The fuse on the global debt bomb has been lit. It started in the emerging market space, where over 23 stock markets are crashing. It will be spreading to the U.S. soon. In short, we are now officially in the crisis to which the 2008 meltdown was just the warm up.

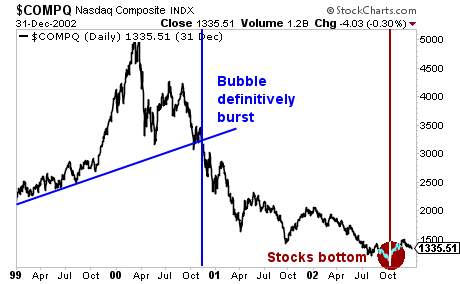

The process will take time to unfold. The tech bubble, arguably the single biggest stock market bubble of all time, was both obvious to investors and isolated to a single asset class: stocks. In spite of this, it took two years for stocks to finally bottom on the NASDAQ Composite:

In contrast, the current crisis that we are facing involves bonds — the bedrock of the financial system. Every asset class in the world trades based on the pricing of sovereign bonds, so the fact that bonds are in a bubble (arguably the biggest bubble in financial history), means that every asset class is in a bubble.

And what a bubble it is.

All told, globally there are $100 trillion in bonds in existence today. A little over a third of this is in the U.S. About half comes from developed nations outside of the U.S. And finally, emerging markets make up the remaining 14%.

Over $100 trillion — the size of the bond bubble alone should be enough to give pause. However, when you consider that these bonds are pledged as collateral for other securities (particularly over-the-counter derivatives), the full impact of the bond bubble explodes higher to $555 trillion.

To put this into perspective, the credit default swap (CDS) market that nearly took down the financial system in 2008 was only a tenth of this ($50-$60 trillion).

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.