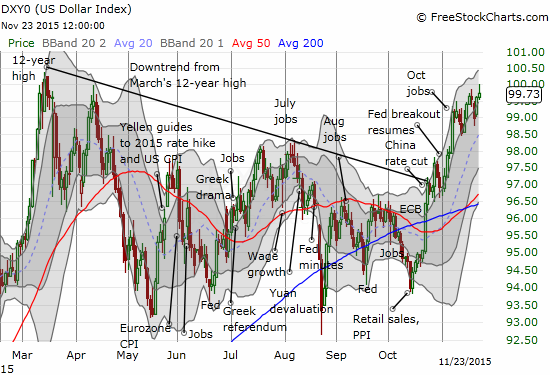

The U.S. Dollar Index hit 100 on an intraday basis for the first time since March 16th, the day after the index closed at a 12-year high. The index faded back to a close of 99.73 at the end of the U.S. trading day.

Source: FreeStockCharts.com

The U.S. dollar index (DXY) finally hits 100 again as it flirts with a fresh breakout

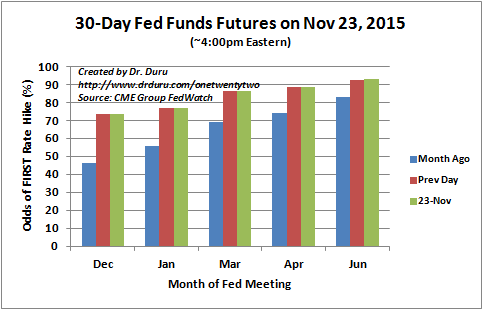

The U.S. dollar’s steady, albeit slow, strengthening is happening in parallel to firming odds for a December rate hike from the U.S. Federal Reserve.

Source: CME Group FedWatch

The 30-Day Fed Fund futures are essentially guaranteeing a rate hike in December. The odds have jumped considerably over the last month.

I find it a bit reassuring that the market is not yet ready to play contrarian and fade the U.S. dollar ahead of the rate hike. Perhaps such “pricing in” will occur after the Fed actually hikes.

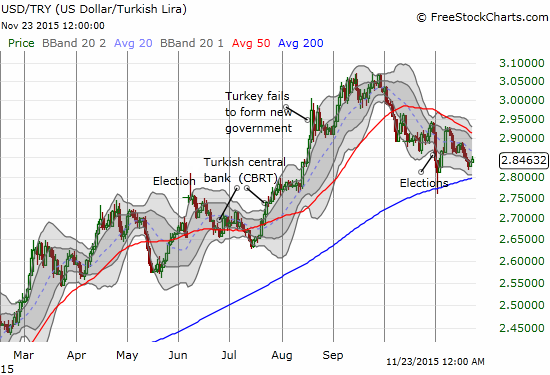

While I have been right to stick by my long dollar bias, I have been caught by surprise by the relative resilience in the Australian dollar (N:FXA) and the outright strength in the Turkish lira (USD/TRY) both against the U.S. dollar. I am sticking by my positions against these currencies.

I explained my position on the Australian dollar in an earlier piece. For the Turkish lira, I am currently assuming that the currency is experiencing a significant election-related relief rally which began before the last election. I am also assuming sellers are “exhausted” (from a technical standpoint). I am waiting for a rendezvous with presumed support at the 200-day moving average (DMA) for USD/TRY as a test of my assumption. Note in the chart below how the Turkish lira surged in strength in the immediate election aftermath but has still failed to follow-through. This makes an imminent 200DMA test even more important. (USD/TRY weakness represents strength in the Turkish lira).

Source: FreeStockCharts.com

Political related turmoil has delivered major turning points for the Turkish lira.

Be careful out there!

Full disclosure: long U.S. dollar

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.