PBoC, China's central bank, is having trouble stimulating lending. The trouble now seems to be more demand driven, as the economic slowdown sets in.

Bloomberg: Combined net lending by Industrial and Commercial Bank of China, China Construction Bank Corp., Bank of China and Agricultural Bank of China Ltd. was almost zero in the two weeks through May 13, Shanghai Securities News reported today, citing an unidentified person familiar with the matter.

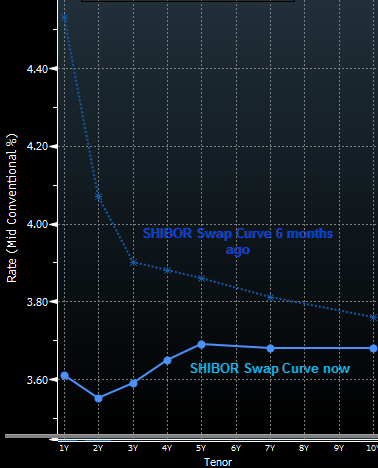

The slowdown (particularly the lack of demand for loans) is driving interest rates lower. The one-year SHIBOR swap rate is registering the sharpest decline since 2008. Again, swap rates show the market "consensus" of short-term rates in the future - a rate at which someone is willing to "lock in" short-term rates for a year or longer (in this case locking in the 3-month SHIBOR rate for a year).

When we discussed China's inverted yield curve a couple of months back, many dismissed it as supply/demand aberration. But as has been the case in the US, an inverted curve continues to be the best predictor of economic downturns.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI