Bitcoin price today: hits record high over $121k ahead of ’crypto week’

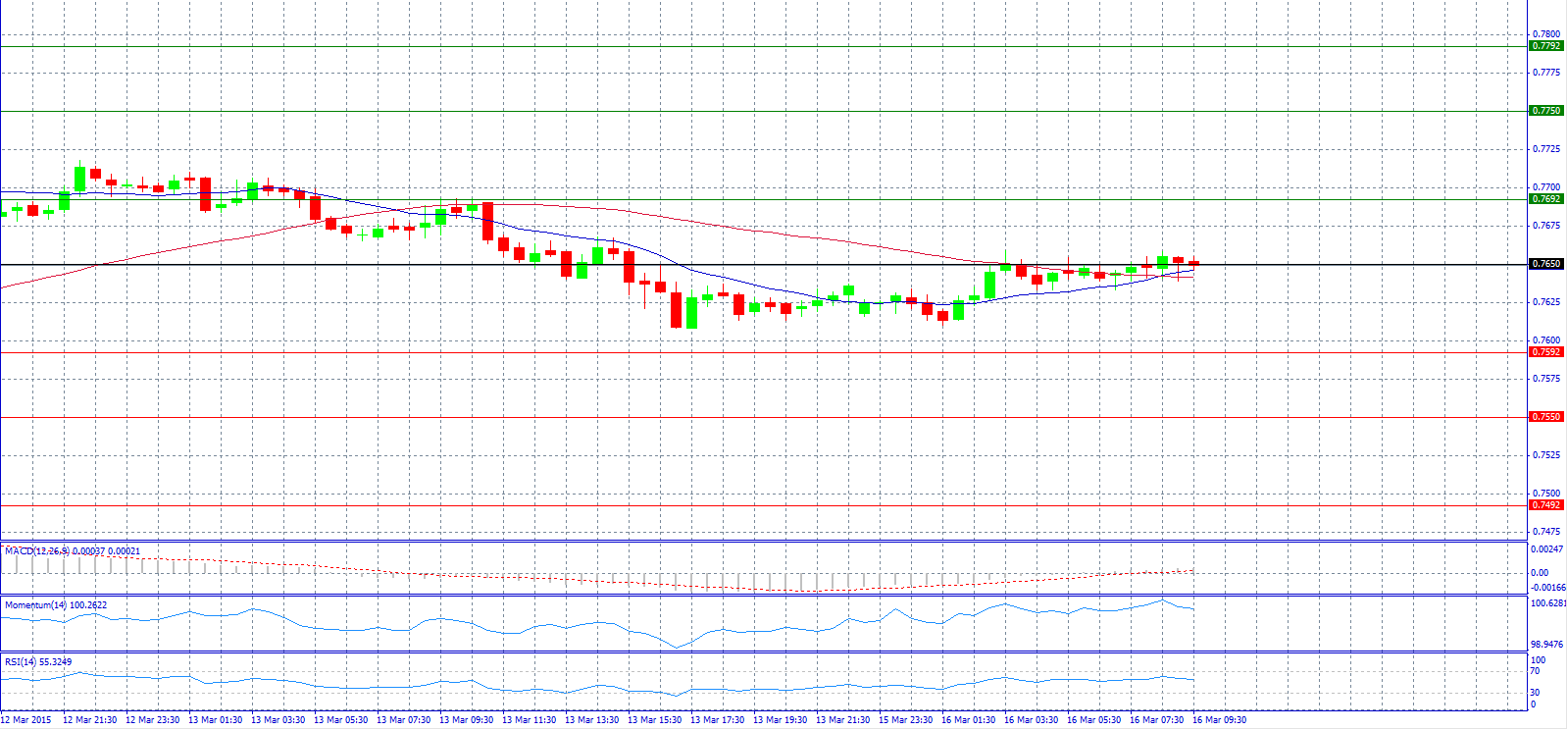

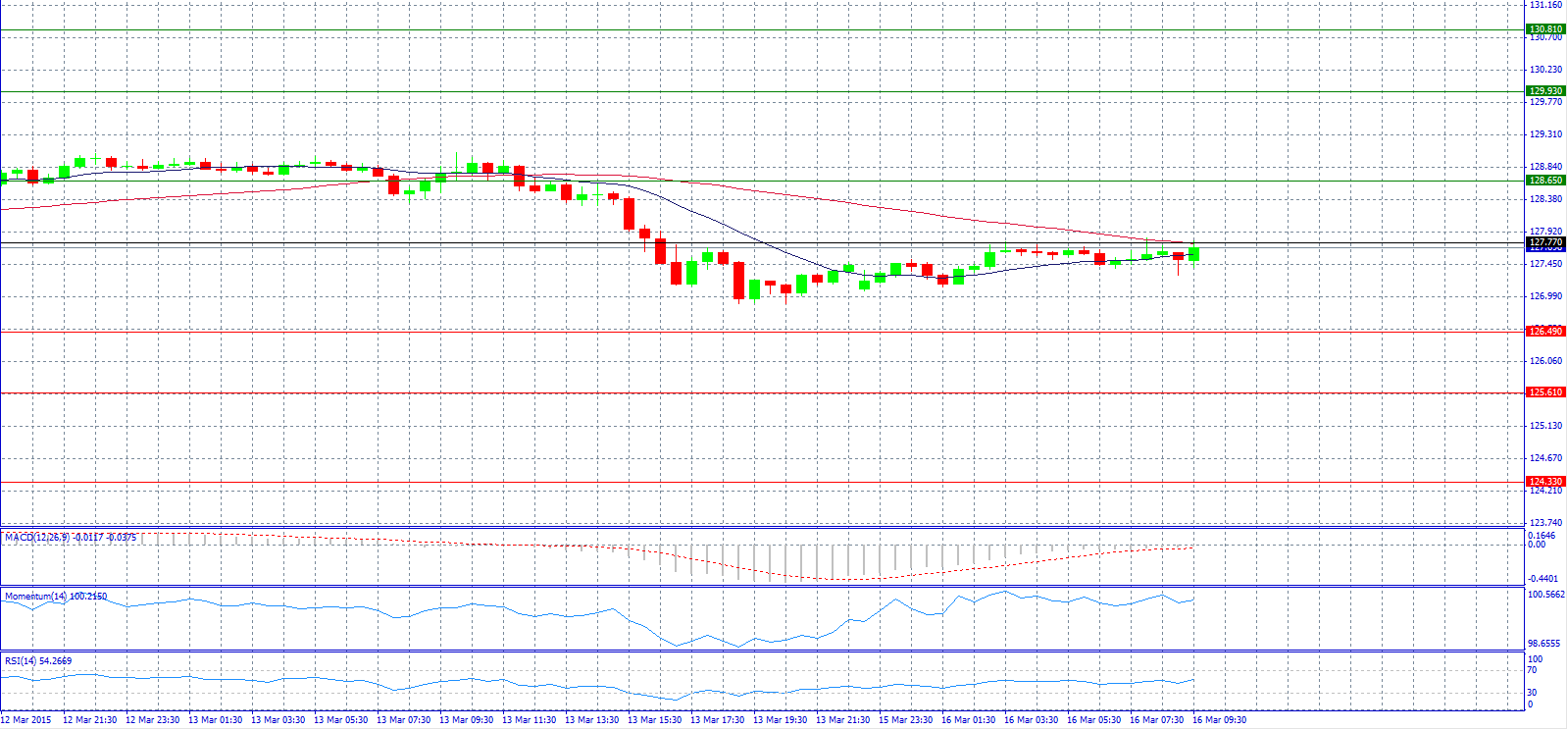

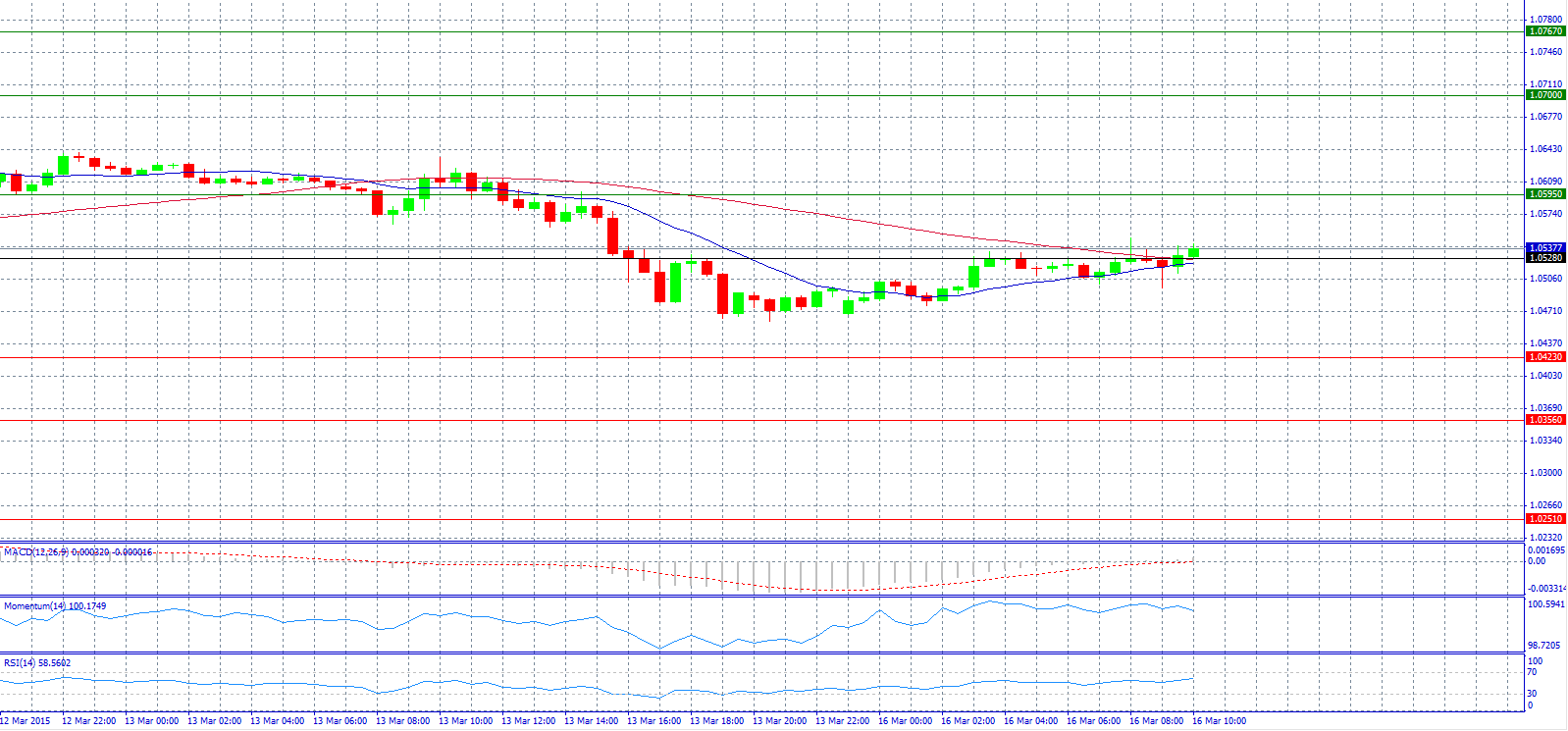

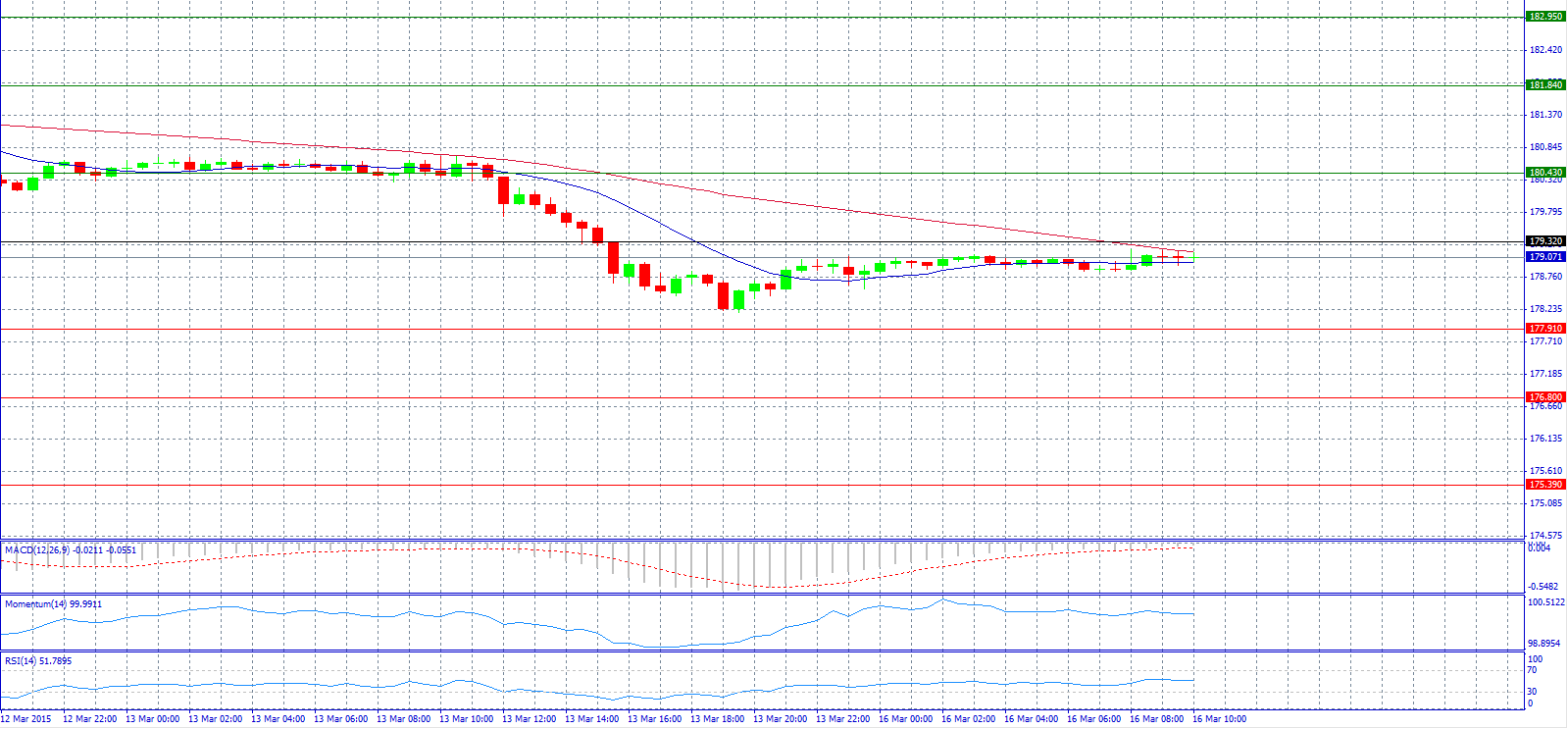

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7650 with target @ 0.7692.

Market Scenario 2: Short positions below 0.7650 with target @ 0.7592.

Comment: The pair trades near pivot point 0.7650.

Supports and Resistances:

R3 0.7792

R2 0.7750

R1 0.7692

PP 0.7650

S1 0.7592

S2 0.7550

S3 0.7492

Market Scenario 1: Long positions above 127.77 with target @ 128.65.

Market Scenario 2: Short positions below 127.77 with target @ 126.49.

Comment: The pair remains below 128.00 level.

Supports and Resistances:

R3 130.81

R2 129.93

R1 128.65

PP 127.77

S1 126.49

S2 125.61

S3 124.33

Market Scenario 1: Long positions above 1.0528 with target @ 1.0595.

Market Scenario 2: Short positions below 1.0528 with target @ 1.0423.

Comment: The pair slips to a fresh 12-year low of 1.0457 early, but then rebounds to a 1.0547 high.

Supports and Resistances:

R3 1.0767

R2 1.0700

R1 1.0595

PP 1.0528

S1 1.0423

S2 1.0356

S3 1.0251

Market Scenario 1: Long positions above 179.32 with target @ 180.43.

Market Scenario 2: Short positions below 179.32 with target @ 177.91.

Comment: The pair seems to trade steady below pivot point 179.32.

Supports and Resistances:

R3 182.95

R2 181.84

R1 180.43

PP 179.32

S1 177.91

S2 176.80

S3 175.39

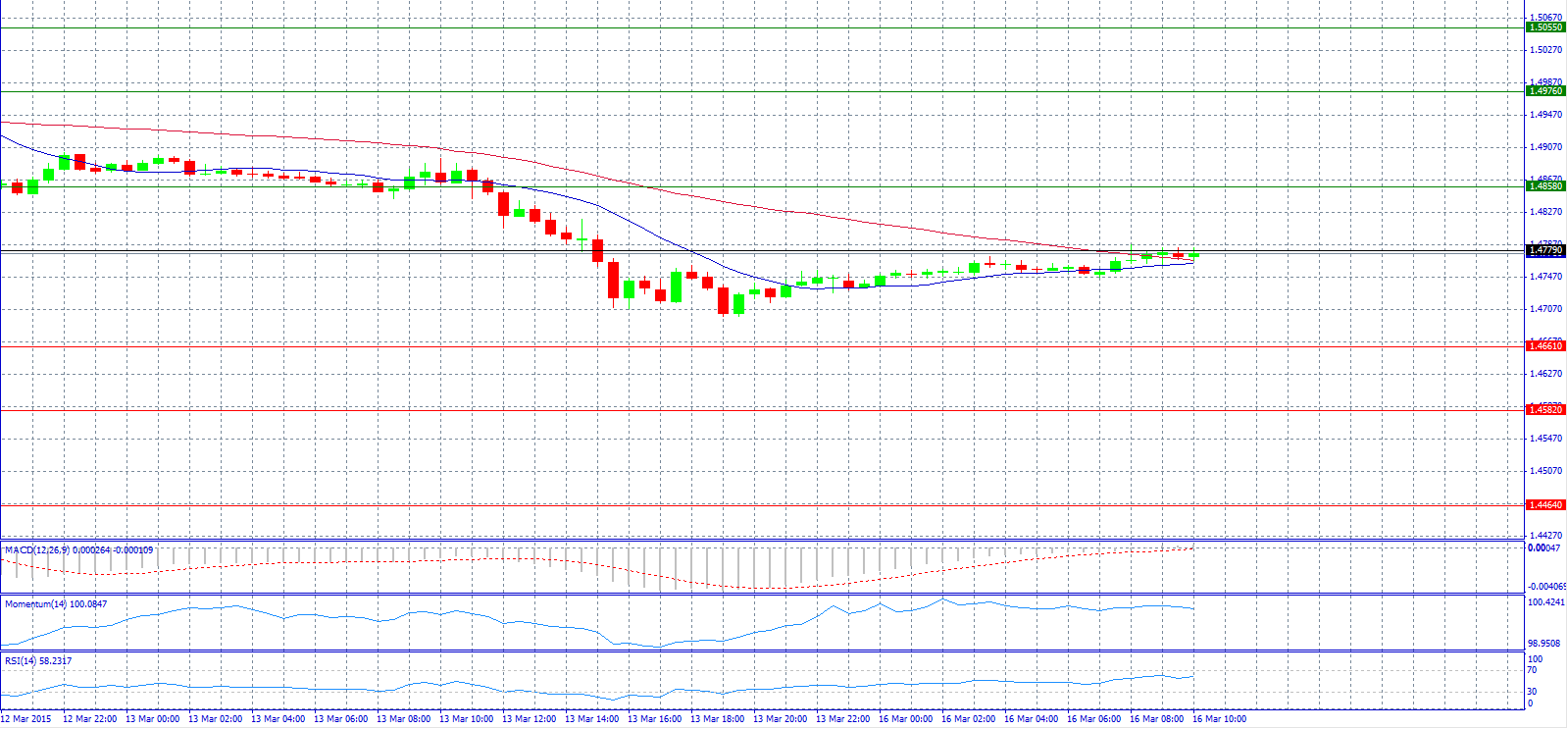

Market Scenario 1: Long positions above 1.4779 with target @ 1.4858.

Market Scenario 2: Short positions below 1.4779 with target @ 1.4661.

Comment: The pair trades near pivot point 1.4779.

Supports and Resistances:

R3 1.5055

R2 1.4976

R1 1.4858

PP 1.4779

S1 1.4661

S2 1.4582

S3 1.4464

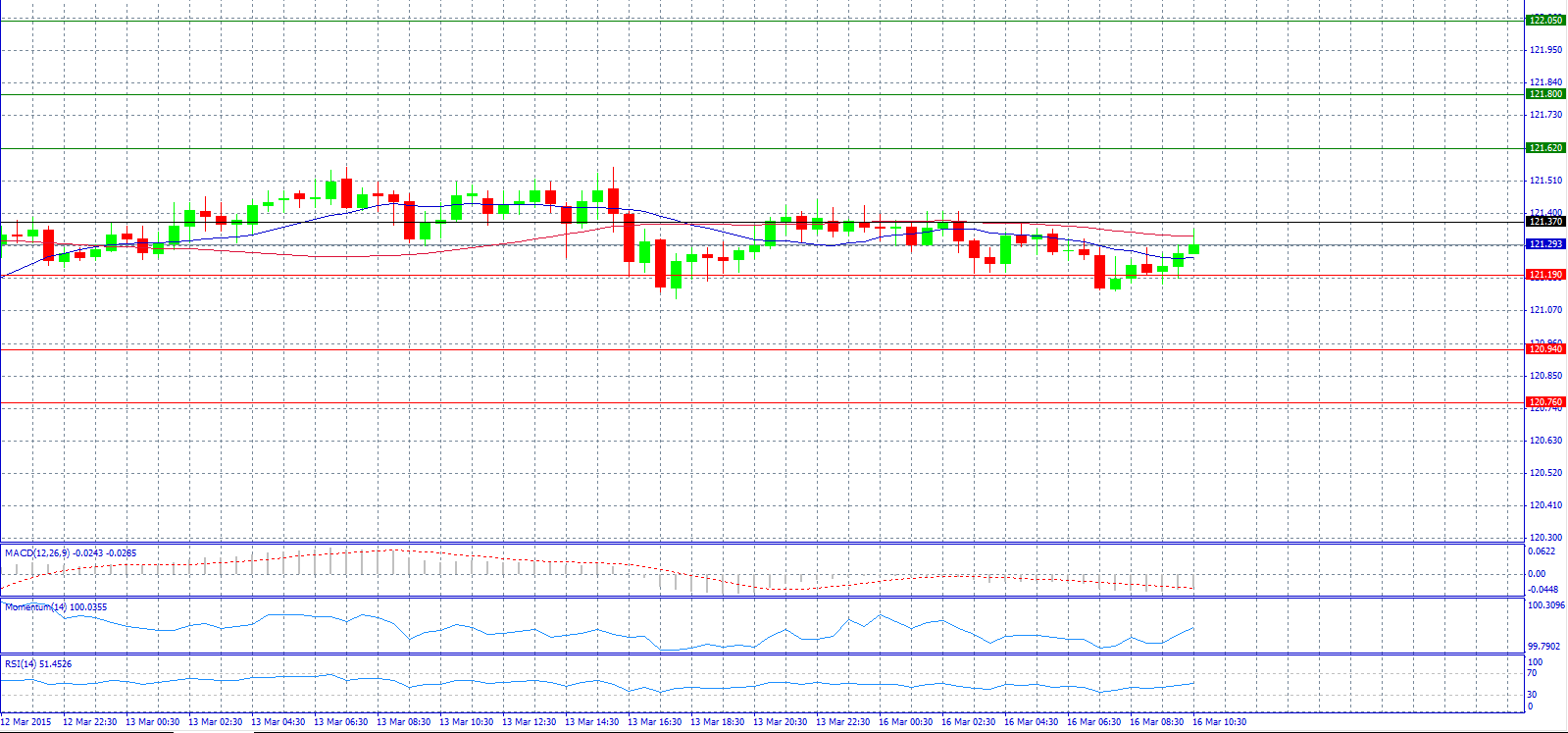

Market Scenario 1: Long positions above 121.37 with target @ 121.62.

Market Scenario 2: Short positions below 121.37 with target @ 120.94.

Comment: The pair found support at 121.19 level and now it’s advancing again.

Supports and Resistances:

R3 122.05

R2 121.80

R1 121.62

PP 121.37

S1 121.19

S2 120.94

S3 120.76

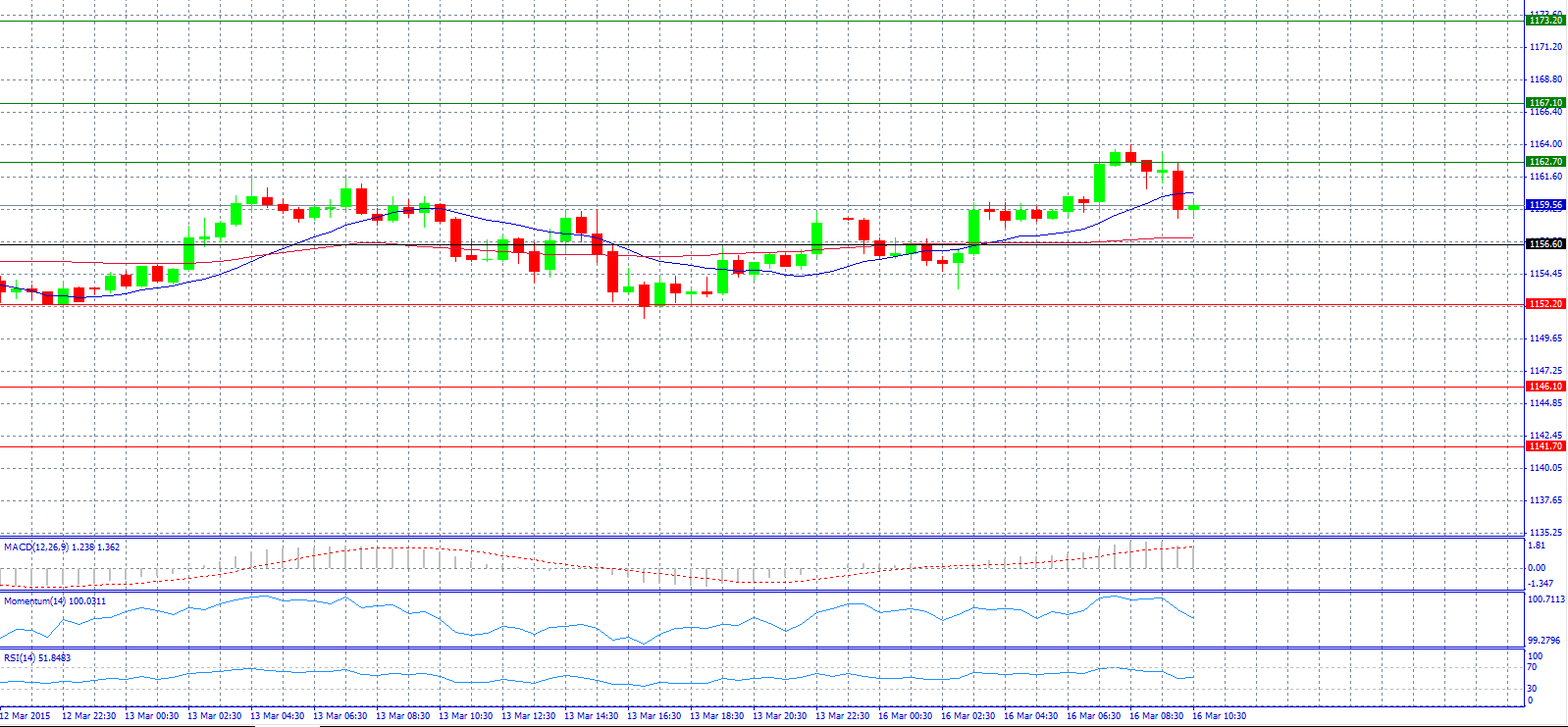

Market Scenario 1: Long positions above 1156.60 with target @ 1167.10.

Market Scenario 2: Short positions below 1156.60 with target @ 1152.20.

Comment: Gold prices are near lowest levels in over three months ahead of Fed meeting.

Supports and Resistances:

R3 1173.20

R2 1167.10

R1 1162.70

PP 1156.60

S1 1152.20

S2 1146.10

S3 1141.70

Market Scenario 1: Long positions above 45.68 with target @ 46.60.

Market Scenario 2: Short positions below 45.68 with target @ 44.07.

Comment: Crude oil prices fall by 2.1% on weak Asian cues.

Supports and Resistances:

R3 49.13

R2 48.21

R1 46.60

PP 45.68

S1 44.07

S2 43.15

S3 41.54

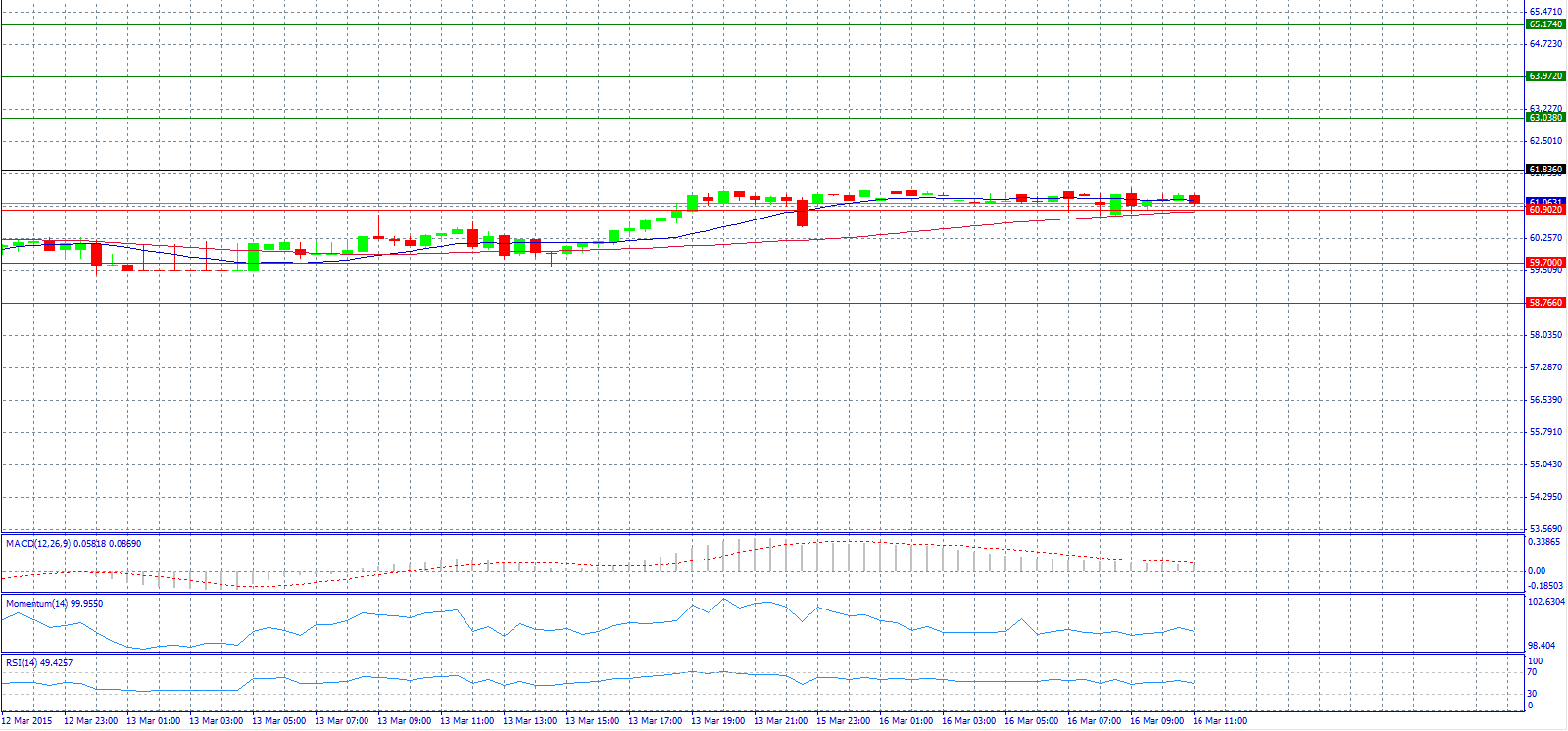

Market Scenario 1: Long positions above 61.836 with target @ 63.038.

Market Scenario 2: Short positions below 61.836 with target @ 59.700.

Comment: The confidence of the investors has returned for the ruble, and even a rate cut today left it unfazed.

Supports and Resistances:

R3 65.174

R2 63.972

R1 63.038

PP 61.836

S1 60.902

S2 59.700

S3 58.766

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.