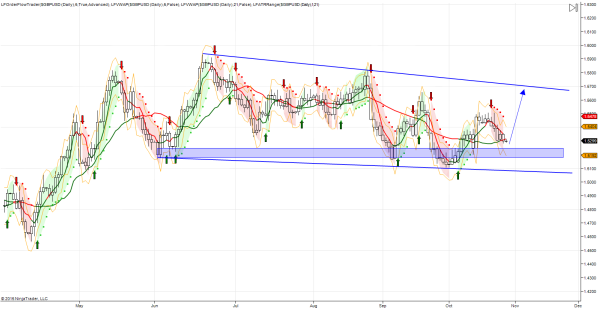

GBP/USD – STILL holding at key support

GBP fell below the 1.53 handle with pressure from broad USD strength, hitting a low of 1.5280. The surprisingly weak UK GDP figures left the pound vulnerable against the dollar, and markets are waiting for the FOMC’s meeting while the currency pair is currently testing the pivotal 1.53 at writing.

While 1.5300 supports downside reactions expect a grind higher to test 1.56 symmetry objective. A breach of 1.5280 targets a retest of pivotal 1.52 support.

Trade Idea

- While 1.5280 continues to support, I am still looking to play the long side in GBP. High probability that the FOMC disappoints USD bulls this evening, with GBP holding support, it looks like there is room for a bounce here at least.

- I will venture long back through 1.5330 stopping out at 1.5250, targeting an upside objective of 1.5650 to topside of the range.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI