accord over the aforementioned proposal may prompt some EUR-bulls to liquidate their positions and force the common currency to correct lower.

From the US, we get the preliminary UoM consumer sentiment index for June, which is expected to have risen to 75.0 from 72.3.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI