Only one yield curve represents the pan-eurozone interest rates implied by actual lending transactions. It's the Eurepo curve - rates at which short-term EUR lending is done on a secured basis (collateralized lending). Sovereign curves are specific to each nation, while Euribor does not represent any real transactions and is basically a figment of bankers' imaginations.

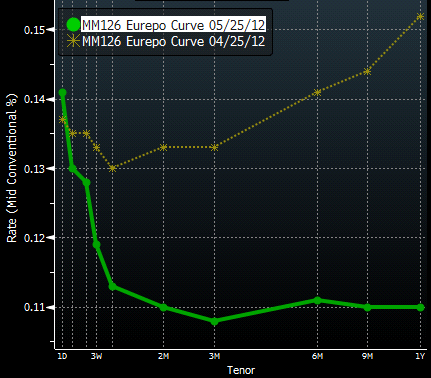

A month ago the Eurepo curve was upward sloping, as hopes of some sort of stabilization in the eurozone later this year still existed. These hopes have now been dashed, with the curve becoming inverted in the short-end and flat at around 11bp out to one year. There is no active repo market beyond one year.

This demonstrates lack of borrowers willing to tie up precious repo-eligible collateral beyond a month, while money market funds and other cash accounts are desperately trying to get any non-zero secured term yield. Inverted yield curves rarely spell good news - and the only news here is the onset of the eurozone recession.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI