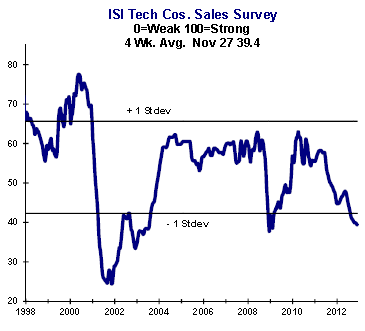

The ISI Tech Company Index (see discussion) shows continuing weakness. The survey, which is heavily weighted towards US semiconductor firms, is now at the lows of 2008/09. It seems that firms have been postponing spending on equipment and to a lesser degree on software. The obvious explanation is the uncertainty in Washington.

So far this weakness has not been reflected in the equity markets. The PHLX Semiconductor (SOX) index is definitely off the highs but is still up for the year. At some point (probably within the next couple of months), either the sentiment in the industry will begin improving or we will see a sell-off in the tech sector. Companies manufacturing and servicing business tech equipment (as opposed to retail) are particularly vulnerable.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.