Large Caps and Tech indices enjoyed a good week last week, with breakouts holding by Friday's close. There was no real volume on the breakouts but new highs leave markets in a position to attract sideline money.

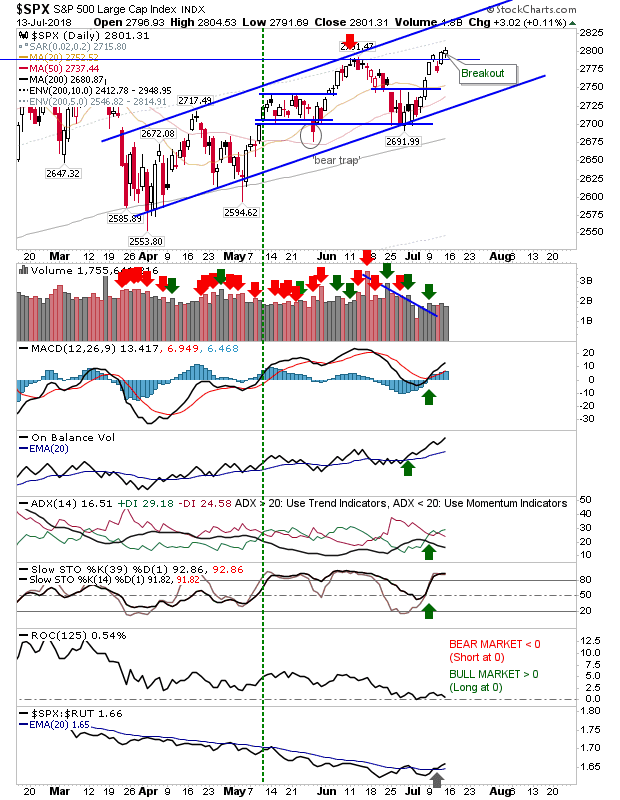

The S&P didn't do a whole lot on Friday but it remains on course to test channel resistance. Technicals are all in the green and the previous period of underperformance against the Russell 2000 looks to have shifted back in Large Caps' favor.

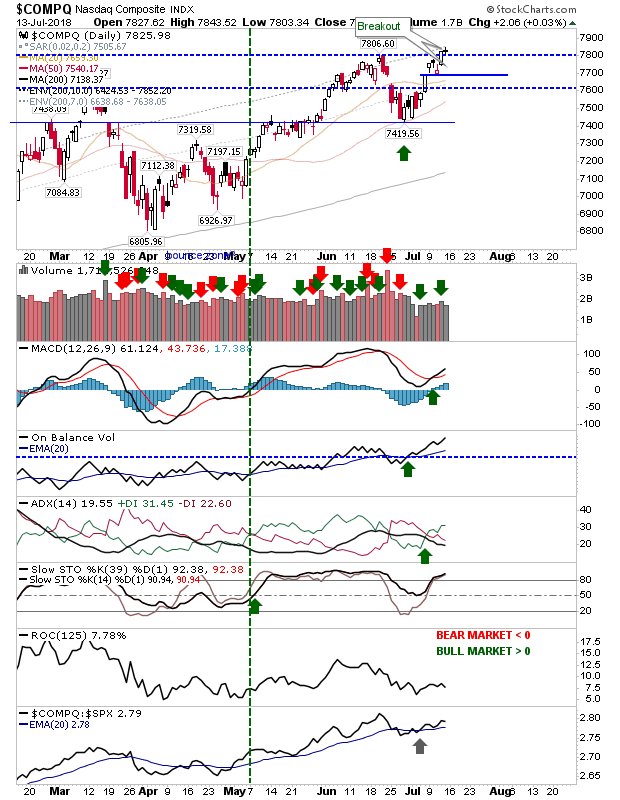

The NASDAQ didn't quite convince on its breakout but On-Balance-Volume has managed a new reaction high while other technicals are bullish. Wednesday's swing low is the risk level for new buyers and there is likely value for a long trade based on Friday's finish.

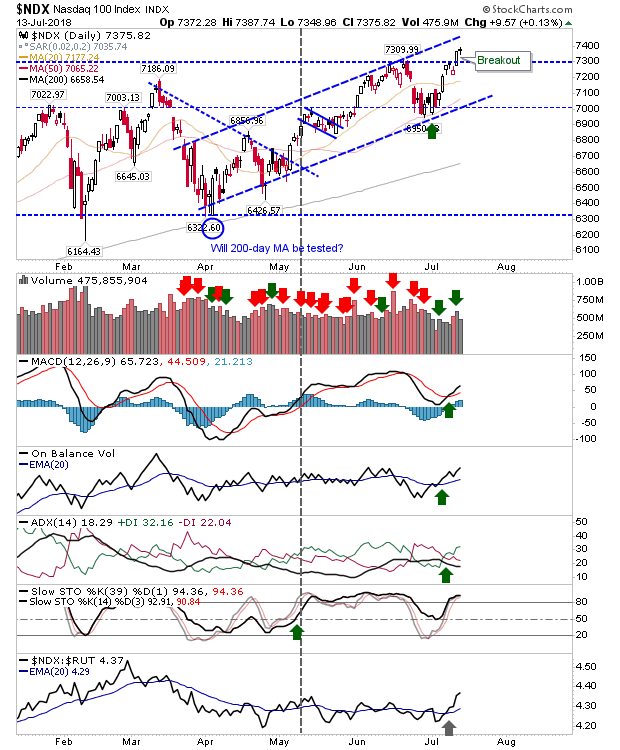

The NASDAQ 100 had the stronger breakout of the two Tech indices. It will run into resistance before other indices but also has the most room to defend support.

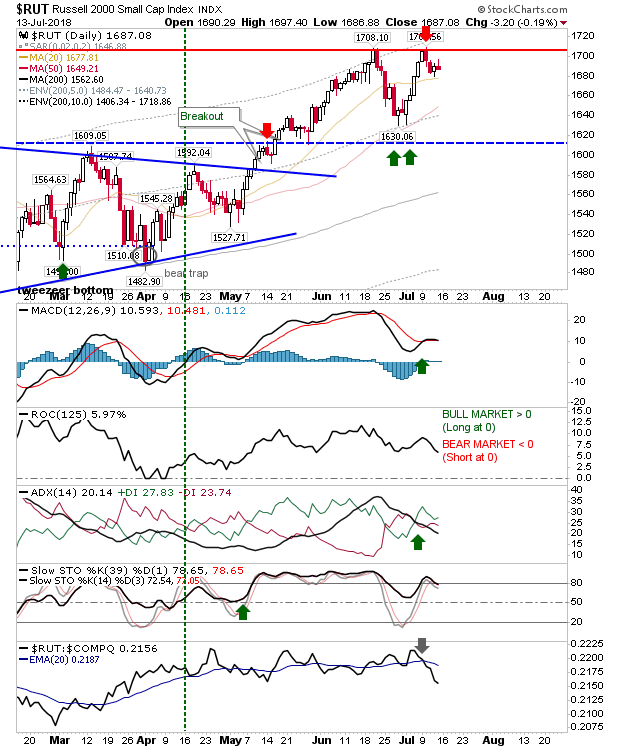

The index struggling a little for attention is the Russell 2000. While Friday's broader market gains were small they didn't get as far as the Small Caps index. The double top remains in play and aside from relative performance, other technicals are okay.

For today, bears will be looking to push nascent breakouts back below their latter support levels and generate a new round of 'bull traps' (shorting opportunities). Profit taking is also likely. However, if sellers fail to make their presence felt in early morning trading, sidelined bulls will become encouraged to step in and bid markets higher; Wednesday's swing lows will become 'stop' levels for measuring risk (vs potential reward).

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI