As we discussed this past weekend, everyone is in the car driving along with no worries about how much “gas is in the tank.”

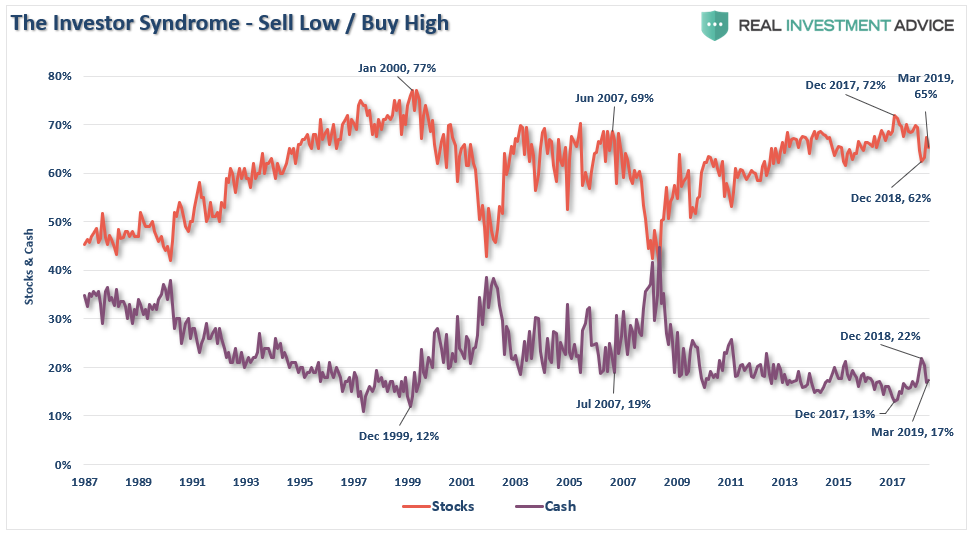

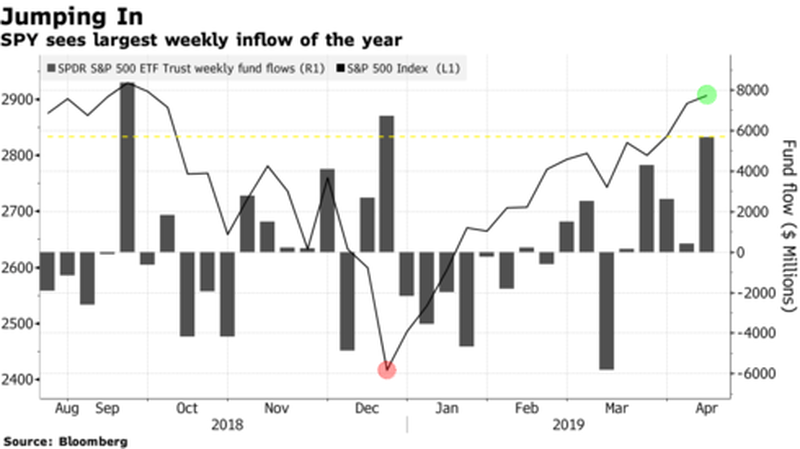

“Yes, since investors did sell the December lows, they are now buying the February-March highs. But to Doug’s point, investors are still heavily weighted towards equity.”

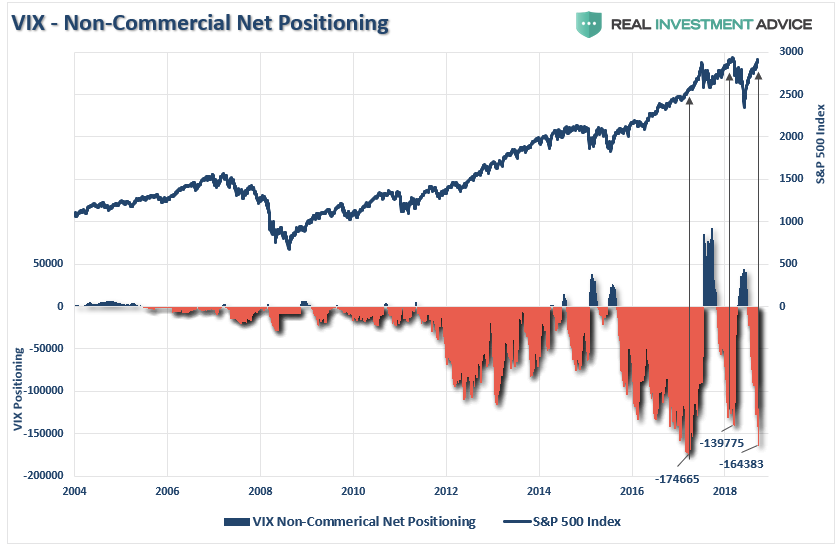

More importantly, they are getting long at a time where volatility has once again become extremely low which has historically led to negative outcomes.

“Lastly, market ‘complacency’ is back to levels which have denoted short-term corrections in the market previously with near record levels of short-volatility positioning.”

After four months on advances in the market, investors have once again been lured back into the belief that markets are a “one-way trip higher.”

As noted by the Wall Street Journal on Monday:

“Sentiment is incredibly bullish. So many people are chasing performance now.” – Nancy Davis, CIO at Quadratic Capital Management.

She is right.

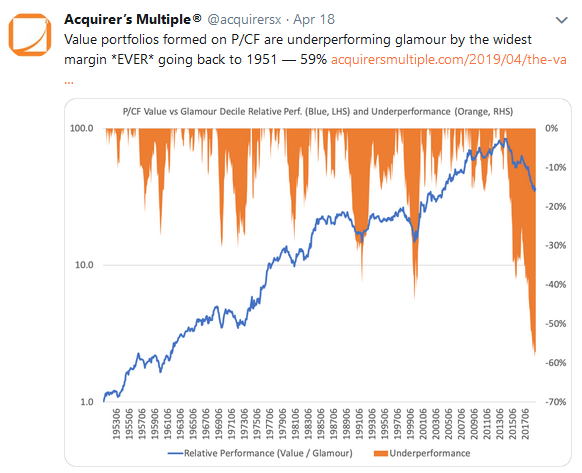

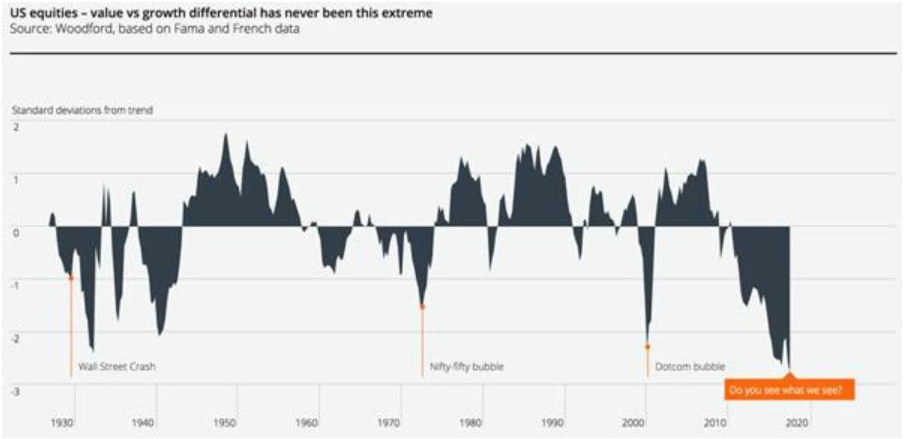

Currently, momentum and growth stocks are substantially outperforming value-oriented stocks.

But investors are paying an excruciatingly high premium for that performance.

Growth Stocks vs. Value Stocks

- Price/Sales: 8x more

- Price/Book: 16x more

- Price/Cash Flow: 7x more

- Dividend Yield: 5% less yield.

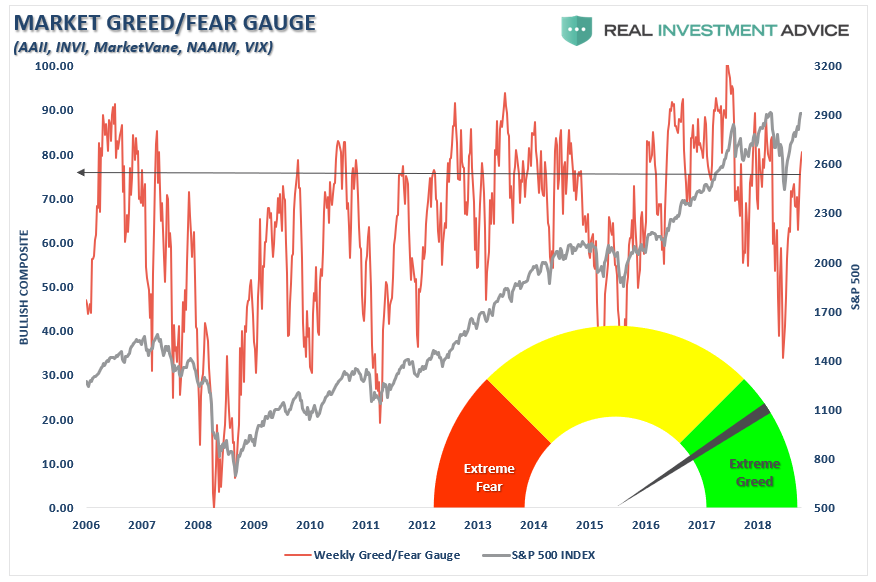

More importantly, our “Greed/Fear Gauge,” which is based on allocation exposure, is back to historically high levels.

Investors are current extremely optimistic that even with the fuel gauge warning light glaring red, that passing the “last chance” gas station won’t be a problem.

Maybe, they are right.

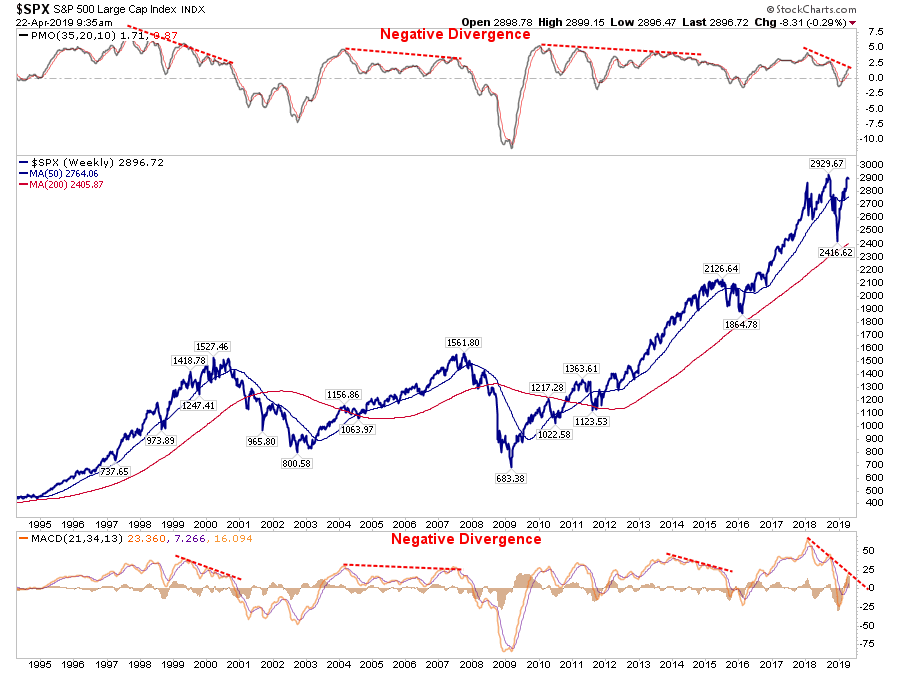

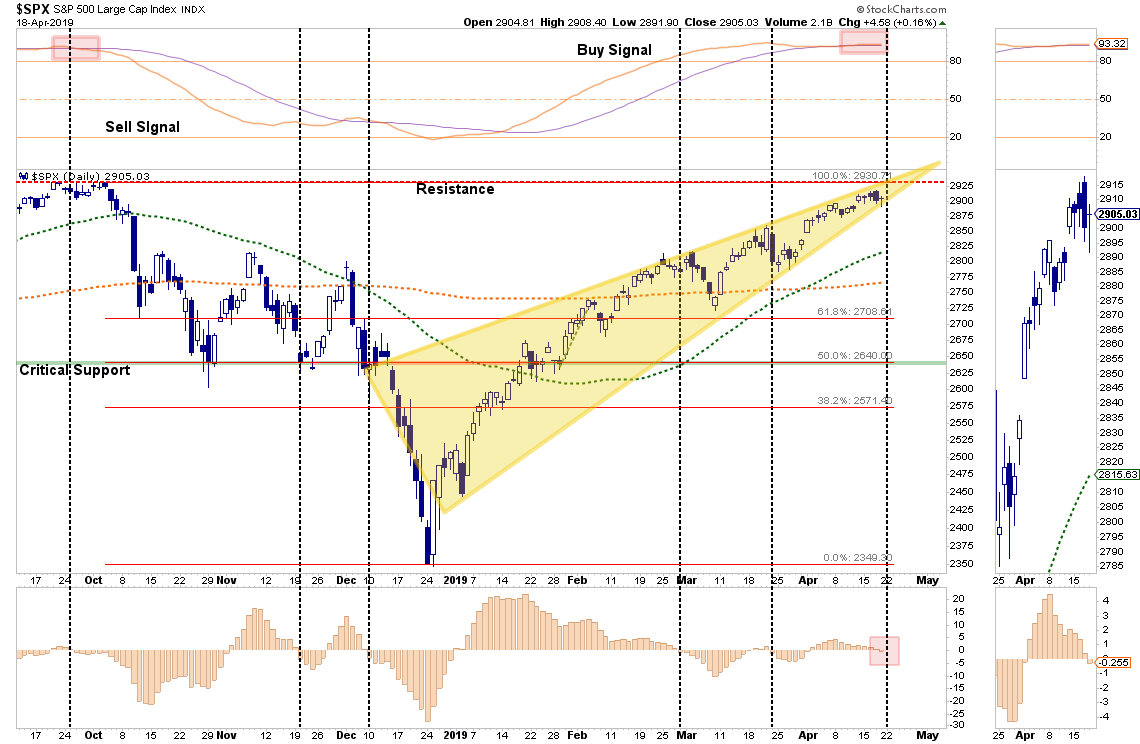

However, historically, and as shown in the chart below, when markets have previously been this overbought combined with negative divergences in momentum, short-term outcomes have been less than optimal.

Let me clear, this does not mean the markets are about to “crash.”

It simply suggests that after an incessant run higher, asset prices are likely going to correct which will provide a better “risk/reward” entry point for investors.

But it also doesn’t rule out a much deeper correction either.

As I noted on Friday:

“The overbought condition (top panel) is now back to where was the last time we were registering ‘all-time highs.’ Currently, that signal has flattened out to the point where it is dangerously close to crossing lower. Any additional weakness this week will likely trigger a sell signal.”

Importantly, it is where we close the week that matters. A break that is reversed by the end of the week doesn’t register as a valid signal.

I will update this chart this coming weekend and discuss the next set of actions as necessary.

Running On Hope

The current advance is not built on improving economic or fundamental data. It is built simply on “hope.”

- Hope the economy will improve in the second half of the year.

- Hope that earnings will improve in the second half of the year.

- Hope that oil prices will trade higher even as supply remains elevated.

- Hope the Fed will not raise interest rates this year.

- Hope that global Central Banks will “keep on keepin’ on.”

- Hope that the US Dollar doesn’t rise.

- Hope that China will keep stimulating.

- Hope that a “trade deal” will be concluded soon.

- Hope that high-yield credit markets remain stable

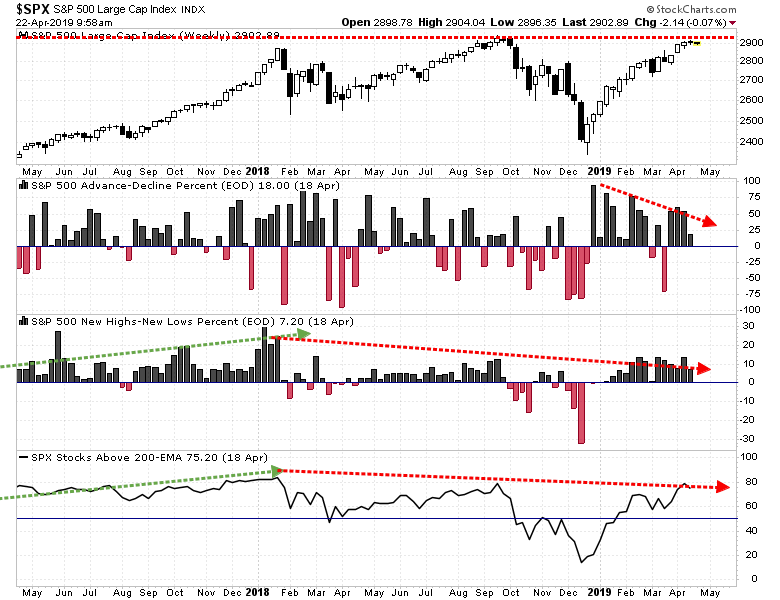

However, with valuations expensive, markets overbought, volatility low, and sentiment pushing back into more extreme territory, there are a lot of things which can go wrong. While stocks above their 200-DMA have surged from their recent nadir, the negative divergence, light trading volume, and narrowness of the rally leaves a lot to be wished for.

The overriding message is that fundamentals are not driving the current rally.

Prices are dictating policy.

The sharp decline in prices in 2018 set the Fed against the White House.

You can deny it. You can rail against it. You can call it a conspiracy.

But in the “other” famous words of Bill Clinton: “What is…is.”

The markets are currently betting the economy will begin to accelerate later this year. The “hope” that Central Bank actions will spark inflationary pressures and economic growth is a tall order to fill considering it hasn’t worked anywhere previously. If Central Banks are indeed able to keep asset prices inflated long enough for the fundamentals to catch up with the “fantasy” – it will be a first in recorded human history.

My logic suggests that sooner rather than later somebody will yell “fire” in a very crowded theater.

When that will be is anyone’s guess.

In other words, this is probably a “trap.”

But as I wrote previously:

“Over the next several weeks, or even months, the markets can certainly extend the current deviations from long-term mean even further. But that is the nature of every bull market peak, and bubble, throughout history as the seeming impervious advance lures the last of the stock market ‘holdouts’ back into the markets.”

Unfortunately, for most investors, they are likely stuck at the very back of the theater.

With sentiment currently at very high levels, combined with low volatility and excess margin debt, all the ingredients necessary for a sharp market reversion are currently present.

Just to clarify, I am not calling for the “end of the known universe.”

I am simply suggesting that remaining fully invested in the financial markets without a thorough understanding of your “risk exposure” will likely not have the desired end result you have been promised.

As I stated often, my job is to participate in the markets while keeping a measured approach to capital preservation. Since it is considered “bearish” to point out the potential “risks” that could lead to rapid capital destruction; then I am unabashedly a “bear.”

But I have been through three previous bear markets and lived to tell about.

However, just to be very clear, I am still in “theater;” I am just moving much closer to the “exit.”

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI