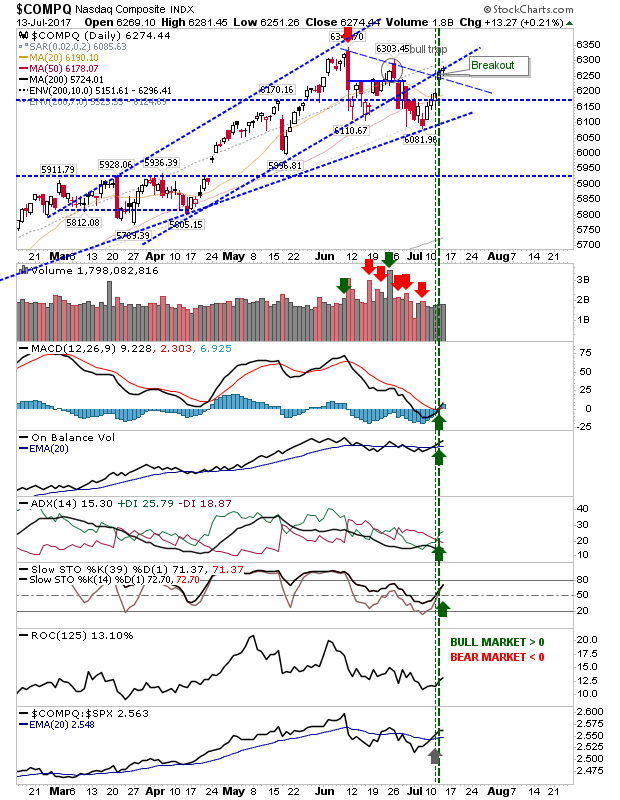

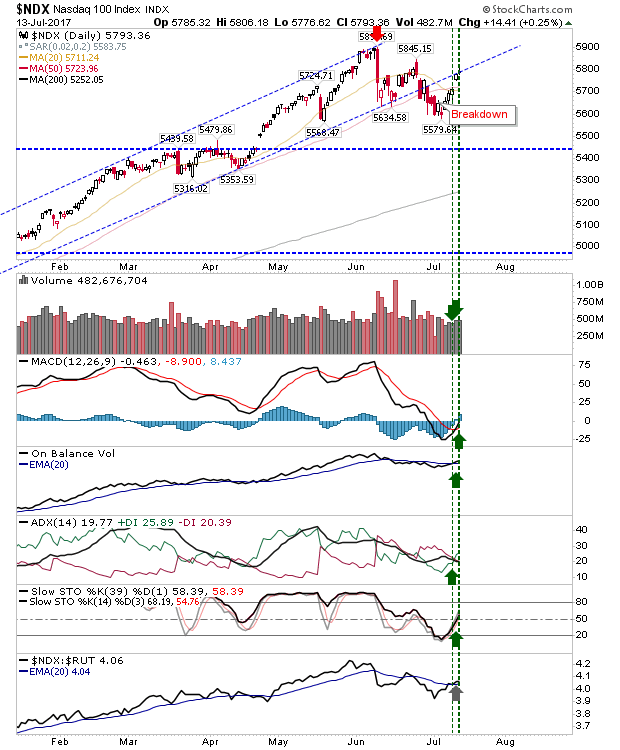

Two days of gains have helped re-establish the bullish technical picture for tech indices, NASDAQ and NASDAQ 100. While the improvement was welcomed it didn't come without a price.

The NASDAQ broke through declining resistance but also left itself wedged beneath the former rising channel. If there is a chance for shorts, then Friday could be it.

The NASDAQ 100 has also touched on former channel support – now resistance – offering a chance for shorts to launch an attack.

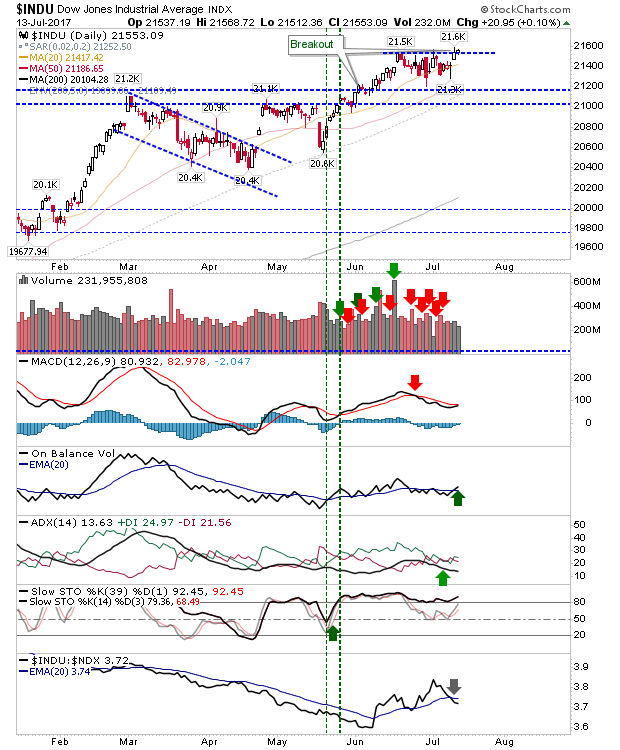

The Dow Jones continued its good form, albeit on a small gain as it shapes a bullish handle (off an earlier handle). While above the breakout resistance level of 21,550 it will need more volume to confirm whether the move is valid.

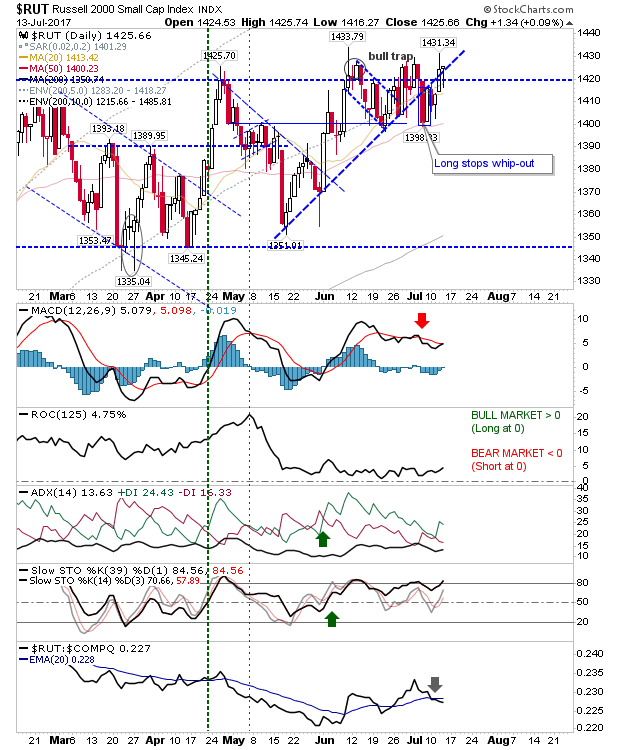

The Russell 2000 continues to be the index with the most potential energy to drive the next major market rally. Thursday's 'hammer' next to 1,430 sets the tone for a strong Friday. Momentum players should take note.

Friday will either prove to be a victory for shorts with channel resistance reversals for the NASDAQ or NASDAQ 100 or a win for the Russell 2000 and an opportunity for a solid 1%+ breakout style gain. Those are the indices and trades to watch.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI