The ISI Company Survey (conducted by the ISI Group) is a weekly corporate activity indicator, covering some 300 firms. See this document for information on the index methodology.

The overall ISI Index had a significant drop this week from 50.4 to 49.3, the largest one week drop in 18 months. This does not bode well for earnings going forward.

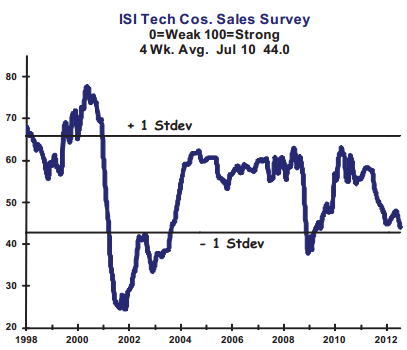

One of the weakest spots has been IT spending. The weakness is seen across the board, particularly in businesses that concentrate on Europe and China. The tech index is now at the lows not seen since 2009.

Related to this, the ISI survey component that measures US companies' exports to China as well as sales within China hit a new a recent low.

If this continues, the third quarter corporate earnings may be quite weak, particularly across cyclical sectors. It also does not bode well for job growth in the US.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.