Are DOGE layoffs set to resume?

10:30pm EST could provide some volatility for the Greenback as we have housing and employment data released simultaneously.

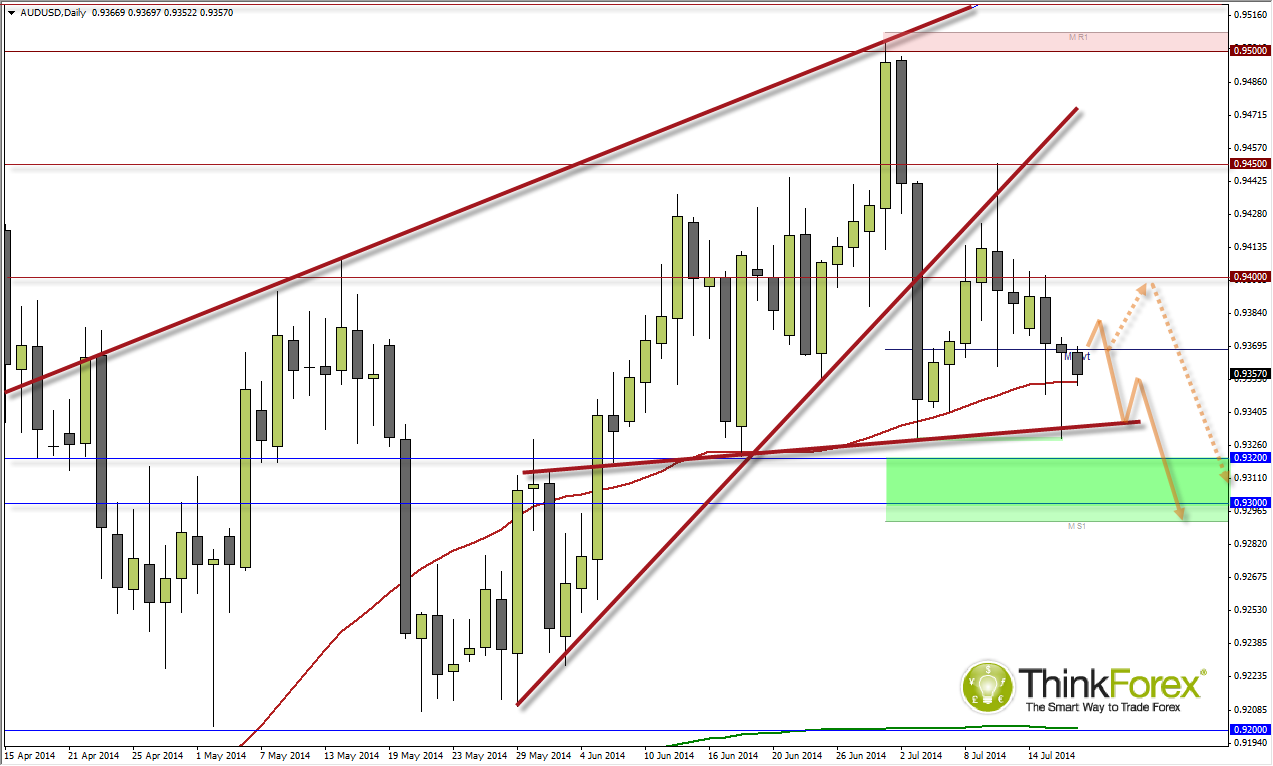

Yesterday's bullish hammer may provide a glimmer of hope for the bulls who want to see it back at 94c. It traded within a whisker of the July low but managed to maintain above this key swing.

Today's business conditions rose by one point but the dollar hardly reacted. Business confidence did slip by one point in Q2, but when you consider the tough budget this reading could be considered fairly resilient. The trouble is it remains sandwiched between the 50 sMA and Monthly Pivot.

Further direction should come tonight from the US as both employment and housing data are released together. For a cleaner directional move we'd want to see both data sets either above or below expectations. There is an expectation tonight to see improved employment and housing data - both data sets continue to rise within healthy trends, and both are at similar levels to summer 2008. If this trend continues tonight then this will weigh down the Aussie Dollar.

However on the flip side poor numbers from either sector could support the AUD and see it trade up towards 94 US cents. Whether it will stay up there this time is debatable, but we suspect the Australian dollar will visit 93c before it sees 94c again. While the dollar rebounded from falls yesterday, the dollar was technically exhibiting more bearish signals on the charts.